Introduction

In 2022, the share of exports of goods and services in India to the GDP was 21.4%. And in 2023-24, Indian exports reached $778.21 billion. This was considered a historic rise as it marked a 67% increase from what it was in 2013-14. However, what these numbers don't reveal is the efficient systems and processes working behind the scenes to power India's export engine.

And one such efficient system is the EDPMS, full form of which is Export Data Processing and Monitoring System, which was launched by the RBI in 2014. This robust platform ensures that every export transaction is tracked, verified, and compliant, enabling faster clearances and secure payments.

If you are an exporter, knowing what is EDPMS and its various nuances is as essential as shipping your goods or providing your services. Without proper EDPMS compliance, your export proceeds may even get delayed or blocked, disrupting your entire business flow.

Let's try to understand what is EDPMS and what significance it holds for your export business.

What is EDPMS?

Export Data Processing and Monitoring System (EDPMS) is a centralized online platform created by RBI to monitor and manage all your export transactions annually. The platform brings together every step of the export process, right from filing shipping bills to tracking and confirming final payment, into one seamless system. It streamlines data sharing between banks, customs, and exporters, turning what used to be a fragmented process into a smooth, end-to-end digital workflow.

Key system capabilities

- Consolidated data management: EDPMS unifies export-related data from all stakeholders on one platform. This centralization ensures accurate transaction records while eliminating manual errors and data silos

- Transaction monitoring: The system enables stakeholders to track payment and shipping status in real time, reducing ambiguity and speeding up discrepancy resolution.

- Compliance framework: EDPMS continuously monitors adherence to FEMA guidelines and RBI regulations. The system tracks realization deadlines and maintains comprehensive audit trails, protecting businesses from compliance risks.

- Integration with external systems: EDPMS connects directly with ICEGATE (Indian Customs EDI Gateway) and DGFT's (Directorate General of Foreign Trade) digital platforms, enabling automated data exchange between regulatory bodies.

Why did RBI launch EDPMS?

Prior to the launch of EDPMS, the Indian export system was replete with several challenges such as manual paperwork, lack of real-time tracking, poor coordination between banks and customs, delays in payment realization, and limited oversight on export compliance. The purpose behind launching the comprehensive digital platform was to:

EDPMS has transformed this landscape, delivering several advantages across the export value chain:

1. Monitor export proceeds and payments

Earlier, RBI had limited visibility over whether exporters were receiving payments for their shipments on time. With EDPMS, RBI can track export proceeds, ensuring that all payments due to Indian exporters are received and accounted for.

2. Enhance transparency and traceability

The export lifecycle was previously managed through manual submission of documents, leading to delays, discrepancies, and potential data manipulation. EDPMS centralizes and digitizes the process, which brings the much-needed transparency and traceability to export transactions.

3. Improve data collection for forex management

EDPMS helps RBI collect accurate and timely data on export bills and foreign remittances, which is crucial for the effective management of India's foreign exchange reserves and operations.

4. Streamline and automate export processes

By integrating with customs and banks, EDPMS automates the reporting and monitoring of export transactions, reducing administrative burdens and making the export process more efficient for both exporters and regulators.

5. Prevent non-compliance and fraud

The system allows RBI to identify exporters who are not complying with regulations or are attempting to hide export proceeds, enabling timely enforcement actions and better regulatory oversight.

What is the EDPMS caution list?

The EDPMS caution list is for those exporters who have unresolved transactions for more than two years without extension or who fail to comply with the essential regulatory requirements of RBI and FEMA. However, a shipping bill may remain open due to genuine reasons as well, which is why RBI revised its caution-listing guidelines in 2020.

According to new guidelines, exporters won't be included in the list automatically if they fail to close payments within two years. Instead, the onus was shifted to the authorized dealer bank to recommend exporters' inclusion in the list based on their previous track record.

The bank has to offer its recommendations to the relevant Regional Office of the Foreign Exchange Department of the Reserve Bank if an exporter's track record seems suspicious and their shipping bills have been open for more than two years. Moreover, the bank can also recommend de-cautioning an exporter from the list.

But what are the consequences if an exporter gets listed on the caution list?

- They won't be able to access export benefits.

- Their whole shipment will be subject to strict scrutiny from the authorities.

What are the benefits of EDPMS?

Before EDPMS, India's export sector struggled with fragmented processes and manual documentation. Exporters faced significant challenges in payment tracking, reconciliation, and compliance management. With international trade volumes growing exponentially, these inefficiencies created substantial business risks, from delayed realizations to potential penalties.

EDPMS has transformed this landscape, delivering several advantages across the export value chain, such as:

1. Process optimization: If you are a service exporter, particularly in IT and consulting, you can benefit from systematic operations through centralized tracking of all export invoices and payments. The system enables automated reconciliation of incoming remittances and provides real-time visibility into payment status, significantly reducing processing time and manual errors.

2. Performance analytics: EDPMS provides comprehensive insights into payment patterns and client performance, which enables you to take informed decisions regarding credit terms and market expansion. These analytics help you identify operational bottlenecks early and optimize your export strategies based on concrete data.

3. Documentation efficiency: Through single-window processing, EDPMS simplifies your document management and regulatory compliance. This standardized approach across banks has significantly reduced paperwork and follow-ups, which allows you to focus on core business activities.

4. Enhanced market credibility: Clean EDPMS records strengthen your position as an exporter when seeking trade finance or negotiating with new international buyers. Banks often consider EDPMS track records when assessing credit proposals, making them a valuable tool for business growth.

5. Better regulatory compliance: Your EDPMS clearance ensures that all your export transactions are properly documented and reported in line with the Reserve Bank of India (RBI) and Foreign Exchange Management Act (FEMA) regulations. This helps you stay off the caution list and avoid penalties, fines, or costly operational disruptions caused by non-compliance.

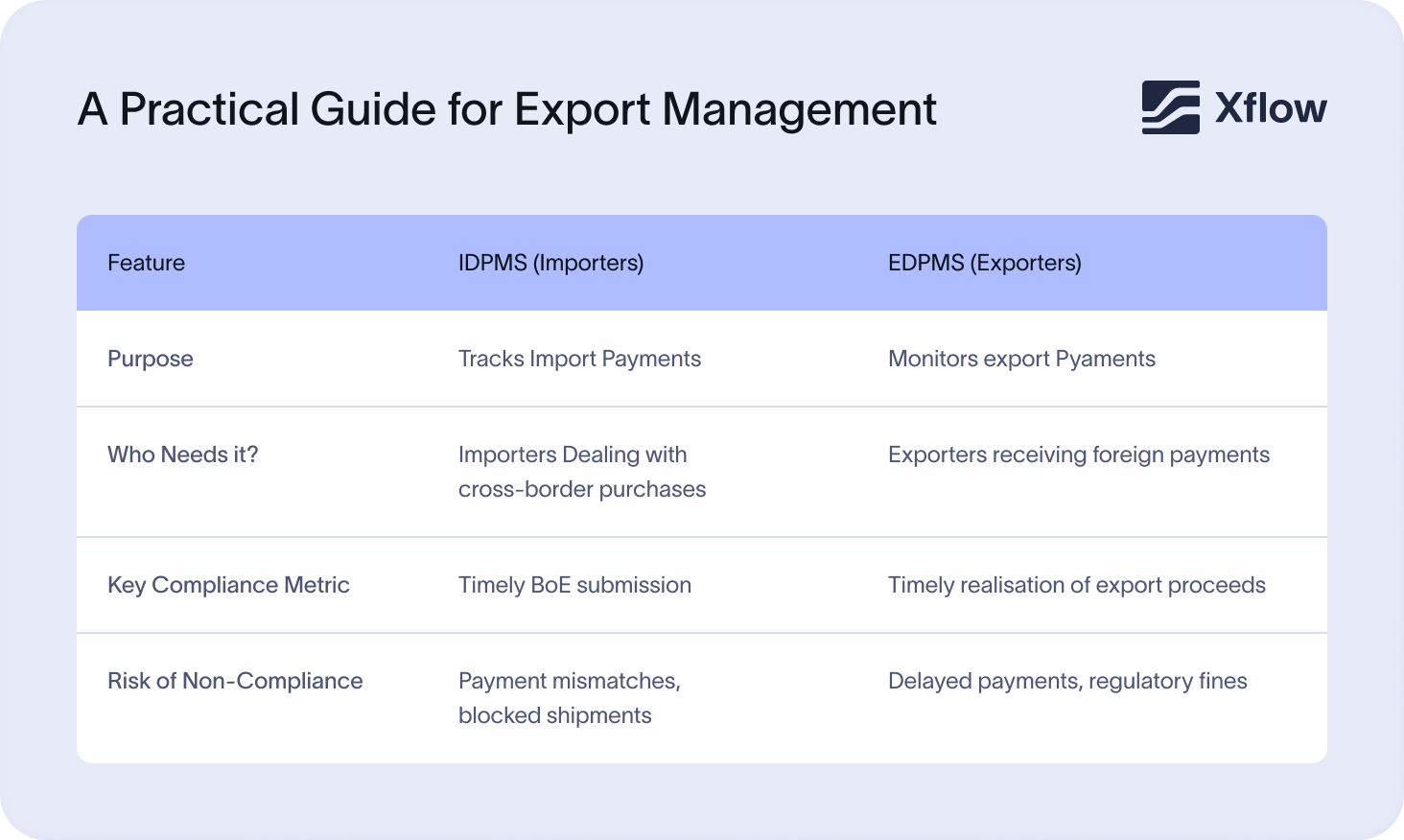

What is the difference between EDPMS and IDPMS?

IDPMS, or Import Data Processing and Monitoring System, is an online platform that monitors and optimizes import transactions. So, while both IDPMS and EDPMS are associated with cross-border transactions, the former is strictly confined to managing and monitoring imports of goods and services and ensuring importers' compliance, the latter is for exports only. The detailed differences are highlighted in the table below.

| Features | EDPMS | IDPMS |

|---|---|---|

| Objective | Oversee export transactions and ensure regulatory compliance of exporters | Monitor import transactions and ensure importers’ compliance |

| Essential Compliance Metric | Timely submission of Bill of Entry (BoE) | Timely realization of export proceeds |

| Transaction Type | Handles export bills, shipping documentation, and FIRC-related transactions | Manages import bills, evidence of import, and settlement of bills of entry (BoE) |

| Functions | Offers modules to report advance remittances on exports, track shipping bills, and manage electronic bank realization certificates (eBRC) | Includes processes for managing advance payments on imports, settling transactions, and verifying import evidence |

Who should use EDPMS?

EDPMS is mainly used by:

1. Exporters: In this category come exporters of various goods and services, including software services. If you handle shipping bills for goods and services exports or SOFTEX Forms for your software export, you need to register on the EDPMS platform. Freelancers who offer their services to international clients are not required to register on the platform.

2. Banks: Banks also use the EDPMS platform to download shipping bills, SOFTEX forms, and bills of entry issued by export agencies. They use this information to match datasets and export proceeds and track the status of the consignment that's been exported. Once the verification is done, exporters can swiftly claim their benefits.

Steps to get your EDPMS clearance

Securing EDPMS clearance is a multi-step process. Here's a breakdown of the essential steps that ensure smooth documentation flow and timely approvals:

- Initial registration: The EDPMS clearance process begins with mandatory registration with the authorised dealer bank. Exporters must submit their Importer Exporter Code (IEC) along with the required banking details. This foundational step ensures all subsequent export transactions are properly tracked and attributed within the system.

- Shipping and customs documentation: Once registration is complete, the active monitoring phase begins with shipping and customs clearance. After goods are dispatched and customs procedures are cleared, the shipping bill details are automatically transmitted to EDPMS with a 'Pending Acknowledgment' status. This digital initiation creates the primary reference point for tracking the entire transaction lifecycle.

- Bank document submission: The third phase requires submission of all export documentation to the authorised dealer bank. Essential documents include shipping bills, commercial invoices, and packing lists. The bank processes these documents and updates EDPMS status to 'Pending Payment', creating a clear trail for payment monitoring.

- Payment receipt processing: Upon receiving export proceeds, the transaction enters the payment confirmation phase. Banks generate an Inward Remittance Message (IRM) and issue a Foreign Inward Remittance Advice (FIRA). These documents provide transaction reference numbers and help match incoming payments with corresponding shipping bills.

- Final verification and closure: The concluding stage involves comprehensive verification by the authorised dealer bank. After thorough checks, the bank issues an electronic Bank Realization Certificate (e-BRC). Once all documentation aligns perfectly, the EDPMS status updates to 'Payment Realized', marking successful transaction closure.

How to check your shipping bill EDPMS status online?

If you want to check your shipping bill EDPMS status, you need to go through the following steps:

1. Visit the official ICEGATE portal at https://www.icegate.gov.in/

2. On the dashboard, move to the navigation menu and select Services

3. From the Services section, select Quick Information and click on the Public Enquiries

4. On the Public Enquiries page, select RBI-SB-EDPMS Enquiry

5. Enter the details asked on the page

6. Your Shipping Bill EDPMS status will be displayed on the screen

What documents are required to close your EDPMS shipping bill cycle?

When you are closing your EDPMS shipping bill cycle, there are certain documents that are required. These documents are included in the table below.

| Document | Purpose |

|---|---|

| Shipping Bill | This critical document outlines the details of the goods or services you are exporting and is submitted to the custom authorities. It's central to the EDPMS tracking process. |

| Invoice | Your invoice captures key transaction details such as product descriptions, quantities, and values. It validates the export transaction and links it with the corresponding shipping bill. |

| Export Contract | The export contract serves as proof of the agreed terms between you and the buyer, providing legal assurance for the transaction. You need to submit a copy of this. |

| Bill of Landing | Acting as both a shipment receipt and a transport contract between shipper and carrier, this document confirms that the goods have been handed over to the carrier. |

| Payment Receipt | Payment receipt is used to validate the receipt of export earnings. You should provide evidence such as remittance advice or a copy of the credited bank transaction. |

| Forward Inward Remittance Advice (FIRA) | FIRA confirms receipt of international payment. It's a mandatory step to close the shipping bill in the EDPMS system. |

| Bank Certification | It’s your bank’s confirmation that all required paperwork is in order and payment has been realized. It’s also an important step in your shipping bill closure. |

How to close the shipping bill in EDPMS?

Follow these steps to successfully complete your shipping bill closure in EDPMS.

1. The first step is to confirm that you have received the export payment and that it's duly recorded in your bank account.

2. Next, make sure your FIRA and Authorized Dealer documents are submitted to the bank as proof of payment.

3. After that, your bank will verify those documents and update the transaction details on the EDPMS portal.

4. Your job is to monitor the EDPMS portal regularly to check the realization of your shipping bill.

5. The bank then performs the reconciliation, which matches the export transactions and your shipping bills. If there are no discrepancies and the data matches, the bank will close the transaction in the portal.

6. As confirmation of the closure, you will also receive a notification from your bank.

Staying off the caution list

Exporters who fail to comply with EDPMS requirements may be placed on the caution list. Being on the caution list can have long term implications. It affects banking relationships, limits access to trade finance, and can damage a business's reputation.

Since 2020, banks directly manage the caution list instead of RBI. Hence, they have full discretion to put exportors on this list in case they suspect any transactional discrepancies.

Key reasons for being added to the caution list:

- Delayed realization of export proceeds

- Repeated discrepancies in export documentation

- Non-adherence to RBI and FEMA norms

Best practices for EDPMS compliance and monitoring

Exporters can face payment delays and compliance challenges due to improper EDPMS implementation. Following these best practices can help optimize your workflow:

- Regular monitoring: Check EDPMS status at least weekly through your bank portal. Track all pending shipping bills and payment realizations to prevent delays.

- Documentation standards: Create a digital repository of all export documents. Maintain chronological records of shipping bills, BRCs, and bank communications.

- Compliance management: Ensure strict alignment with RBI requirements. It will prevent payment clearance delays and strengthen your export compliance profile.

- Bank coordination: Build strong relationships with your AD bank's EDPMS team. Regular communication helps resolve issues faster and can improve processing times.

How does Xflow help in your export management?

EDPMS has fundamentally transformed how India's export sector manages international transactions. For IT companies and service businesses handling cross-border payments, the system delivers critical business intelligence while ensuring regulatory compliance.

However, none of this is possible without secure and efficient transaction processes. If your cross-border transaction workflows aren't streamlined and safe, it can lead to delays, increased risks, and compliance issues that impact your business operations and reputation. And that's where Xflow steps in.

Xflow makes your international transactions simple and reliable. With its exceptional reliability and faster settlement features, you get your money in your bank account within hours without the need for intermediary banks or any additional charges. No matter what's the size of your business, you can make limitless transactions on a single invoice with complete visibility on FX rates.

It offers smart integration with your favorite third-party tool so you can track every transaction in real-time on a single window. Moreover, the simplified KYC process streamlines onboarding, while a dedicated team of experts ensures smooth, hassle-free resolution of urgent matters.

Book a demo with Xflow now and experience how effortless cross-border payments can be!

Conclusion

EDPMS has fundamentally transformed how India's export sector manages international transactions. For IT companies and service businesses handling cross-border payments, the system delivers critical business intelligence while ensuring regulatory compliance. The impact shows in faster payment reconciliation, stronger banking relationships, and more efficient forex management.

Indian exporters leveraging the system effectively gain significant operational advantages. Beyond mandatory compliance, EDPMS provides the transparency and documentation essential for scaling global operations.

To monitor and manage export-related payments, ensuring compliance with Indian regulations.

All exporters and their authorised banks are mandated to use EDPMS for reporting and reconciliation.

EDPMS flags overdue payments, and exporters may face compliance scrutiny or penalties.

EDPMS status can be checked online through the ICEGATE website. Navigate to Public Enquiries, select RBI-SB-EDPMS Enquiry, and enter the required details, such as location, shipping bill number, and bill date.

No, EDPMS is mandatory for compliance with FEMA regulations.