Introduction

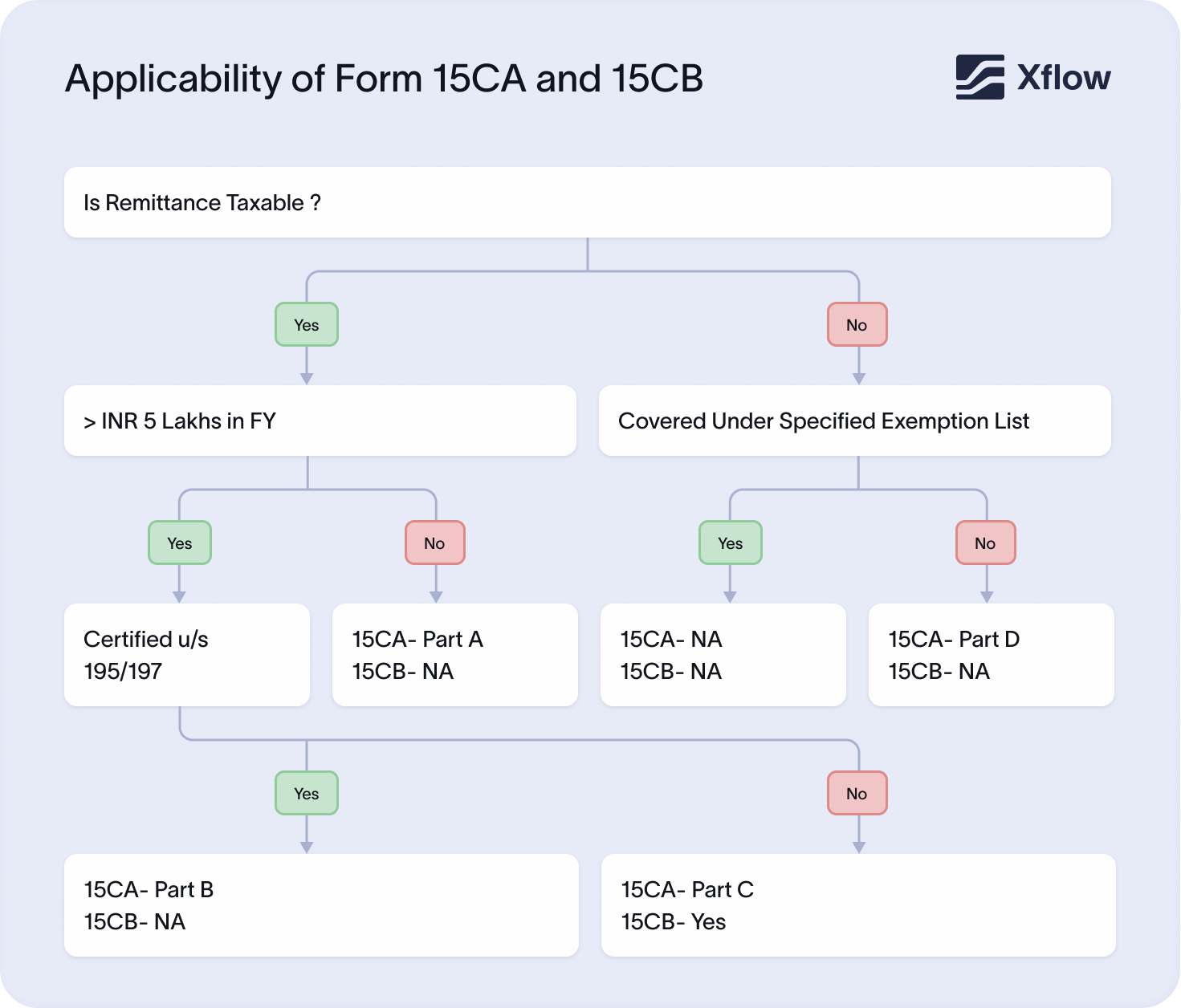

When you send money to someone outside India, you would likely be expected to meet certain compliance requirements. This is where Forms 15CA and 15CB come into play. These forms are critical tools used by the Income Tax Department to track foreign exchange outflows and ensure Tax Deducted at Source is correctly tackled. In this guide, we’ll walk you through what 15CA and 15CB are, when they need to be filed, and how to ensure you stay compliant.

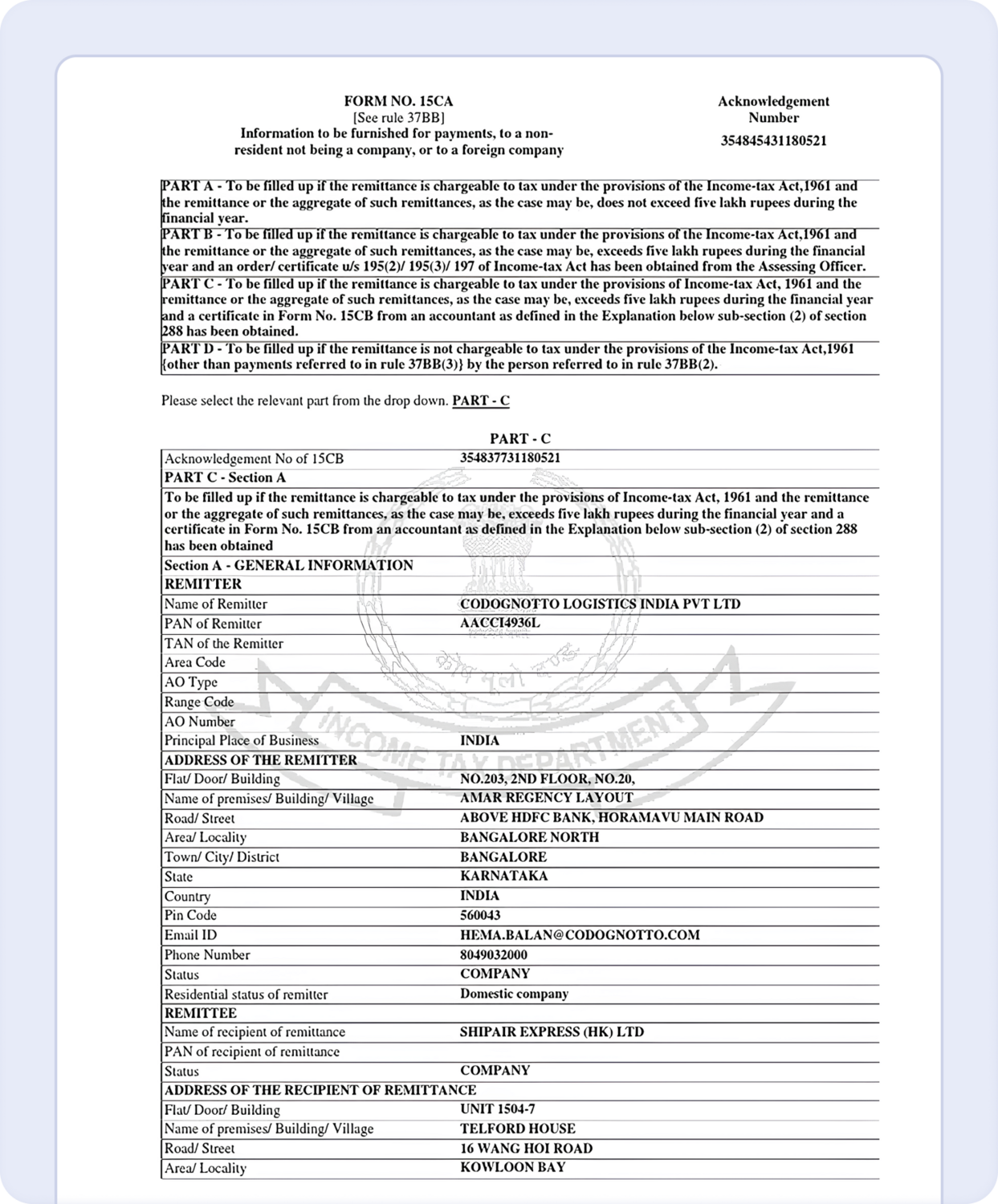

What is Form 15CA?

‘Form 15CA’ is a self-declaration by an individual while transferring money from India to a foreign country. It ensures that the TDS deductible when making foreign remittances is actually deducted and deposited with the government.

Let’s understand with an example: An individual wants to learn how to speak Russian and decides to engage a teacher in Russia to teach him online. Both agreed to a fee, and now the individual is sending the fee to the Russian teacher. For this, he fills out ‘Form 15CA,’ stating all the details as prescribed and paying the required tax.

Parts of Form 15CA

| Part A | Part B | Part C | Part D |

|---|---|---|---|

| To be filled irrespective of whether the amount is taxable or not. Applicable only when the aggregate amount does not exceed Rs. 5 lakh in a financial year. | This part has to be filled only if a certificate under Section 195(2) or 195 (3) or 197 of the Income Tax Act has been obtained from the Assessing Officer (AO). | To be filled when the annual aggregate value of taxable remittances exceeds Rs. 5 lakh in a financial year, and a 15CB certificate needs to be obtained from the CA | This part is to be filled in when the transaction falls within the exemption list. |

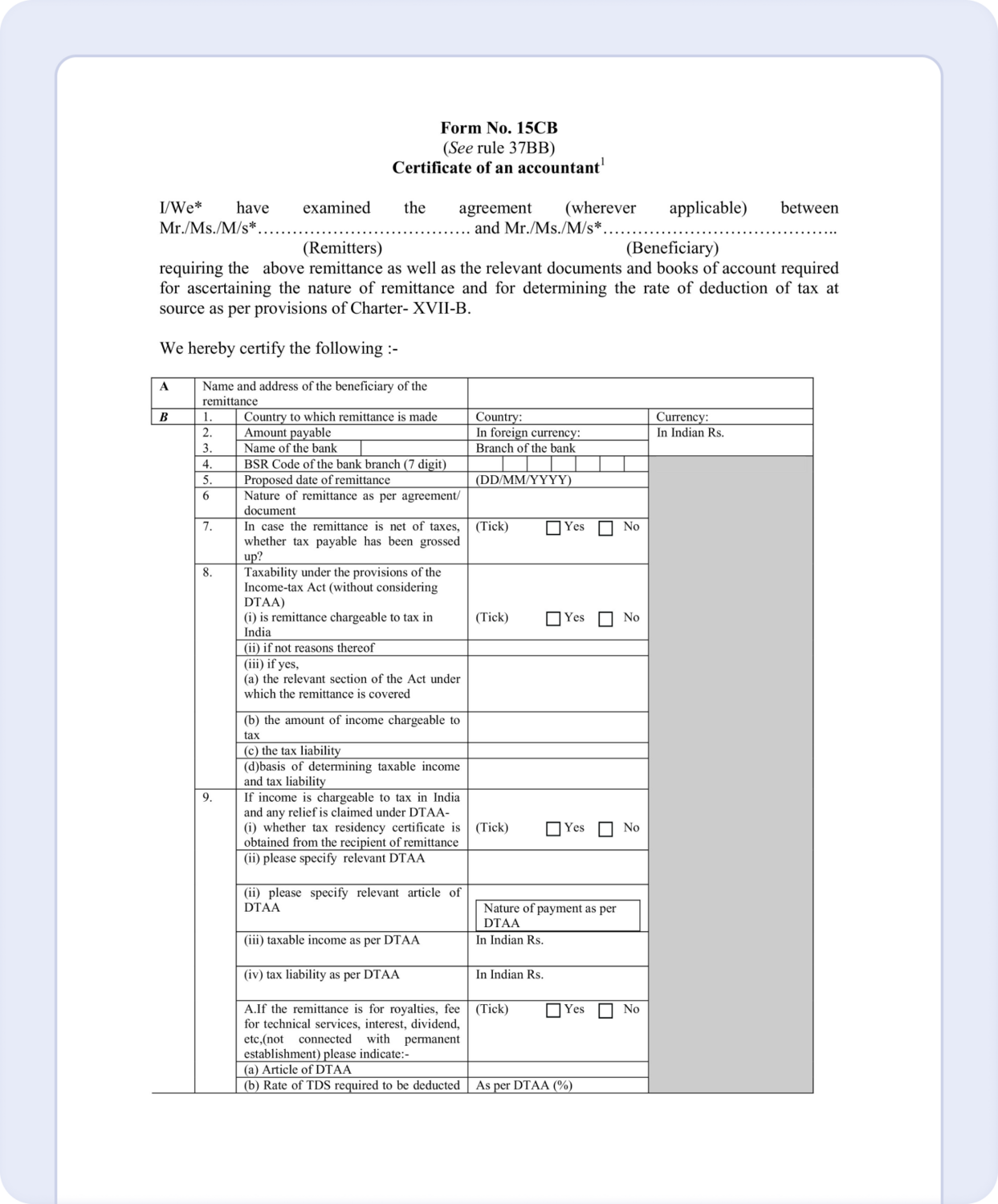

What is Form 15CB?

Unlike 15CA, 15CB is not a self-declaration form. It is a certificate issued by a Chartered Accountant and is required before making some foreign remittances from India. It certifies that the nature of remittance has been verified, it has been correctly taxed, and Double Taxation Avoidance Agreement (DTAA) provisions have been considered. Think of it as additional due diligence to make sure the outward remittance complies with the regulations. Form 15CB is required only when the taxable remittance exceeds 5 lakhs in a financial year.

List of payments where Form 15CA and 15CB are not required

While 15CA and 15CB compliance is expected for most transactions, there is a list of transactions that are made by an individual that do not require such prior approval.

- Nature of the Payment

- Indian investment abroad -in equity capital (shares) / debt securities.

- Indian investment abroad in branches and wholly owned subsidiaries

- Indian investment abroad -in subsidiaries and associates

- Indian investment abroad -in real estate

- Loans extended to Non-Residents

- Advance payment against imports

- Payment towards the imports-settlement of the invoice

- Imports by diplomatic missions

- Intermediary trade

- Imports below Rs.5,00,000-(For use by ECD offices)

- Payment for the operating expenses of Indian shipping companies operating abroad.

- Operating expenses of Indian Airlines companies operating abroad

- Booking of passages abroad -Airlines companies

- Remittance towards business travel.

- Travel under basic travel quota (BTQ)

- Travel for pilgrimage

- Travel for medical treatment

- Travel for education (including fees, hostel expenses, etc.)

- Postal Services

- Construction of projects abroad by Indian companies, including the import of goods at the project site

- Freight insurance – relating to the import and export of goods

- Payments for the maintenance of offices abroad

- Maintenance of Indian embassies abroad

- Remittances by foreign embassies in India

- Remittance by non-residents towards family maintenance and savings

- Remittance towards personal gifts and donations

- Remittance towards donations to religious and charitable institutions abroad

- Remittance towards grants and donations to other Governments and charitable institutions established by the Governments.

- Contributions or donations by the Government to international institutions

- Remittance towards payment or refund of taxes.

- Refunds or rebates, or reduction in invoice value on account of exports

- Payments by residents for international bidding.

Information required to file Form 15CA and 15CB

Now that you have clarity on whether the outward remittance you made needs filing of 15CA/15CB or not, it is important to understand the details you should keep handy when filling in the form. The comprehensive list is as below:

I. Details of remitter

- Name of the remitter

- Address of the remitter

- PAN of the remitter

- Principal place of business of the remitter

- E-mail address and phone no. of remitter

- Status of the remitter (firm/company/other)

II. Details of remittee

- Name and status of the remittee

- Address of the remittee

- Country of the remittee (country to which remittance is made)

- Principal place of business of the remittee

III. Details of the remittance

- The country to which the remittance is made

- The currency in which remittance is made

- Amount of remittance in Indian currency

- Proposed date of remittance

- Nature of remittance as per agreement (invoice copy to be requested from the client)

IV. Bank details of the remitter

- Name of the bank of the remitter

- Name of the branch of the bank

- BSR Code of the bank

V. Others

- The father’s name of the signing person

- Designation of the signing person

Procedure to file Form 15CA and 15CB online

Below is the step-by-step guide on how to fill out these forms through the Income Tax E-Filing portal.

Online filing of Form 15CA

- Go to the income tax e-filing portal - https://www.incometax.gov.in

- Log in using your PAN or TAN credentials

- Go to the e-File tab

- Go under ‘File Income Tax Forms’

- On the new page, ‘Others’

- Select Form 15CA

- Click on ‘Let’s get started’

- Feed in “Information for payment to Non-resident’

- Filing type as ‘Original/Revised’

- Choose the Financial Year and click on ‘Continue’

- Choose your Part A / B / C / D

- Complete E-Verification through a digital signature certificate (DSC) or electronic verification code (EVC)

- Make a note of the transaction ID and acknowledgement numbers displayed

- A confirmation message will be received at your registered email ID and mobile number

Online filing of Form 15CB

- Under the ‘My Account’ tab, furnish the details of your CA in the ‘Add CA’ option.

- Enter the membership number and select the Form 15CB option.

- The rest steps after this are done by the CA.

- Download the ‘Form 15CB Utility xml file’ from the Download page and prepare it offline for uploading.

- CA will fill the form with remittance details, DTAA details (if applicable), and TDS (if any).

- Generate and upload the .xml file through the utility.

- Click on ‘Submit’.

- Once Form 15CB is uploaded, you can log in and check the status of the Form by selecting ‘For Your Information’ on the Worklist tab.

- The status of the Form will be displayed thereafter.

Frequently asked questions

No, it is required only for outward remittances.

It is governed by the Reserve Bank of India, the Foreign Exchange Management Act, and the Income Tax Act.

No, CA authentication is required only under Form 15CB.

Form 15CA is a self-declaration by the remitter confirming TDS payment. Form 15CB is a certificate received from a CA stating that the remittance does, in fact, comply with tax laws.