Introduction

Expanding into international markets opens up vast opportunities but it also introduces challenges, particularly in managing international payments. The complexities of handling foreign currencies and navigating regulatory requirements can be overwhelming, especially if you're a freelancer or a small-and-medium-sized business starting out with international clients.

But there's a solution to all these problems. Enter a Virtual Bank Account Number (VBAN) – a modern solution that simplifies international payments for businesses of all sizes. VBANs provide a streamlined, secure, and efficient way for businesses to manage their finances across borders. With VBANs, businesses can help enhance financial operations, reduce costs, and easily manage international payments.

What is a Virtual Bank Account Number (VBAN)?

For those unfamiliar with it, a Virtual Bank Account Number (VBAN) is a digital account enabling businesses or freelancers to receive payments in a foreign currency without the need to establish a physical presence or open a bank account in another country.

A VBAN is advantageous over an international bank transfer as it is:

- Faster

- Cost-effective

- Convenient

To learn more about how a VBAN facilitates better international payments, check this section below.

6 benefits of having a Virtual Bank Account Number (VBAN)

VBANs deliver a flexible, secure, and efficient solution for modern businesses seeking quick and cost-effective ways to receive payments in India. In addition to costs and time, VBANs help simplify compliance, eliminating associated concerns. Here's how:

- Secure payments - Working with VBAN providers partnered with an RBI-authorized bank ensures that international payments are as safe and secure as traditional wire transfers. Further, some VBAN providers also secure required certifications like SOC 2 and ISO–assuring an added layer of protection.

- Compliance ready - Compliant transactions are the cornerstone of international payments. The Reserve Bank of India (RBI) requires FIRA–Foreign Inward Remittance Advice–for every withdrawal. At Xflow, we offer free eFIRA issued by an RBI-authorized bank for every withdrawal. By integrating these compliance measures, VBANs provide a secure and regulated environment for managing transactions, ensuring legal adherence and financial integrity.

- Easy to track - Some VBAN providers send you an email or phone alerts to notify the receipt of payments, removing the hassle of following up with banks and checking account balances. Each VBAN comes with unique labels, making it easier to track payments--ensuring accurate financial records and simplified reconciliation.

- Local payment options - Clients can easily make a payment into a VBAN using a local payment method of their choice. Just like IMPS or NEFT in India, most countries have their own local payment methods. For instance, if you have a client in the US, they can initiate payments using ACH or FedWire to settle funds into your VBAN. The flexibility to choose a local payment method enhances the overall payment experience and ensures fast payments.

- Faster settlements - Payments are credited faster into VBANs than traditional methods like wire transfers. For instance, SWIFT may take 3 to 4 days to transfer funds into your INR bank account. In comparison, with providers like Xflow, funds are transferred within one business day.

- Lower transaction costs - VBANs typically offer lower transaction fees and better exchange rates than traditional methods. For example, while traditional banks may charge $25 to $50 per international transaction, VBAN fees can be as low as $1 to $5, with reduced currency conversion fees. Additionally, if you offer options like ACH, your payments will be nearly cost-free for your customers.

How to sign up for a virtual bank account number?

VBAN providers like Xflow make it seamless to get a Virtual Bank Account Number (VBAN).

- Sign up for an Xflow account for free. This typically takes less than 5 minutes (share details required for KYC)

- The account is verified within 1 business day

- Share VBAN details with customers to start receiving payments

How to receive international payments with VBAN?

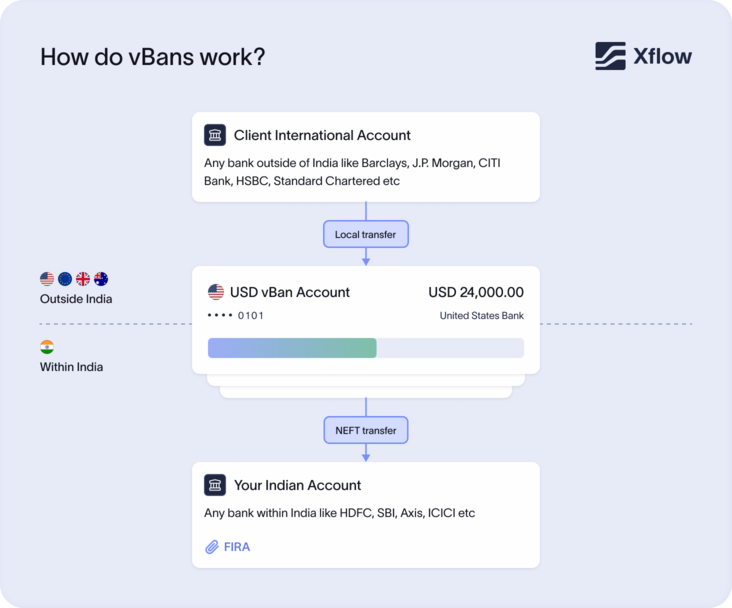

Upon signing up for a VBAN, the provider assigns a unique virtual bank account number. This account number can be shared with clients to receive a payment. Here's how it works:

- The client initiates payment: The client makes a payment to the VBAN in their local currency.

- Fund collection: The funds are collected and credited to the VBAN.

- Transfer to local account: The financial service provider converts the received funds into your preferred currency (e.g., INR) and transfers them to your local bank account. A nominal fee is charged for this service in addition to the Foreign Exchange (FX) conversion rate.

VBANs fuel global expansion

In a scenario where a freelancer or, service provider, or exporter in India is unable to set up a subsidiary in the US or apply for a non-resident bank account, a VBAN allows them to: :

- Get paid in USD without a local bank account

- Receive payments with minimal transaction costs

- Efficiently manage cash flow

- Stay compliant with tax and international payment regulations

Receive payments effortlessly and grow internationally with VBANs

According to the Asia-Pacific Small Business Survey by CPA Australia, 77% of Indian small businesses grew last year. Even more exciting, around 84% of small businesses are expected to grow this year, far surpassing the market average of 70%.

Virtual Bank Account Number (VBANs) are becoming more common in the international payments landscape as businesses leverage digitisation to drive growth and expand their global footprint.