Introduction

If you run a startup, sell designs overseas, or export goods, your business depends on timely foreign payments. Unfortunately, receiving money from abroad is not just about clicking “accept transfer” on your bank app.

In India, every foreign inward remittance must move through a regulated path, following rules laid down by the Reserve Bank of India under the Foreign Exchange Management Act (FEMA). You need to keep track of these RBI compliance for exporters requirements and constantly update your processes.

In this guide, we take a deep dive into what are foreign inward remittances, RBI guidelines for these remittances, and more.

Key pointers

- Foreign inward remittance means receiving money from a sender outside India into your Indian bank account via approved banking channels under RBI guidelines.

- Inward remittances in India move through authorized dealer (AD) banks using channels like SWIFT, evolving UPI cross-border networks, and RBI-approved fintech platforms such as Xflow, Wise, and Payoneer.

- The RBI, under FEMA, regulates all such transfers. AD banks handle verification, reporting, and issuing proof documents like FIRCs.

Using platforms with the right tools (like Xflow’s compliance tools) ensures correct purpose codes, faster settlements, lower FX spreads, and automatic compliance documentation.

What is a foreign inward remittance?

Foreign inward remittance is a financial process through which businesses and individuals receive payments from other countries. This could be in the form of pension payments, routine business transactions, salaries, and more.

All payments are typically facilitated through banking channels governed and authorized by the Reserve Bank of India (RBI). This ensures compliance with domestic and foreign exchange regulations.

For many businesses dealing with overseas clients, these payments are often the primary source of revenue. They are also important for individuals and can be used for family support or investment proceeds. When receiving a foreign remittant, the proof of receipt or FIRC is a legal requirement for tax, GST exemptions, and export documentation.

How does foreign inward remittance work in India in 2025?

Inward remittances to India are routed through authorized dealers in India using SWIFT or emerging UPI cross-border networks. RBI-approved platforms like Xflow integrate with these banks to speed compliance, automate documentation, and offer faster settlements.

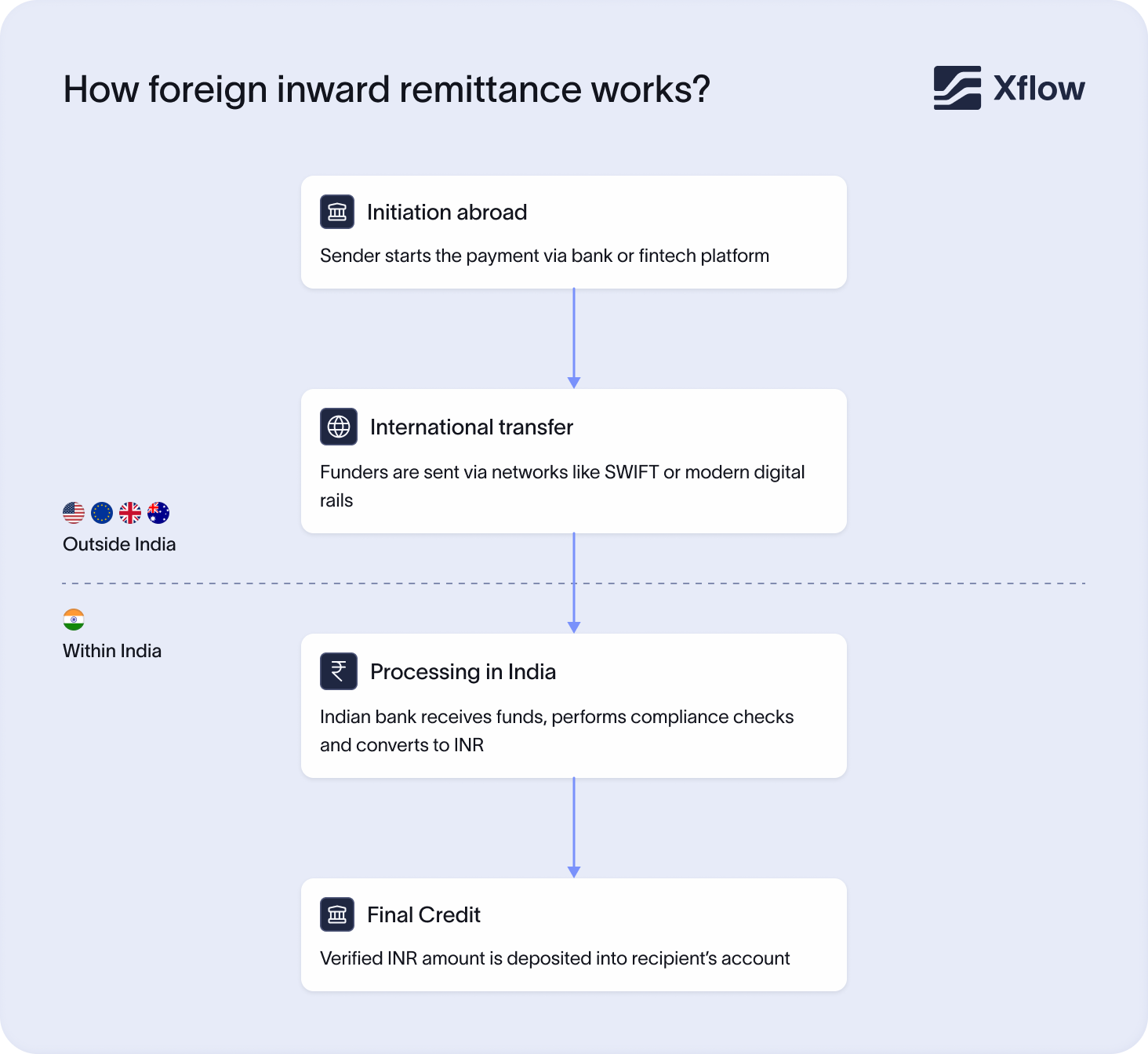

Here’s the typical flow:

1. Initiating the payment

The first step in the process is to initiate the payment. The sender will choose a service provider, like a bank or fintech platform. They must then provide the details of the recipient’s full name, bank account number, and IFSC code.

2. Transfer of funds

Next, the funds have to be transferred to India through secure, RBI-approved channels. Traditionally, most banks use the SWIFT network. The payment may be routed via intermediary banks, and some fintechs may use their digital rails for foreign payments as well.

3. Depositing of funds

Lastly, the recipient’s bank in India will receive the funds. The bank will first perform the required compliance checks and convert the funds into INR depending on the current exchange rate.

After verification, the money, in INR, will be deposited into the recipient’s account, and confirmation will be sent.

Who regulates foreign remittances in India?

The Reserve Bank of India oversees foreign exchange regulations under FEMA. Authorized dealer banks act as intermediaries that ensure compliance, report to the RBI, and verify purpose codes and documentation before releasing funds.

RBI

The Reserve Bank of India regulates all foreign exchange transactions in the country. It creates the policies that govern the movement of money in and out of India, ensuring every transfer is legal and traceable. The RBI’s framework keeps the payment process secure and compliant.

FEMA

FEMA stands for Foreign Exchange Management Act. Passed in the Indian Parliament in 1999, it oversees all cross-border payments in the country. It outlines guidelines for the type of payments allowed, documentation required, and penalties for non-compliance.

The guidelines outlined under FEMA are implemented by the RBI, establishing legal frameworks for businesses and individuals who deal with foreign trade. Under FEMA, specific Authorized Dealers, Documents, and Payment Aggregators are required:

Authorized Dealer Banks

Authorized dealers in India, such as SBI, HDFC, and ICICI, handle foreign transactions. These banking channels for remittance check purpose codes, verify documents, and release funds once everything is in order.

Payment aggregators

Platforms like Xflow, approved by the RBI, work alongside AD banks. They handle much of the compliance and paperwork in the background, integrate seamlessly with banking systems, and speed up settlement times.

Foreign Inward Remittance Certificate (FIRC)

FIRCs serve as proof of inward remittances. They are key documents for businesses and exporters, companies providing services to other countries, as well as freelancers dealing with foreign clientele. It proves they have received payment from an international client and contains details about the amount, purpose of remittance, and other crucial information.

Purpose codes for remittance

Purpose codes are used to identify and define the purpose of a remittance. They are listed on the RBI’s website, and must be carefully selected and assigned to each transaction. They must also be mentioned to the AD bank.

Required documentation

For inward remittances, RBI requires a purpose code, FIRC, Form 15CA/15CB for some instances, KYC documents, and export invoices or SOFTEX forms for services exports.

What are the key RBI guidelines you need to know for 2025?

In 2025, RBI inward remittance guidelines require purpose codes, KYC verification, timely documentation, and use of authorized channels. Export proceeds must be realized within nine months for goods and twelve months for services.

Under RBI guidelines, businesses must ensure that the following guidelines are adhered to when dealing with international transactions:

1. An Authorized Dealer (AD) Bank must be used

As per FEMA, all transactions have to be done via AD Category-I banks authorized by the RBI. Businesses must open an account with these banks and use them to receive any foreign payments.

2. KYC & Due Diligence

To verify transactions, AD banks will complete a thorough KYC and due diligence check. This is done to verify the authenticity of the business, prevent money laundering and fraud, and ensure safety. Businesses are required to provide their PAN, GSTIN, and business registrations.

3. Ensure shipments are done within a fixed timeframe

FEMA mandates that all shipments must be completed within six months of their export. This is to avoid any delays in the inflow of foreign exchange and ensure the timely realization of payments. Businesses must submit their invoices, shipping bills, and transport documents to their bank.

4. Use the correct purpose code

All foreign remittances must have a valid, RBI-approved purpose code as well. These classify foreign exchanges.

5. Payments must be realized within a fixed timeframe

To ensure a timely inflow of foreign currencies into the economy, FEMA mandates that all payments have to be realized within 9 months for goods and 6 months for services.

6. Submit Export Declaration Forms

Exporters and businesses dealing with the supply of goods to foreign countries are also required to file the correct forms to declare exports. This helps the RBI maintain an accurate record of foreign currency inflows.

7. Receiving funds in foreign currency

According to FEMA regulations, foreign payments must be received via the SWIFT network and be in freely convertible currency. This is done to maintain traceability and regulatory compliance. Businesses must ask their clients to send funds to their AD accounts via SWIFT, verify the foreign currency, and collect Foreign Currency Advice.

8. FIRC requirements

Once the funds have been received, banks must issue an FIRC/FIRS certificate as proof of receipt of the foreign currency. These are required for GST refunds, SEZ benefits, and further tax filings.

9. Form 15CA/15CB

While these documents are not always required for export receipts, FEMA does deem them mandatory for repatriation or foreign commission payments.

10. Maintain clear records and respond to any queries

Businesses must maintain thorough documentation for further verification and audits. They must keep records of at least the previous 5 years, and respond to any RBI or AD bank queries promptly and accurately.

What are the types of inward remittances?

The RBI classifies inward remittances as personal transfers, export proceeds, service payments, and investment inflows, each with specific documentation and compliance requirements.

Personal transfers

Personal transfers are a common occurrence across borders. Here, funds are sent from a foreign bank account to another account in India, and are typically initiated by NRIs or OCIs. They are generally done to provide family support, pay tuition fees, fund education, cover medical expenses, or make donations or gifts.

Export proceeds

Export proceeds refer to inward remittances received in India as payment for goods, services, or software exported from India.

Freelance payments

India has millions of freelance professionals. For them, foreign inward remittances are often a primary source of income, and refer to the funds received in their accounts from their foreign clientele. In this instance, foreign inward remittance allows them to be paid by international clients in foreign currencies and have that currency converted into INR before being deposited into their AD bank accounts.

Investment inflows

If you receive investments from international businesses or individuals, these are referred to as investment inflows. In short, it represents foreign capital invested in Indian companies.

Use cases: freelancers, startups, exporters, NRIs

Freelancers, startups, exporters, and NRIs use inward remittance channels to receive cross-border payments for services, goods, or personal support, with RBI-compliant documentation for each category.

Here are some examples:

- A freelancer receives USD 2,000 for a web development project.

- An exporter claims payment for shipped textiles within 9 months.

- A startup raises seed funding from a Singapore VC.

- An NRI sends funds to parents for living expenses.

Inward vs. outward remittance: What’s the difference?

Inward remittance brings money into India from abroad. Outward remittance refers to sending funds from India to another country. Both require RBI compliance under FEMA but have different rules, limits, and documentation.

| Feature | Inward remittance | Outward remittance |

|---|---|---|

| Flow | Refers to money coming into India from foreign individuals, customers, or businesses. | Refers to money being sent from India to individuals or businesses abroad. |

| Common uses | Inward remittance is often used to provide support to family, as income generated by businesses (that is, payment for goods and services), or as investment inflows. | Outward remittances are popularly the result of educational expenses, medical bills, investment, donations to charitable causes, and more. |

| RBI scheme | FEMA | Liberalised Remittance Scheme (LRS) |

What are some common challenges with RBI-regulated inward remittances?

Delays, incorrect purpose codes, missing documents, and bank restrictions are common challenges in RBI-regulated inward remittances. Here is a closer look at these challenges:

1. Delays

One of the most common challenges associated with foreign inward remittances are delays in processing. Delays could be caused by documentation problems or bottlenecks in the process.

The best way to avoid delays is to ensure the sender has input the correct banking details. Your business can also reach out to your AD bank to check for any delays.

2. Documentation

RBI and FEMA guidelines require all foreign inward remittances to have specific documentation, such as the use of the correct applicable purpose code. In case there are mistakes in documentation, it can lead to errors in processing payments, delays, and may even trigger compliance issues.

3. Bank restrictions

Sometimes, there may be restrictions imposed on the amount of inward remittance an account can receive. For example, some financial institutions may have daily transaction limits of USD 3000. However, these restrictions can vary based on the institution, and in many cases, there are no limits at all.

What are some of the best practices to ensure smooth compliance with RBI Guidelines?

Some of the best practices to ensure compliance include using the correct purpose codes, processing payments through authorized dealers, maintaining documentation, and tracking every transaction:

1. Using the correct purpose codes

Purpose codes outline why the foreign inward remittance is being received. It is crucial to confirm that the proper purpose code matches the right transaction. Checking the RBI website and verifying the code with your AD bank can help avoid compliance problems and delays further down the line.

2. Use RBI-approved channels

RBI-approved channels like Xflow allow you to receive foreign payments without worrying about regulations. Xflow provides features like next-day settlements, as well as automated digital FIRA generation for all foreign payments.

3. Track all transfers

Maintaining proper records and tracking transfers will help your business remain audit-ready at all times. It also proves helpful in case of queries from AD banks or the RBI.

Integrating RBI-compliant inward remittance into your business stack

Integrating RBI-compliant inward remittance with your business stack is a key step in ensuring adherence to regulatory standards. This typically involves staying up-to-date on all regulations set forth by the RBI and FEMA. It also consists of using authorized channels, such as authorized dealer banks (AD banks), money transfer services schemes (MTSS), or payment platforms like Xflow.

Integrating technological solutions into your business stack, like Xflow, can offer countless benefits. They typically help you streamline the inward remittance process, quicker transfers, potentially lower fees, and more. Xflow offers free FIRC generation, as well as the following benefits:

- API integration with accounting tools

- Automatic FIRC generation

- Low FX markup and faster settlements

- Bulk payouts and custom workflows for exporters

What are the legal and tax implications of foreign inward remittances?

Inward remittances may attract GST on export services if specific criteria are not met, and must be reported as income under the Income Tax Act. FEMA violations carry penalties. Some legal and tax guidelines to be aware of include:

1. Income

Any foreign remittances received as income, such as for services rendered, goods provided, or consultancy fees, are taxable according to the individual’s tax bracket.

2. Double taxation

India has a DTAA (Double Taxation Avoidance Agreement) with several countries, which prevents double taxation on the same income. For example, if an NRI has paid tax in the country of their residence, they are eligible to avail tax relief in India.

3. Penalties for non-compliance

Under Section 13 of FEMA, in case any business or individual fails to comply with FEMA’s regulations, they could be penalized a sum of up to three times the original amount (if justifiable), up to INR 2 lakh where the amount is non-quantifiable, or a fine of INR 5,000 per day of continuing contravention.

What’s new in 2025: Digital compliance tools, faster approvals, and automated reporting

Studies show that remittance flows across the globe have increased by 4.6% from 2023 to 2024, and continue to grow. In 2025, we can look forward to more digital compliance tools, faster approvals, and automated reporting, among other trends. Let’s take a closer look below:

1. Digital compliance tools

Digital compliance tools help streamline the foreign inward remittance process. They ensure your transactions comply with RBI and FEMA-mandated regulations, preventing delays, penalties, and bottlenecks in the payment process.

2. Faster approvals

Digital tools, automated verification and FIRC generation, and third-party platforms like Xflow, PayPal, and Payoneer are making the process of receiving payments nearly instantaneous. They partner with international banking systems and local banks to settle funds.

The process is quicker since they batch settlements, use pre-funded local accounts, and automate compliance checks, all while meeting FEMA guidelines.

3. Automated reporting

Platforms like Xflow, for example, are authorized by the RBI to process foreign inward payments, automate the creation of digital FIRCs, and more. This automated the reporting process, making it quicker, more streamlined, and efficient.

Why Xflow is built for RBI-compliant inward remittance

Navigating RBI rules for foreign inward remittances is about preparation and precision. As a business, getting paid from abroad should be fast, predictable, and compliant. With Xflow, it can be. Xflow offers low FX spreads, faster settlements, and automated compliance for inward remittances, approved by RBI as a payment aggregator.

With RBI approval, Xflow enables exporters, agencies, and startups to get paid faster, with APIs for accounting sync, bulk payouts, and dedicated onboarding. Its regulatory support and compliance means your payments are clear without any back-and-forth with banks.

Frequently Asked Questions

A Foreign Inward Remittance Certificate is proof from your AD bank that you’ve received funds from abroad in foreign currency. It’s required for GST exemptions and export documentation.

The RBI uses purpose codes to track the reason for foreign exchange inflows. This helps enforce FEMA and prevent misuse.

For goods, the limit is 9-15 months; for services, it is 12 months from the date of the export invoice.

Yes, business earnings and income from investments are taxable under the Income Tax Act. Personal gifts from relatives may be exempt if they are below INR 50,000.