What does remittance mean?

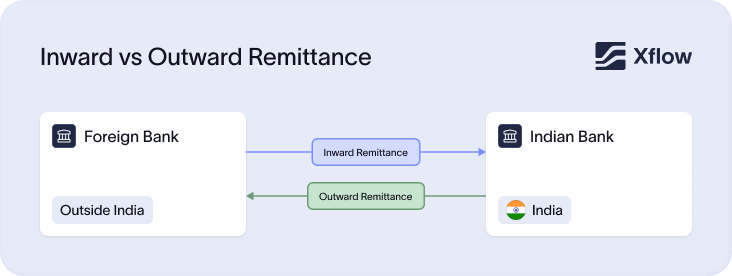

The simple meaning of remittance is the flow of money across borders. There are typically two types of remittances – inward and outward. Understanding the difference between these two helps both the remitters and remittees navigate the regulatory and economic implications effectively. Whether you are a business owner expanding internationally or a student waiting to receive funds in the US from your family in India, understanding the concepts will help you manage your legal responsibilities and tax implications seamlessly.

What is inward remittance?

Inward remittance is the receipt of money into the home country from a foreign country. This term is used when funds are sent from a foreign country to the home country. This can include, but is not limited to, individuals, businesses, or organizations located in the home country. For instance, any exporter receiving the money from the sales value is also counted as an inward remittance. However, these transactions don’t necessarily need to be in a professional capacity. For example, an individual living abroad sending money to their parents in India is also an example of inward remittance as an individual. This also includes an individual or an organization that receives money from a client who lives abroad for any purpose, like a donation, payment towards the investment in the home country, or any aid that is not returned.

What is outward remittance

Outward remittance means money sent from India to another country. It can be incurred for personal and professional reasons such as international education, medical treatment, travel, investments, donations, importing goods or services, sending money for medical expenses, etc.

Inward vs Outward Remittance

While on the face of it, Inward vs Outward Remittance might seem quite obvious, there are some stark regulatory differences between the two that also need to be accounted for. Here is a comparative table:

| Basis | Inward Remittance | Outward Remittance |

|---|---|---|

| Country | Money brought to the home country | Money sent to a foreign country |

| Regulation and Authority | FEMA, RBI | FEMA, RBI |

| Application | NRI/NRE, Businesses, Individuals | Students, travelers, investors, and businesses |

| Tax | As per the home country. Up to a limit no or low tax based on the purpose of sending or receiving. | As per the foreign country. Up to a limit, no or low tax based on the purpose of sending or receiving. |

| FOREX rate | As determined by the home country while sending money | As determined by the foreign country while sending money |

| Payment and Settlement System (PSS) | Applies all the relevant payment systems authorized by the central bank of the home country (RBI). | Applies all the relevant payment systems authorized by the central bank of the home country (RBI). |

| Transaction Limit | There is no specific limit to these transactions, but they will be subject to KYC and scrutiny. | Up to USD 250,000 in a FY through an acceptable transfer facility like online money transfer or cheque under the Liberalised Remittance Scheme. |

RBI guidelines on remittances

Liberalized Remittance Scheme (LRS) is a facility provided by the government to allow residents of India (including minors with a guardian operating on their behalf) to freely be able to send money internationally for specified current and capital account transactions.

These transactions can be for educational purposes, travel, tourism, medical treatment, gifts, donations, investments, business trips (for individuals), maintenance of relatives, purchasing properties, etc.

However, LRS does not allow transactions for betting, gambling, speculative activities, margin trading, or transfer to non-cooperative countries identified by the Financial Action Task Force (FATF).

Taxes on remittances

While you understand the difference between inward and outward remittance, it is crucial to note that Tax Collected at Source (TCS) is applicable to both. As announced in the 2025 speech, TCS on foreign remittance is applicable only when transactions exceed Rs 10 lakhs under LRS. This limit has increased from the previous limit of Rs 7 lakhs. The budget also stated that there is no need of payment of TCS on transactions for educational purposes, provided the remittance is made using an educational loan taken from specific financial institutions.

Common challenges in cross-border remittance

Sending money across borders isn’t always as easy as it seems. It comes with its own set of financial and logistical challenges that can affect the sender and the receiver.

(i) Transaction cost: Beyond the actual amount to be transferred, there is a common transaction cost involved between two different currencies. It varies from country to country based on the trade relations and the balance of payments between those two countries. For example, if an Indian transfers the money from India to Sri Lanka, the fee may be less compared to the transfer made between India and the USA.

(ii) Processing time: Another common challenge faced during the transaction is the time taken to process the receivables and payables. There might be a value change between the day the transaction started and the transaction ended. This could lead to a positive or a negative gain to the receiver or the sender.

(iii) Exchange rate: The big challenge is the foreign exchange rate, where the value of the currency can differ considerably between the sender country and the receiver country.

(iv) Regulation: Every country has its own rules and regulations that impact the parties involved from time to time, depending on the relationship between the countries.

How Xflow simplifies inward and outward remittances

While these common challenges can make cross-border payments feel overwhelming, Xflow is here to simplify the entire process for you. Xflow is designed to make compliance and transfer of money smooth and hassle-free. Whether you are an individual or a business transferring money, Xflow takes out the complexity from international transactions to leave you time and space to focus on what is truly important.

Related reading

1. How to report inward remittance in India

Inward remittance means when funds are transferred from a foreign country to the home country (India). Outward remittance is when funds are transferred from a home country to a foreign country.

As per the budget announcement of 2025, the limit has been increased from Rs 7 lakhs to Rs 10 lakhs. This means that only when the amount exceeds the said limit will TCS have to be paid.

Beneficiaries can be anyone from students, individuals, businesses, or families.

Yes, the rules and regulations of both countries involved are applicable; however, the interrelationship of them reduces the common burden of such transactions.