When a client in Singapore sends you $5,000, it doesn't instantly show up in your account. Behind the scenes, that money travels through a secure global network used by more than 11,000 financial institutions. This system is called SWIFT, short for the Society for Worldwide Interbank Financial Telecommunication.

It is the core infrastructure behind almost every international payment, quietly moving trillions of dollars across borders every day. While most businesses never see it directly, their global transactions rely on it completely.

What is SWIFT?

The Society for Worldwide Interbank Financial Telecommunication, or SWIFT, isn't a payment processor. It's a secure messaging system that tells banks how to move money between each other across borders.

Think of SWIFT as the postal service for financial institutions. It doesn't transfer funds or hold accounts. Instead, it delivers critical instructions—securely and in a standardized format—that tell one bank to credit or debit another.

Today, the SWIFT banking system connects over 11,000 financial institutions across more than 200 countries, exchanging over 44.8 million messages every day. These messages underpin trillions of dollars in international payments, from small business transfers to institutional trades.

For example, if Deutsche Bank in Frankfurt wants to send funds to JPMorgan Chase in New York, both banks use the SWIFT network to exchange a standardized payment message. That message contains all necessary details—recipient account number, currency, amount, and any relevant instructions.

SWIFT is structured as a member-owned cooperative, meaning the banks that use the system also collectively own it. This neutral, non-profit design has helped SWIFT become the dominant infrastructure for global bank-to-bank communication.

The world before SWIFT

Before 1973, international banking was in chaos. Banks used telegrams, telex machines, and phone calls to coordinate cross-border payments. Each bank had its own messaging format, leading to constant errors and delays.

Imagine trying to send $100,000 from New York to London in 1970:

- Your bank would telex the London bank with payment details

- The London bank might not understand the format

- Multiple back-and-forth messages to clarify details

- Transactions took days or weeks to complete

- High error rates led to lost or misdirected funds

This inefficiency cost banks millions and made international trade unnecessarily complex.

A brief history of the SWIFT system

- 1973: 239 banks from 15 countries formed SWIFT to standardize international banking communications.

- 1977: SWIFT went live, processing 3.4 million messages in its first year – a fraction of today’s volume.

- 1980s: Expansion beyond Europe and North America as global trade increased.

- 1990s: Introduction of new message types for securities trading and foreign exchange.

- 2000s: Enhanced security measures and real-time messaging capabilities.

- 2010s: Development of new standards for faster payments and regulatory compliance.

- 2017: Launch of SWIFT gpi (Global Payments Innovation), providing real-time payment tracking and faster settlement for international transfers.

- 2021: Introduction of SWIFT Go, a service enabling fast, cost-effective low-value cross-border payments.

Today, SWIFT handles a significant portion of international payment instructions, making it virtually irreplaceable in global finance.

Why is SWIFT dominant?

The SWIFT payment network dominates for several compelling reasons:

- Universal standards: Every participating bank uses the same message formats, eliminating confusion and errors that plagued pre-SWIFT banking.

- Security: Bank-grade encryption and multi-layered authentication protect trillions in daily transactions. SWIFT's security standards are so robust that even cryptocurrency exchanges adopt similar protocols.

- Network effects: With 11,000+ members, SWIFT offers an unmatched global reach. A small community bank in rural America can seamlessly send money to a major bank in Tokyo.

- Regulatory compliance: SWIFT messages include built-in compliance checks for anti-money laundering (AML) and know-your-customer (KYC) requirements.

- Cost efficiency: Standardized messaging reduces operational costs compared to bilateral banking relationships.

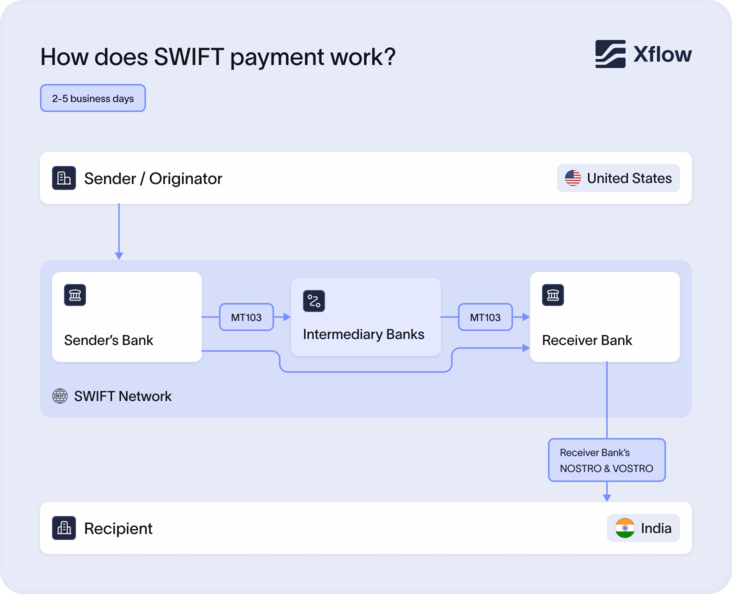

How does a SWIFT payment work?

Here's what happens when you initiate an international wire transfer:

Step 1: Instruction creation

Your bank creates a SWIFT message (typically MT103 for customer transfers) containing:

- Your account details

- Recipient's bank and account information

- Transfer amount and currency

- Purpose of payment

- Any special instructions

Step 2: Message routing

SWIFT's network routes the message through its secure channels. For a payment from Wells Fargo (USA) to HSBC (UK), the message travels through SWIFT's data centers in the Netherlands and Switzerland.

Step 3: Correspondent banking

If your bank doesn't have a direct relationship with the recipient's bank, the message routes through correspondent banks. For example:

Wells Fargo → JPMorgan Chase (correspondent) → HSBC

Step 4: Settlement

Banks settle the actual funds through their nostro/vostro accounts (accounts banks hold with each other) or through central bank systems like Fedwire or TARGET2.

Step 5: Confirmation

The recipient's bank confirms receipt and credits the beneficiary's account, sending confirmation back through the SWIFT network.

How to make a SWIFT transaction?

Making a SWIFT payment requires specific information:

Essential details you'll need:

- Recipient's full name and address

- Recipient's bank name and address

- SWIFT/BIC code of the recipient's bank

- Recipient's account number or IBAN

- Transfer amount and currency

- Purpose of payment (for compliance)

Step-by-step process:

- Visit your bank: Online banking, mobile app, or visit.

- Choose international wire transfer: Select the SWIFT/international option.

- Enter recipient details: Double-check all information for accuracy.

- Specify payment details: Amount, currency, and purpose.

- Review fees: Understand all charges upfront.

- Authorize transfer: Digital signature, PIN, or written authorization.

- Receive confirmation: Get the transaction reference number for tracking

What are SWIFT codes?

A SWIFT code (also called BIC - Bank Identifier Code) is an 8-character code that uniquely identifies every bank in the SWIFT network.

SWIFT code structure:

- First 4 characters: Bank code (e.g., "CITI" for Citibank)

- Next 2 characters: Country code (e.g., "US" for the United States)

- Next 2 characters: Location code (e.g., "NY" for New York)

- Last 3 characters: Branch code (optional)

Real examples:

- CITIUS33: Citibank N.A., New York, USA

- DEUTDEFF: Deutsche Bank AG, Frankfurt, Germany

- HSBCHKHH: HSBC, Hong Kong

Is BIC the same as a SWIFT code?

Yes, the BIC (Bank Identifier Code) and SWIFT codes are the same. The terms are used interchangeably:

- SWIFT code: A common term in North America

- BIC: Preferred term in Europe and other regions

- Bank identifier code: Full technical name

Regardless of terminology, they serve the same function – uniquely identifying banks in international transactions.

What are the fees for SWIFT transfers?

SWIFT clearing system fees vary significantly by bank and transfer details:

Typical fee structure:

- Outgoing wire fee: $15-50 per transaction

- Incoming wire fee: $10-25 per transaction

- Correspondent bank fees: $10–30, deducted along the route (sometimes without notice)

- Currency conversion margin: 1–3% over the mid-market rate, depending on the bank

Shared (SHA), Our (OUR), or Beneficiary (BEN) payment instructions:

- SHA (shared): You pay your bank’s fee; the recipient pays their bank’s fees.

- OUR: You pay all fees so the recipient gets the full amount.

- BEN: The recipient bears all fees—usually used for corporate payments.

Transfer time for SWIFT payments

| Transfer speed | Conditions | Likelihood |

|---|---|---|

| Under 1 hour | GPI-enabled banks, major currencies, early in the day | ~90% of cases |

| Same day (few hours) | Accurate details, no compliance flags, no FX or minor FX | Most transfers |

| 1 business day | Includes FX, non-GPI, minor delays (e.g. cut-off timing) | Common |

| 2–3 days | Less common currencies, added compliance or routing steps | Occasional |

| 3–5 days | Major issues: manual compliance, missing info, holidays | Rare (edge cases) |

Despite faster infrastructure, certain operational factors can stretch delivery times:

- Compliance screening (AML/KYC): Payments flagged for regulatory review (e.g., large amounts, new recipients) may be held for manual checks.

- Cut-off times: Banks process wires only during business hours. Transfers sent after cut-off (usually afternoon local time) are processed the next day.

- Weekends and holidays: SWIFT doesn’t process transfers on non-business days. Payments made late Friday may settle Monday.

- Currency conversion: Exotic or low-liquidity currencies often require more routing and time than major pairs (e.g., USD/EUR).

- Incorrect details: Errors in SWIFT/BIC codes, IBANs, or recipient info can cause delays or rejections.

Multiple intermediary banks: Each additional bank adds minor time, though most transfers today use 0–1 intermediaries.

Who uses SWIFT payments?

The SWIFT pay systems serve diverse users across the global economy:

- Commercial banks: Process customer wire transfers and interbank settlements

- Investment banks: Handle large securities transactions and foreign exchange deals

- Corporations: Make international supplier payments, manage global payroll, and collect receivables

- Government agencies: Transfer funds between countries for aid, trade, and diplomatic purposes

- Central banks: Coordinate monetary policy and manage foreign reserves

- Market infrastructure: Stock exchanges, clearing houses, and settlement systems

Who owns the SWIFT banking system?

SWIFT is a member-owned cooperative based in Belgium. It’s used by over 11,000 institutions across more than 200 countries. About 3,500 of these members hold shares—allocated based on how much they use the network—and they elect the board. The board has 25 directors who serve staggered three-year terms. To reflect global usage, the six biggest user countries get to nominate two directors each, the next ten get one each, and the rest of the world shares up to three seats. Directors and the chair (elected yearly) aren’t paid a salary, just travel expenses.

Importance of SWIFT in global finance

The SWIFT international payment system is fundamental to the global economy:

- Trade facilitation: Enables $15 trillion in annual international trade by providing payment certainty

- Financial stability: Standardized messaging reduces errors and systemic risks

- Economic integration: Connects emerging markets to global financial networks

- Regulatory compliance: Built-in controls help prevent money laundering and terrorist financing

- Market infrastructure: Supports foreign exchange, securities, and commodity markets

- Development impact: Enables developing countries to participate in global commerce

Without SWIFT, international business would return to the inefficient, error-prone methods of the 1960s.

SWIFT and economic sanctions

SWIFT stays neutral, but it follows the laws of Belgium and the EU. When authorities legally require it, SWIFT disconnects sanctioned institutions. This happened in 2012 with Iranian banks, and again in 2022, when the EU ordered the removal of seven major Russian banks after the invasion of Ukraine.

These disconnections are technical—SWIFT simply cuts off messaging. But the impact is real: without access to SWIFT, banks struggle to make international payments. It’s one of the most powerful tools governments have for isolating targeted economies.

SWIFT emphasizes that it doesn’t handle or control the underlying transactions. Still, its role as the global messaging backbone gives it an outsized influence on how connected (or disconnected) a country can be from the global financial system.

Common issues and challenges with SWIFT

Despite its dominance, the SWIFT clearing system faces several challenges:

- Slow settlement: Even with SWIFT gpi, most payments still take 1–3 business days.

- High costs: Fees from multiple banks along the route can add up quickly.

- Lack of transparency: Traditional SWIFT payments (without gpi) offer little visibility into where your money is or when it will arrive.

- Manual processes: Many banks still handle parts of the SWIFT process manually, increasing room for delay or error.

- Not available to individuals directly: You can’t use SWIFT yourself—you must go through a bank or fintech provider.

- Correspondent banking: Declining relationships increase costs and complexity

- Regulatory burden: Increasing compliance requirements slow processing

- Cybersecurity: High-value targets for sophisticated attacks

- Competition: New technologies like blockchain and digital currencies offer alternatives

- Geopolitical risks: Sanctions usage creates incentives for alternative systems

The future of SWIFT

SWIFT is adapting to maintain relevance:

- ISO 20022 standard migration: A new, richer data format that improves automation, compliance, and reconciliation.

- Real-time payments: Integrations with instant domestic networks like India’s UPI or Europe’s SEPA Instant.

- Open APIs and SWIFT Go: For enabling low-value, fast, consumer-facing payments.

- Combatting fraud: AI-based anomaly detection to reduce payment fraud risks.

The bottom line

SWIFT is the backbone of global finance, moving trillions of dollars every day. It's trusted, secure, and used worldwide. But let's be honest, it can also be slow and expensive.

Suppose you're doing business internationally; understanding how SWIFT works is important.

But the good news? You don't have to handle it all on your own. Platforms like Xflow make international payments a whole lot easier. You get faster transfers, transparent pricing, and a smoother experience—without giving up the reliability of SWIFT.

No, SWIFT is a bank-to-bank network. Individuals access SWIFT through their banks for international wire transfers.

SWIFT is the messaging system that enables wire transfers. The wire transfer is the actual movement of funds.

Processing involves multiple banks, compliance checks, and settlement procedures. Each step adds time.

Yes, SWIFT uses bank-grade security with encryption and authentication. However, fraud can occur through social engineering.

Rarely. Once funds are sent and received, reversal requires cooperation from all involved banks and is not guaranteed.

The transfer may be rejected, delayed, or sent to the wrong bank. Always verify codes independently.