Obtaining an Importer Exporter Code (IEC) is a fundamental compliance requirement for legally engaging in international business. This article walks you through everything you need to know about IEC, how to obtain it, and integration with new-age platforms like Xflow to make your transactions faster and more secure.

What is IEC Code verification?

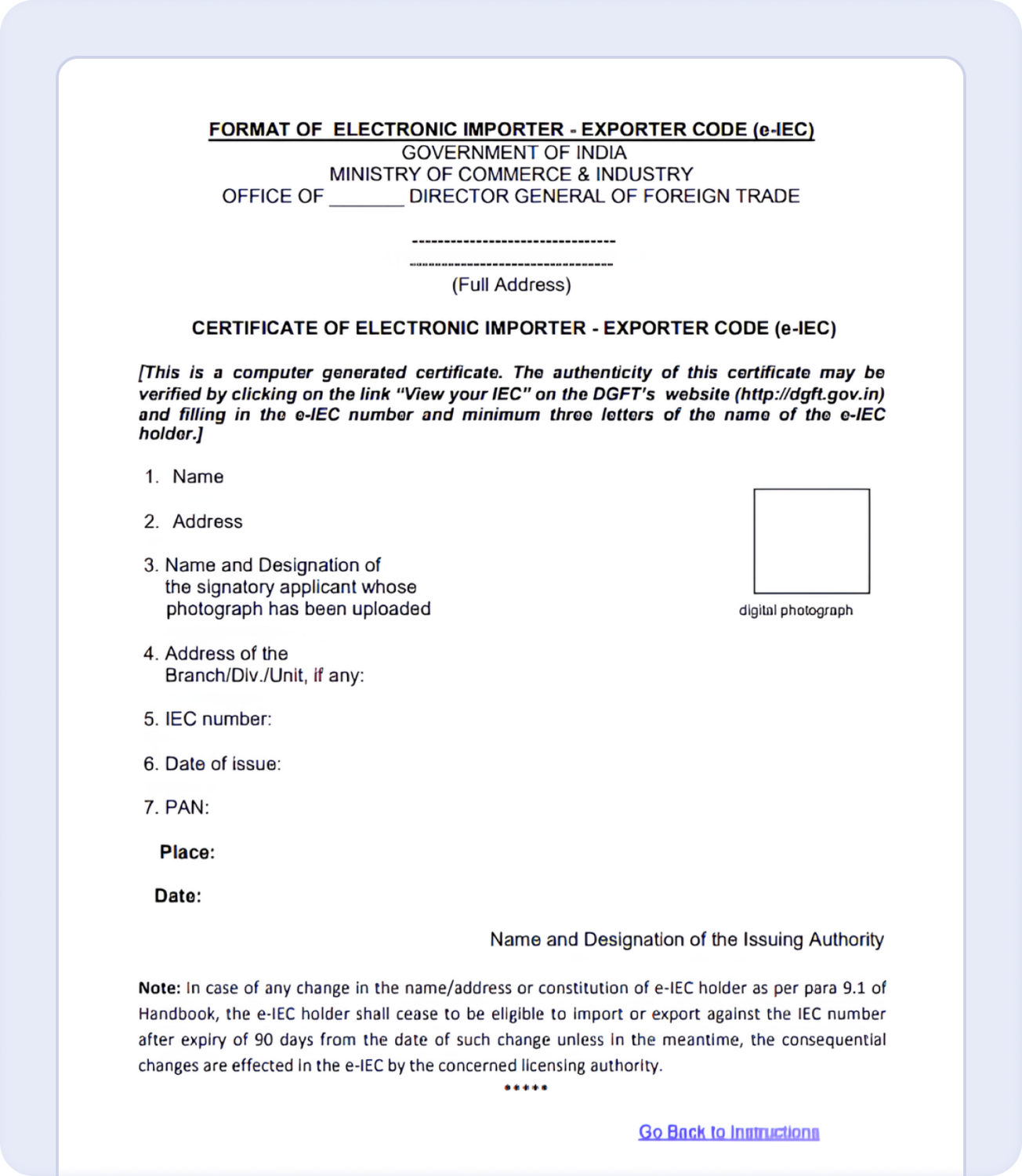

The IEC is a unique ten-digit registration number issued by the Directorate General of Foreign Trade (DGFT), Government of India. Without this registration, importers cannot clear customs, and exporters cannot ship goods or receive payments from foreign clients. While obtaining the IEC was previously considered a one-time registration, the shift towards digital integration and the need for a stronger compliance framework have further prompted changes. The DGFT has now mandated that all IEC holders must update their business details between 1st April and 30th June every year. If they fail to do so, it will result in automatic deactivation of the code.

Importance of IEC verification

IEC (Importer Exporter Code) verification is important because it ensures the legitimacy and compliance of businesses involved in cross-border trade.

IEC code verification confirms that a business is legally registered to import or export from India. It helps ensure compliance with RBI and customs rules, prevents fraud, and makes international payments more secure and transparent.

In short, IEC verification builds trust, ensures compliance, and protects both parties in a cross-border transaction.

Benefits of IEC Code verification

India has set a target of $ 2 trillion in exports by 2030, evenly split between merchandise and services. To achieve this target, the government has intensified its focus on ensuring that only verified businesses can access the global market and its associated benefits. Here are some of the key benefits the IEC code brings with it:

Scheme benefits:

IEC is mandatory to claim benefits under schemes like the Service Exports from India Scheme (SEIS), Merchandise Export from India Scheme (MEIS), government-introduced export schemes, tax rebates, and exemptions that have been created to promote cross-border trade in services.

Seamless customs clearance:

An active IEC code is crucial for seamless customs clearance in India. ICEGATE uses this code to track the import and export of consignments. If the code is invalid or incorrect, shipments could be held up or even denied clearance. Consider the case of an exporter from Mumbai experiencing shipment delay due to an inactive IEC. During the customs clearance, the IEC code status was found to be inactive. It halted shipment and resulted in prolonged warehousing, and the exporter had to incur additional costs and penalties.

Improved Supply Chain:

With the IEC code linked to PAN, the export or import process becomes more efficient and not only saves time but also increases the overall efficiency of the supply chain integration.

Building Trust:

Trust is a key factor in building long-term relationships. By having compliances in check, one can demonstrate commitment to secure trade practices and encourage professionalism and transparency at the importer's and exporter’s end.

IEC status & what to do next

After you've applied for or verified your IEC code, the next step is to check its status and understand what it actually means.

You’ll typically see one of the following labels when you check your IEC status on DGFT or ICEGATE:

- Active

- Inactive

- Suspended

- Cancelled

- Under Scrutiny

Each of these indicates how ready you are to start trading internationally. Sometimes, there might be certain actions you can take to expedite the application depending on the current status.

Here’s a table that breaks down what these IEC statuses mean, why they occur, and what you can or need to do next.

| EC Status | What It Means | Why It Happens | What to Do Next (Solution) |

|---|---|---|---|

| Active | Your IEC code is verified and valid on DGFT and ICEGATE | It means that you've completed annual verification (April–June window) | No action needed. Set a calendar reminder to verify again next year between April 1 and June 30. |

| Inactive | IEC has been deactivated. You can’t use it for import/export, customs, or payment settlements. | It happens when you miss the annual update window. DGFT auto-deactivates all IECs that are not verified by June 30. | Log in to the DGFT Portal. Select “Modify IEC”, update details, and resubmit for reactivation. |

| Suspended | IEC temporarily halted due to compliance or regulatory issues. | Non-filing of returns, GST mismatch, or legal issues flagged during scrutiny can be behind it. | Check your DGFT dashboard or registered email for notices. Contact your DGFT regional office to resolve and reinstate. |

| Cancelled | IEC is permanently revoked. Cannot be used for any trade activity. | It means that it’s either voluntarily surrendered or cancelled by DGFT due to fraud, non-compliance, or business closure. | If cancelled by mistake, you’ll need to reapply for a new IEC. Cancellation is not reversible. |

| Under Scrutiny | Your IEC application or status is pending manual review by DGFT. | PAN mismatch, missing DSC registration on ICEGATE, or conflicting GSTIN. | Double-check your PAN/GST/DSC. Resolve mismatches and submit any missing documents as and when requested by DGFT. |

| DGFT Active, ICEGATE Inactive | IEC is updated on DGFT, but not visible or active on ICEGATE. | You skipped port registration via Digital Signature Certificate (DSC). | Go to the ICEGATE portal and then complete DSC-based registration for full activation. |

How to apply for IEC Code online?

The process of applying for an IEC is fairly straightforward and does not have too many steps. Here is how you can do it:

Step 1: Visit the DGFT Website: https://www.dgft.gov.in.

Step 2: Create an account if you do not have one already.

Step 3: Click on "Register" and provide details such as your name, email ID, mobile number, and PAN.

Step 4: You can log in using your credentials, go to IEC Profile Management within the Services tab, and choose “Apply for IEC”.

Step 5: Once on the page, you will be required to fill out Form ANF 2A. The form will need you to fill out business information and upload certain documents such as the name and address of the business, PAN, bank account details (along with a cancelled cheque), address proof, email ID, and mobile number.

Step 6: You will be required to pay the application fee on the portal and use Aadhar-based OTP or DSC to apply.

Step 7: The details will be reviewed, and if everything is okay, you will receive approval within 1–2 working days.

How to verify IEC Code online?

While applying for an IEC is a one-time procedure, verification of the IEC needs to happen on an annual basis. According to DGFT Circular 04/2025 (dated April 1, 2025), 1, all IEC holders, including service between 1st April to 30th June each year. The failure to comply with the annual verification requirement will directly lead to deactivation effective 1st July 2025 without a separate notice. Here is how you can do it:

DGFT Verification Steps:

- Visit the DGFT website.

- Navigate to the IEC profile management from the home page.

- Click on the IEC status.

- Log in to the account, enter the IEC code number in the provided field, and submit.

- After validation, the IEC code details are displayed, including status, such as Active/Inactive/Suspended/Cancelled.

This process ensures the IEC is active for consistent and smooth exports or imports.

List of Types of Different Statuses of IEC Code Verification

Now that you have applied for your IEC Code or verified it, you might want to check the status. Here are the steps to check the status of your application online:

ICEGATE Verification Steps:

- Access the ICEGATE portal.

- Navigate to the verification services and check on the IEC code/BIN number.

- Input the details on the port location and the captcha code on the screen.

- Click on the IEC code button to display the status.

While checking through the portal, here are the different messages that can show up:

- Active: An active IEC code is valid for all types of export or import transactions, customs clearance, and access to benefits without any hindrance.

- Inactive: The IEC code inactive status means your IEC has not been updated during the specified period for the April to June window; failure to update results in deactivation and restricts all import-export operations.

- Suspended: A suspended IEC code denotes temporarily halted due to a compliance issue or any legal matters.

- Cancelled: A cancelled IEC indicates that the code has been revoked either by the authorities or voluntarily by the holder, due to reasons such as fraud, business closure, or mergers. Once an IEC code is cancelled, it can no longer be used for any international trade activities.

- Under Scrutiny: An IEC code marked as "under scrutiny" typically indicates discrepancies in PAN or GSTIN details. Trade activities remain restricted until the verification process is completed.

Regular monitoring and updating of IEC status ensures uninterrupted trade operations and compliance with regulators.

Common IEC issues and their solutions

While the application and verification process in itself is quite straightforward, here are some issues that might come up along with how you can resolve them:

| Problem | Cause | Resolution |

|---|---|---|

| IEC marked as “Inactive” | Not updated during the April–June FY window. | For reactivation, log in to the “DGFT” portal, click on “Modify IEC”, and submit. The process ensures IEC remains active for the financial year. |

| PAN not matching | Wrong or outdated PAN in DGFT records. | Submit PAN correction requests online. |

| ICEGATE displays IEC “not registered” | Depending on manual port registration. | Register on ICEGATE using DSC Registration is mandatory for customs clearance and export-import related activities. |

| Mobile/email outdated | Details not updated since the issue date. | Log in to the DGFT portal> Manage Profile >Update contact details. |

| IEC suspended | Non-compliance issues or GSTIN missing. | Submit documents to the DGFT regional office. It facilitates the IEC. |

What happens if I don’t verify my IEC Code?

Failing to update or verify the IEC code leads to significant disruptions in international trade operations. The potential consequences are:

Banking and financial transactions:

- Payment Delay or Freezes: The IEC code is inactive, resulting in cash flow disruption.

- Trade finance rejection: Pre and post-shipment credit applications are denied due to inactive IEC status.

- Letter of Credit: The Letter of Credit process is hindered; credibility and reliability are affected in international business operations.

Customs and regulatory compliance:

- Customs Clearance Delays: An Unverified IEC results in goods being held at the port.

- Regulatory Compliance: Non-compliance may attract scrutiny from customs authorities.

Legal implications:

- Penalties and fines: Operation without a valid IEC code results in monetary penalties as per the foreign trade policy.

- Suspension of Trade Activities: Persistent non-compliance leads to the suspension of import-export business.

- Legal Proceedings: A business may face legal actions for violating trade laws.

Receiving export payments with Xflow

Once your IEC is verified, the next step is to ensure smooth and compliant international transactions. That is where Xflow comes in.

- RBI & FEMA-compliant fund transfers

- Automatically generates FIRA (Foreign Inward Remittance Advice)

- Transparent and competitive FX rates, access to mid-market foreign exchange without hidden SWIFT charges or hidden spreads.

- Supports more than 140+ countries across USD, EUR, GBP, and AED, in compliance with local regulations.

- One-click integration with accounting tools like Zoho Books and Tally for real-time synchronization.

- Real-time tracking of funds and Forex conversions.

Conclusion

In a regulated trade environment, IEC verification is your business passport to global markets. Whether you are an IT service provider or a manufacturing firm exporting garments to Europe, maintaining a verified IEC is essential. An unverified IEC can block your exports, delay remittances, or even freeze operations if left unattended.

Start by obtaining your IEC code from the DGFT, and ensure it is verified through ICEGATE. To streamline operations and stay compliant, integrating with Xflow is the next step.

The IEC code is the 10-digit identification number assigned to the trading parties involved in expert and import by DGFT. It stands for Importer Exporter Code and is necessary to clear customs, receive payments, and even to comply with guidelines outlined by RBI and custom regulations.

You can check the status of your IEC code directly on DGFTs website. Just visit the website, click on Profile Management option in the menu, go to “Check IEC Status” option and then you can check your status by entering your IEC number.

You can check IEC/BIN status directly from ICEGATE online Portal. Just go to the website, click on the IEC/BIN status button under the services corner, and enter your IEC code and port location. Once you complete the CAPTCHA and submit, you’ll be able to check your status on ICEGATE.

The Business Identification Number (BIN) is a 15-digit code combining your IEC and PAN, used for tracking and clearing shipments at Indian Customs. It’s port-specific, so you need to register it on ICEGATE with a Digital Signature Certificate (DSC) to handle imports/exports at that port.

For businesses that deal with expert and import, updating and verifying IEC is crucial as not doing so can deactivate your account. It’s mandatory step that all IEC holders need to do every year between April and 30th June.

30th June is the last date to update IEC every year. If you miss the deadline, your IEC will be deactivated automatically after 1st July. Since it’s mandated by the government, you won’t be able to trade, import, or export once your account is deactivated. However, you can reactivate it by updating your IEC details and submitting for reactivation.

No, there is no government fee for annual IEC updates. The DGFT does not charge for verifying or modifying your IEC details online. The process is completely free of cost.

Reactivating IEC code requires you to updating your IEC information and re-submitting it. Just log in to your DGFT portal, go to profile management section, click on modify IEC, and update your details. You’ll be asked for an OTP to submit the updated details. Copy paste the OTP from your message received on the registered mobile number and click submit. It usually takes two working days to reactivate.

It usually takes 1 to 2 days once you successfully submit your details on DGFT portal. You need to submit the documents like your PAN card, GST information, business details, and then complete verification via Aadhaar OTP or DSC OTP. The system will update your application automatically in most cases and update you via email in 48 hours. You can face delays if the information provided like PAN, GST, and bank details are incorrect, or you leave the application incomplete.