Introduction

Five years ago, cryptocurrency payments were more of a novelty. In 2025, they are increasingly adopted by businesses for digital payments, though adoption varies by region and industry.

A cryptocurrency payment gateway links customers and businesses, transferring funds in the form of cryptocurrency. Behind the scenes, these gateways can handle exchange rates, verifications, conversions, and compliance. Here, we’ll look at crypto payment gateways in detail, what the top options are, and how to pick the right one for your business.

What is a crypto payment gateway in digital commerce?

A cryptocurrency payment gateway is used for accepting cryptocurrencies as a form of payment. Using a crypto payment gateway can give businesses better reach, faster transactions, and lower overhead costs.

Crypto payment gateways are online payment methods for transacting in cryptocurrencies like Bitcoin, Ethereum, and stablecoins. Similar to traditional online payment processors, these gateways handle steps like payment information management, verification, and conversion.

Businesses can manage their crypto wallets manually, but using a payment gateway can be more efficient. They can let your business make transactions across the world. These transactions are usually faster and cheaper than traditional methods.

How does a crypto payment gateway work for businesses?

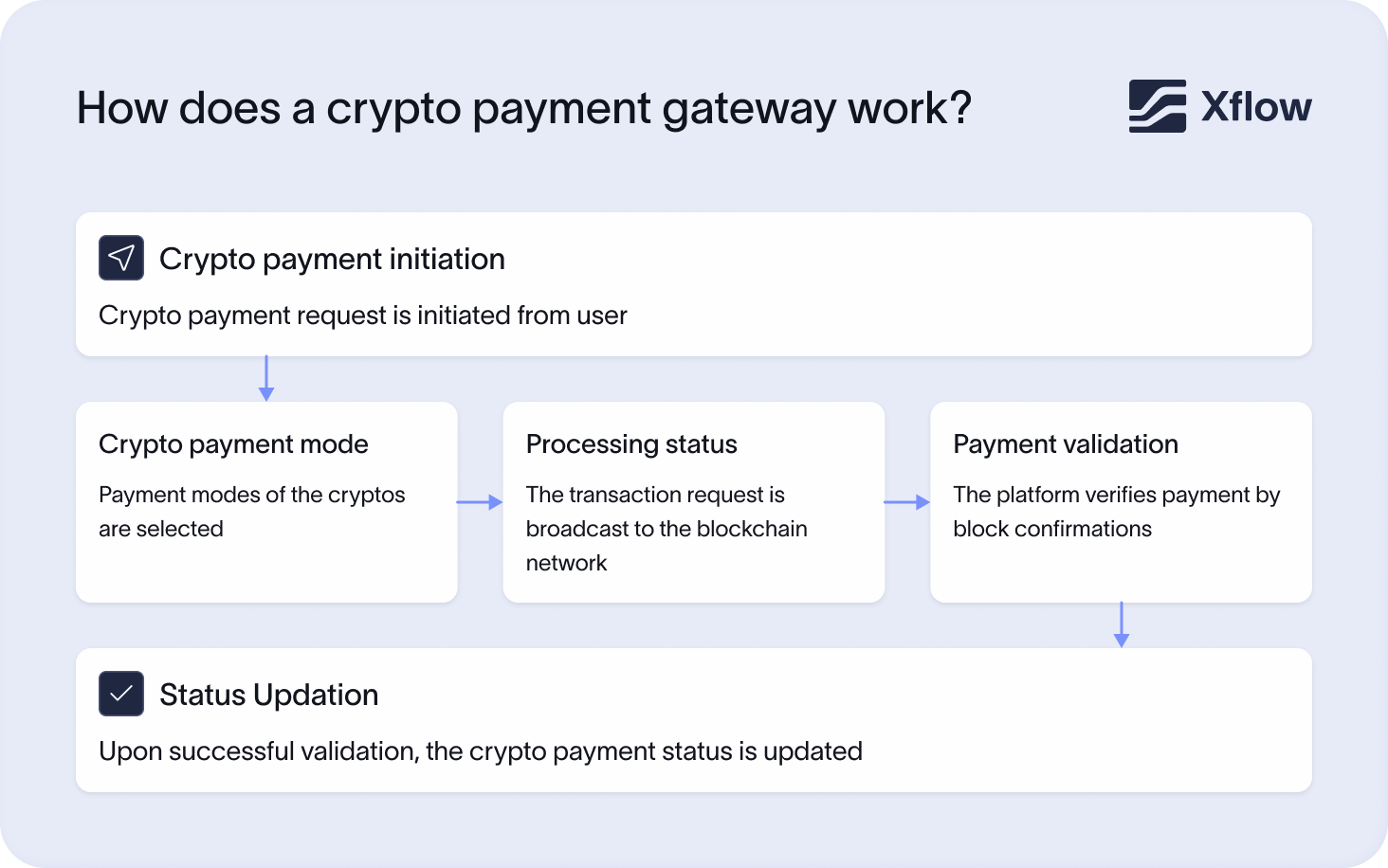

A crypto payment gateway handles the technical end of cryptocurrency payments. It starts from payment initiation by the customer, after which an invoice is generated, and the payment is sent through a blockchain network and validated. The merchant is notified. Depending on the gateway, funds can either be settled in cryptocurrency or automatically converted to fiat

Choose crypto

As the first step, a customer decides to use a cryptocurrency to make a payment. If the checkout screen or terminal they are interacting with has an option for that cryptocurrency, the customer selects it. A crypto payment gateway is now activated.

Get invoice

The gateway creates a unique payment request with the amount, wallet address, and a QR code.

Send payment

Next, the customer transfers funds from their wallet to the wallet address provided by the gateway. This transaction occurs on a “blockchain” network.

Confirmation

The transaction is validated by the gateway, then confirmed.

Merchant notified

The merchant is notified about the completed transaction. Funds can be maintained digitally for some time, or converted to fiat.

Settle funds

The settlement is finalized. The business can choose to keep the cryptocurrency in a wallet or transfer it to a bank account, as per its needs.

What are the key elements of crypto payment gateways?

The technical features that power crypto payment gateways are APIs, blockchain, task automation using constant logic, currency conversion modules, security checks, and reporting tools with dashboards.

APIs

Application Programming Interfaces (APIs) form a communication channel between the payment gateway and other platforms (mobile apps, wallet, banking systems, etc.) API integrations let the gateway handle complex tasks like wallet address generation or notification handling easily.

Blockchain

Blockchain networks and listeners are actually used to settle payments that are made using cryptocurrency. These networks will determine the speed of transaction settlement, the fees charged, and the volume of transaction data managed by the gateway.

Smart contract logic

Some gateways or blockchain-based setups may use smart contracts to automate tasks like routing funds and fiat conversions, though most merchant gateways manage this through their internal logic.

Currency conversion

Crypto payment gateways use real-time currency conversion tools. These tools can check market rates for different currencies and make quick conversions when a merchant requests it.

Security features

All crypto payment gateways need to have strong security features. Encryption and tokenization are used to protect data security. Gateways implement security measures like encryption and tokenization. They may also perform KYC/AML checks for merchants and, in some cases, customers, to reduce fraud and comply with regulations.

Dashboards

Payment gateways often have dashboards and monitoring tools. These are used to get an overview of all payments, settlements, their analytics, and reconciliations.

Crypto payment gateways: advantages and disadvantages

Crypto payment gateways have their pros and cons. They can be convenient, simplified options for managing crypto payments. But they can also introduce some security risks, charge some overhead fees, and leave you dependent on the gateway for accepting crypto payments.

Advantages

- With crypto payment gateways, you can take payments from customers around the world in multiple cryptocurrencies.

- These payment gateways can lock in an exchange rate when a transaction is being made. This protects you from the volatility of currency conversions.

- Payment gateways remove the anonymity of cryptocurrency, without compromising on your customers’ privacy.

- As a business, you won’t need to manage multiple accounts and wallets for crypto payments. Funds will typically land in a provider account first, and then be transferred to your business.

- Providers are always available for support and troubleshooting if you need it.

Disadvantages

- A crypto payment gateway is still a third-party provider, hence a potential vulnerability.

- Businesses need to rely on the gateway to accept payments from around the world. The gateway needs to be functional around the clock, especially if you’re making transactions across borders and time zones.

- Transaction fees are usually higher compared with using a crypto wallet yourself.

- If the gateway gets hacked, any funds sitting in your account before the transfer could be at risk.

Top crypto payment gateways

When it comes to accepting cryptocurrency payments, a few gateways dominate the space. These key providers are BitPay, Coinbase Commerce, NOWPayments, and CoinGate.

1. BitPay

BitPay was established in 2011 in the USA. Today, it supports transactions in over a hundred cryptocurrencies, and is used by both businesses and customers across the world. It offers its services on card and mobile apps.

2. Coinbase commerce

Coinbase began as a San Francisco-based startup. It offers payments, invoicing, reporting, and crypto wallet services. Its strongest features are low operational fees and multiple integration options. Coinbase supports over 200 cryptocurrencies.

3. NOWPayments

NOWPayments is a Dutch payment gateway that supports 50+ cryptocurrencies. Its key features include recurring payments and mass payouts. The gateway is compatible with e-commerce platforms like Shopify and WooCommerce.

4. CoinGate

Based in Lithuania, CoinGate supports payments in Bitcoin, Ethereum, and more than 70 other cryptocurrencies. It offers plugins for popular e-commerce systems and API integration for custom setups. CoinGate is known for its blockchain-based subscription program.

Crypto payment gateway: hosted vs. self-managed

The two ways to host a crypto payment gateway open-source are through a hosted service or a self-managed platform. Here’s how the two compare:

| Feature | Hosted gateway | Self-managed gateway |

|---|---|---|

| Deployment | Managed by a third-party provider. | Installed and run on the merchant's own servers. |

| Setup & integration | Easy setup using plugins or APIs. | Requires more technical expertise to be set up. |

| Maintenance & support | Provider handles updates, maintenance and customer support. | Merchant handles updates, maintenance and customer support. |

| Customization | Limited to the provider's features and settings. | Fully customizable. |

| Best suited for | Businesses that need faster and convenient services. | Fully customizable. |

Crypto payment gateways: custodial vs. non-custodial

Another distinction in crypto payment gateways is whether they are custodial vs non-custodial. This difference affects how much control your business will have over managing the gateway.

| Feature | Custodial payment gateway | Non-custodial payment gateway |

|---|---|---|

| Control of funds | The service provider manages wallets. | The merchant retains control over funds. |

| Technical complexity | Low | High |

| Currency conversion | Often includes automatic conversion to fiat. | No built-in conversion. |

| Security | Security outsourced to the provider; some counterparty risk. | Depends on the merchant. |

| Compliance & regulation | The provider typically handles compliance. | The merchant is responsible for compliance. |

| Integration | Simple integration, dashboards, and customer support included. | Flexible APIs and direct wallet connections; more complex setup. |

| Best suited for | Businesses that are newer to crypto or those with low risk tolerance. | Businesses with high risk tolerance expertise in the crypto industry. |

How to choose a crypto payment gateway?

What does a good payment gateway for cryptocurrency look like? It should support major cryptocurrencies, provide automatic fiat conversions at low transaction fees, use strong security measures, integrate easily with other tools and platforms in your ecosystem, and proactively provide support for issues.

Support for multiple cryptocurrencies

If your business is scaling its operations, locally and globally, you need multiple payment options. Look for a gateway that supports multiple popular currencies like Bitcoin, Ethereum, and others. It increases the convenience of payment for your customers.

Fiat conversions

Your chosen gateway should be able to do quick fiat conversions into multiple currencies or stablecoins. These are used to exchange cryptocurrencies for government-issued currencies and vice versa. The settlement times for these conversions should be quick as well.

Security

You should check if the payment gateway provider has encryption, multi-factor authentication, regular audit practices, and KYC/AML compliance. Using cryptocurrencies can put a lot of sensitive payment data on the web, which is why security is a non-negotiable consideration here.

Integration

Good crypto payment gateways will provide plugins, SDKs and API integrations for different platforms and tools, which will get you up and running quickly.

Fees and support

Fee structures and pricing can vary a lot. When picking a payment gateway, make sure it fits your budget. Be aware of overhead fees, transaction fees, and conversion charges – all of which are costs known by different names.

Having good support and reliability is a plus, too. Having access to 24/7 customer support will let you run your business operations smoothly.

Integration of crypto payment gateways with ERP, treasury, and business tools

Crypto payment gateways offer many SDK and API integration options. How is this useful for a business?

Integrating payment gateways into your ERP software, accounting tools, and e-commerce websites can create a consolidated platform for managing your finances. With this integration, all your financial data lives in one place, you get real-time visibility into your transactions, and website payment integration lets your customers make quick and easy crypto payments. Your reconciliation and reporting processes become simpler as well.

Regulatory and security considerations for crypto payment gateways

A reliable crypto payment gateway must follow strict regulations, protect sensitive data, and proactively monitor transactions to prevent fraud. Key considerations include:

1. KYC/AML

All payment gateways, whether crypto-based or otherwise, must comply with key security measures. These include Know Your Customer or KYC checks, which collect and analyze the information of potential users. Anti-Money Laundering or AML checks look out for suspicious transactions and activities to prevent fraud. Businesses that are accepting payments in crypto across borders should also check these gateways for cross-border compliance.

2. Registration

Crypto payment gateways should comply with applicable local regulations and may need licenses or registrations in certain jurisdictions. Without these regulatory measures, a payment gateway may not be allowed to operate.

3. Data security

Payment gateways handle a lot of sensitive customer and payment information. Complying with guidelines like the PCI DSS for card data protection, and the GDPR for general data protection, are first and essential steps towards data security. Other payment security measures, like encryption and secure data storage, are also in the data security checklist.

4. Transaction monitoring

Cryptocurrency payment gateways need to be proactive. They should regularly monitor transactions and user behaviour, keeping an eye out for suspicious activities. This puts them a step ahead in detecting fraud or illegal transactions.

5. Consumer protection

Protecting the platform users is a top security consideration. Payment gateways need to be transparent about their services, fee structures, and policies. Strong authentication systems and fraud detection tools are some trends in digital banking that crypto gateways should provide, too.

Frequently asked questions

To accept crypto payments manually, you’ll need to create wallet addresses, confirm each transaction, and manage the transaction records. Although slow and error-prone, it’s not a difficult task. Using a crypto payment gateway can automate these tasks for you, making the process more efficient.

A cryptocurrency payment gateway enables your customers to make payments to you in the form of cryptocurrency. These are faster and less expensive to process, making them popular for many groups of people.

There are many options for cryptocurrency payment processors. They let businesses accept payments in the form of crypto. Each processor will offer different features and pricing, so it’s best to look at all their offerings before choosing one.

There isn’t a single best crypto payment gateway. There are many options in the crypto market that you can choose from, and your choice will ultimately depend on your business and its specific needs. Coinbase, BitPay, and NOWPayments are among the top payment gateways for cryptocurrency today.

Many crypto tools offer SDK and API integration options for mobile. Using these integration features, you can use crypto payment features on a smartphone, for purchasing, subscriptions, donations, etc.