Introduction

If you're an Indian business venturing into international trade, you've likely encountered the term FEMA. But what exactly is it, and why should you care? Let's dive in and demystify the Foreign Exchange Management Act (FEMA) of 1999, exploring its nuances and how it impacts your business operations.

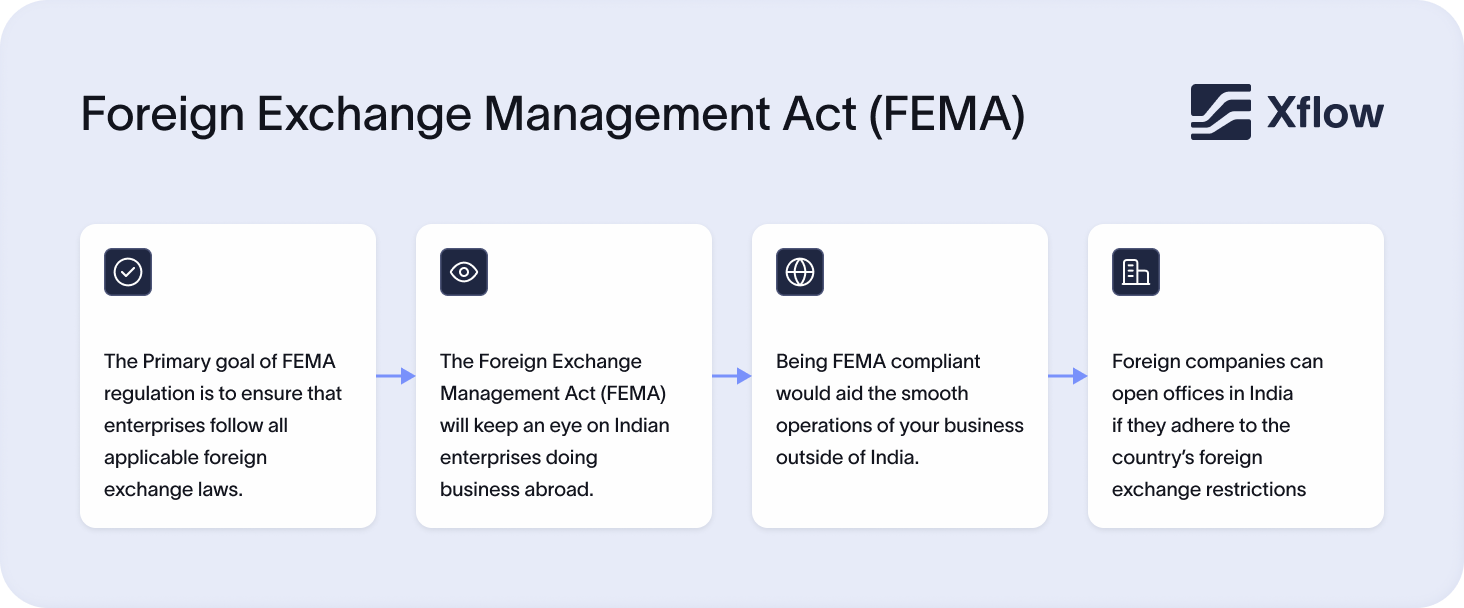

What is FEMA and why does it matter?

FEMA is the rulebook for foreign exchange transactions in India. It replaced the stricter Foreign Exchange Regulation Act (FERA) in 2000, aiming to make international trade easier while keeping our foreign exchange market healthy. Here's why it matters:

- It's your ticket to global trade: FEMA makes it simpler for you to buy and sell internationally. For instance, if you're a software company in Bangalore looking to sell your services to clients in the US, FEMA provides the framework for how you can receive payments in dollars and convert them to rupees.

- It keeps things in check: By regulating foreign exchange, it helps maintain economic stability. This means protecting the value of the rupee and preventing abrupt capital outflows that could destabilize our economy.

- It gives you more freedom: Unlike its predecessor, FEMA allows you to hold foreign currency accounts and invest abroad. As an entrepreneur, this means you can now explore opportunities like setting up a subsidiary in Singapore or investing in US stocks, opening up new avenues for growth and diversification.

From FERA to FEMA: A business-friendly shift

Understanding FEMA starts with knowing what it replaced.

- FERA (1973): Tight controls. Forex violations = criminal offense.

- FEMA (2000): Lighter touch. Forex violations = civil offense.

Key differences:

- From prohibition to regulation: Under FEMA, all forex transactions are allowed unless explicitly restricted.

- From criminal to civil offenses: Mistakes now result in fines, not jail time.

- From control to management: Focus moved to managing forex, not micromanaging businesses.

Bottom line: FEMA created a much friendlier environment for Indian businesses looking to go global.

Key features of FEMA: What you need to know

Understanding FEMA can seem daunting, but let's break it down into digestible bits:

- Authorized Persons: You'll need to work with authorized dealers (usually banks) for your forex transactions. This ensures that all foreign exchange dealings are tracked and regulated. For instance, if you're receiving a payment from a US client, it must come through an authorized bank, not through informal channels

Types of Transactions:

- Current account: Think day-to-day stuff like paying for goods and services. This includes your regular international business transactions such as export earnings, import payments, or paying for a foreign consultant.

- Capital account: This covers bigger moves like foreign investments and loans. If you're planning to invest in a foreign startup or take a loan from an overseas bank, these fall under capital account transactions.

- Civil offences: Unlike FERA, FEMA treats violations as civil offences. It's less about punishment and more about keeping things in order. This means if you make a mistake, you're more likely to face a fine than jail time.

- Penalties: Yes, there are still consequences for non-compliance, but they're designed to guide rather than punish. Penalties can include fines up to three times the amount involved in the violation.

- Residency-based regulation: FEMA applies differently to residents and non-residents of India. As a resident Indian business owner, you have different rights and restrictions compared to an NRI entrepreneur.

💡Pro tip: Stay on top of FEMA regulations by regularly checking the Reserve Bank of India (RBI) website or consulting with a forex expert.

FEMA compliance essentials to keep in mind

1. Purpose Codes: Classify your transactions right

Every forex transaction needs a purpose code assigned by RBI to explain why money is being sent or received.

Examples:

- P0802: Software consultancy services

- S0602: Travel for business

Wrong purpose codes can cause delays, penalties, or compliance headaches.

💡 Tip: Always double-check the code when filling out remittance forms.

2. Foreign Inward Remittance Certificate (FIRC): Proof of earnings

When you receive foreign payments, your bank issues a FIRC. It's crucial for:

- Proving export income

- Claiming tax benefits

- FEMA audits

Always request your FIRC as soon as the foreign payment hits your account.

3. Export Data Processing and Monitoring System (EDPMS): Track export payments

EDPMS is the RBI's system to track your export shipments and payments.

If you don't receive payment within the allowed time (usually 9 months), the system flags your account, and you could face penalties.

💡 Tip: Ensure all export-related payments are properly linked to your shipping bills via EDPMS.

4. Liberalised Remittance Scheme (LRS): For outward remittances

Want to invest abroad or fund an overseas startup?

Under LRS, Indian residents can remit up to $250,000 per year for permitted activities like:

- Education

- Investments

- Travel

- Medical treatment

Know the rules before you send money out to avoid violations.

How FEMA impacts Indian businesses

FEMA isn't just a set of rules—it's a game-changer for Indian businesses. Here's how:

- Attracts foreign investment: Clear rules make India more appealing to overseas investors. For example, the streamlined processes under FEMA have contributed to India's rise in the Ease of Doing Business rankings, making it easier for your startup to attract foreign venture capital.

- Smoothens international payments: Say goodbye to unnecessary delays in settling your import/export payments. With FEMA, you can now receive payments for your exports within a stipulated time frame, improving your cash flow.

- Boosts startups and SMEs: Easier access to foreign capital means more opportunities for growth. Under FEMA, if you're a tech startup, you can more easily raise funds from foreign investors or even list on foreign stock exchanges through ADRs or GDRs.

- Emphasizes compliance: Understanding FEMA helps you avoid penalties and manage risks better. For instance, knowing the reporting requirements for foreign investments can save you from costly fines and legal troubles down the line.

- Facilitates overseas expansion: FEMA provides a framework for Indian companies to set up overseas subsidiaries or branches. This means you can now more easily establish a physical presence in your target markets abroad.

Real-world examples of FEMA in action

Let's look at some scenarios to understand how FEMA works in practice:

- Software exports: Imagine you're a software company in Pune that just landed a $100,000 contract with a US client. Under FEMA, you need to ensure that the payment is received through proper banking channels within 9 months of providing the service. You'll also need to file a Foreign Inward Remittance Certificate (FIRC) with your bank as proof of the forex earned.

- Overseas Investment: Let's say you are an Indian company and you want to set up a subsidiary in Dubai to expand your business. FEMA allows you to invest up to 400% of your net worth in overseas ventures, subject to certain conditions. You'll need to route your investment through authorized dealers and report the details to the RBI.

- ECB for Expansion: If your manufacturing company wants to take an External Commercial Borrowing (ECB) of $10 million for expansion, FEMA provides the guidelines for eligible borrowers, permitted end-uses, the process for approvals where applicable, and the reporting requirements.

Common FEMA compliance mistakes and how to avoid them

Even small mistakes under FEMA can create bigger issues over time. Here are some common pitfalls — and what you can do to stay compliant:

1. Incorrect Purpose Codes

Using the wrong purpose code for a forex transaction can lead to your payments being blocked or delayed by the bank, and may even trigger closer scrutiny from regulators.

2. Missing Foreign Inward Remittance Certificates (FIRCs)

Failing to collect FIRCs for your foreign payments can cause major problems during tax assessments, audits, and when claiming export-related benefits.

3. Ignoring EDPMS Timelines

If you don't receive export payments within the RBI’s specified timeline under the EDPMS framework (usually within 9 months), your shipments may be flagged, and you could face penalties or restrictions on future exports.

4. Misunderstanding LRS Limits

Sending more money abroad than allowed under the Liberalised Remittance Scheme (LRS) — or using it for prohibited purposes — can result in serious compliance violations and hefty fines.

Simplifying FEMA compliance with digital platforms

In today's digital age, complying with FEMA doesn't have to be a headache. Platforms like Xflow are making it easier than ever:

- Authorized transactions: Xflow ensures all your forex dealings go through proper channels, reducing the risk of accidental non-compliance.

- Streamlined processes: Say goodbye to complex paperwork and hello to smooth international payments. These platforms can automate much of the documentation required for FEMA compliance.

- Compliance support: Get guidance on staying within FEMA guidelines. Many digital solutions offer built-in checks to ensure your transactions are compliant before processing them.

- Real-time tracking: Keep an eye on your international transactions as they happen. This transparency helps you manage your forex exposure more effectively.

💡Pro tip: Look for digital solutions that offer transparent pricing, multi-currency support, and easy invoicing. These features can save you time and money while keeping you FEMA-compliant.

Staying updated with FEMA changes

FEMA is not a static set of rules. The RBI regularly updates regulations to keep up with the changing global economic landscape. Here's how you can stay informed:

- Follow the RBI website: The central bank regularly publishes circulars and notifications about FEMA updates.

- Join industry associations: Organizations like FIEO (Federation of Indian Export Organisations) often provide updates and training on FEMA compliance.

- Engage with your bank: Authorized dealer banks are required to stay updated on FEMA. Build a relationship with your bank's forex department for regular updates

- Consider professional help: For complex transactions, consulting with a chartered accountant or legal expert specializing in FEMA can be invaluable.

Final thoughts

FEMA might seem like a complex beast, but it's really your ally in the world of international business. By understanding its key features and leveraging digital solutions, you can turn FEMA compliance from a challenge into an opportunity for global growth.

Remember, staying informed about FEMA isn't just about avoiding penalties—it's about empowering your business to thrive in the global marketplace. So, embrace FEMA, stay compliant, and watch your business soar beyond borders!