Introduction

Stripe is one of the payment processing platforms that businesses use quite often. While it offers many advantages, there’s no denying that it comes with its fair share of challenges. High transaction fees, long settlement times, and an interface that can sometimes border on being complex are common pain points highlighted in Stripe payments reviews.

This article focuses on such Stripe reviews, and offers insights about what Stripe is, what it offers, and whether it’s truly worth your time and money, or if there’s an alternative that can serve you way better.

What is Stripe?

Stripe is a global fintech company that provides the necessary infrastructure and solutions to businesses that need to process payments. The solutions can be added on websites, apps, e-commerce portals, and can include anything from APIs, SDKs, checkouts, to payment links, all of which are used to simplify sending and receiving payments.

Stripe also gives you the flexibility to choose any payment method you want to use to process your payments. Along with that, you also have the advantage of transacting in most of the major currencies.

Key features of the Stripe payments platform

Businesses quite often turn to Stripe to execute their payment processes. The platform offers them standard payment capabilities that are supported by several features, such as:

1. Global payment processing

Using Stripe, you can send and accept payments across several countries and in a wide variety of currencies. In addition, you can choose from multiple payment options, including credit/debit cards, direct bank transfers, digital wallets, BNPL, global and local methods like ACH, UPI, SEPA, etc.

2. Developer-friendly API integration

Tech-savvy businesses can use Stripe’s API to build a payment workflow that’s customized according to their needs. You can even build advanced financial solutions for your business using its SDKs and documentation.

3. Custom checkouts and payment links

In case you don’t have extensive development experience, the platform also provides easy-to-use no-code solutions like payment links and Stripe Checkout.

The former can be used to create shareable URLs through Stripe's dashboard to make one-time or recurring payments.

The latter involves pre-built, hosted payment pages that require minimal setup and can be customized. Once the purchase is complete, your customers will be redirected to these pages that handle the entire payment process, including tax calculation and receipt generation.

4. Subscription and billing management

For businesses that constantly have to deal with recurring bills or manage subscriptions, Stripe Billing is quite handy. It can automate the subscription lifecycle and support complex pricing models, something that SaaS and subscription businesses, membership sites, and any business with recurring revenue streams will find useful.

5. In-person payments

Along with several online payment infrastructures, the platform also supports in-person payments through Stripe Terminal, using POS systems, which can be custom-built to integrate with Stripe.

Stripe Terminal provides APIs, SDKs, pre-certified card readers, and related documentation for this integration.

6. Fraud detection

Defence against fraud is something that most of the payment providers have to consider. Stripe ensures this through Radar, which allows you to build custom logic in order to protect your payments against fraud. It can also block high-risk payments and use rule-based controls and manual review queues to guarantee that protection.

7. Reporting and analytics

Stripe also gives its users reporting and analytics tools, letting them track things like payments, fees, and payouts, and create automated financial reports. Businesses can view dashboards for revenue trends or export the data if they need deeper analysis.

How does Stripe work?

To understand how Stripe works as a payment processing platform, let’s assume you are receiving payments from one of your clients. This is what Stripe’s workflow would look like:

1. Your client initiates the payment by entering payment details like card number, digital wallet credentials, or bank account info at an online checkout or physical POS.

2. Stripe will act as the payment gateway here. It will securely encrypt and transmit the payment information to the payment processor

3. The payment processor will send the encrypted details to the client’s bank (or card network and wallet providers, who then transfer it to the client’s bank) to check if there are enough funds and if the transaction is valid.

4. The client’s bank will check the client’s account status and approve or decline the transaction based on funds availability and risk assessment. It will then send that response back through the processor to Stripe.

5. If approved, Stripe will confirm the payment to you and your client through notification.

6. Once the client’s bank releases the funds, it will first go into your Stripe account.

7. Stripe will then transfer the payout (minus fees) to your business bank account, following its set schedule.

Benefits of using Stripe

So, why do businesses choose Stripe as a payment platform? When it comes to value for businesses, Stripe positions itself around the following benefits.

1. Diversity of payment methods: Allows you to accept payment in a broad array of payment methods. From credit and debit cards (American Express, Visa, Mastercard, Discover), ACH, Apple Pay, Google Pay, and other digital wallets, Stripe supports them all.

2. Secure payments: Provides security to payments through fraud detection, encryption, tokenization, AML and KYC checks, and legal review.

3. Global reach: Gives you the infrastructure to transact in multiple currencies and across a range of countries without establishing your local networks.

4. Scalability: Has the capacity to support you as your business grows, handling higher transaction volumes and expanding into new markets without major system overhauls.

5. Recurring payment automation: Makes it easy to set up subscriptions and collect payments automatically, so you don’t have to chase customers every month.

Pricing and fees of Stripe

Of course, no payment platform talk is complete without addressing the money side of things. Stripe’s pricing and fees play a big role in whether it makes sense for a business, so let’s break down how it works when receiving cross-border payments in India.

1. Transaction processing fee: 4.3%

Stripe charges close to 4.3% on every successful transaction made through international cards or cross-border payments.

2. Currency conversion/Foreign exchange fee: 2%

On top of the base processing fee, Stripe applies an additional 2% for converting the incoming currency (e.g., USD to INR).

3. Chargeback/Dispute fees

If a customer disputes a transaction and it’s lost, Stripe may impose a fixed dispute or chargeback fee (for instance, ₹1,000 in some cases) and reverse the transaction.

4. No FIRA after payment

Unlike some other platforms like Xflow, Stripe doesn’t automatically provide a FIRA (Foreign Inward Remittance Advice) with the payment. To obtain it, you often have to pay your bank’s fee and request it.

To put it in perspective: Imagine you receive an international payment of $5,000. Between the 4.3% processing fee and the 2% currency conversion charge, you’d lose close to ₹25,000-₹26,000 in fees before the money even reaches your account. And if you add in extra costs like obtaining a FIRA from your bank, the total expense can climb even higher.

An extremely important thing to note here is that Stripe in India operates on an invite-only basis and supports only credit/debit card payments for international transactions. This means Indian businesses cannot directly sign up for Stripe, but must apply and wait for approval.

Not just that, your international customers can only pay using credit or debit cards and all other popular payment methods like digital wallets, bank transfers, or Buy Now Pay Later options are not available for cross-border transactions to Indian merchants.

Stripe vs Competitors

Understanding Stripe on its own is useful, but most businesses want to know how it stacks up against other payment platforms. Let’s take a look at how Stripe compares with its main competitors.

| Platform | Best for | Fees & pricing highlights | Key features | Settlement time | G2 ratings |

|---|---|---|---|---|---|

| Xflow | Startups, Exporters, freelancers, Saas businesses, Payment platforms. | Transparent pricing, no hidden fees, flat 1% on monthly volume of $10K or a minimum of $8 (custom pricing beyond $10K). | Instant eFIRA issuance, multi-currency transactions, receiving accounts, built-in invoicing, FX AI analyst, powerful APIs, FIRA calculator, support for local payment methods. | 1 business day. | 4.9 |

| Stripe | SaaS, startups, global businesses | 4.3% transaction fees+ 2% currency conversion fees. | Developer-friendly APIs, subscription billing, no FIRA issuance (problem for GST refunds). | 2-5 business days. | 4.2 |

| PayPal | Freelancers, small businesses. | ~4.4% transaction fees + small fixed fee, 3-4% FX markup. | Global reach, multiple payment methods, eFIRA for exporters (but not in real-time), slower withdrawals, no local payment support. | 1-5 business days. | 4.4 |

| Razorpay | Indian startups & exporters. | ~2.9% + 18% GST on domestic transfers, ~3% + GST on international transfers. | Deep integration with Indian payments methods, API integrations, hosted checkouts, marketplace plugins, FIRA charges. | Close to 2 business days. | 4.2 |

| Wise | Indian freelancers and sole proprietors. | Flat upfront fee, mid-market exchange rate, no hidden charges. | Multi-currency accounts, no high volume transaction support, FIRA charges. | 1-2 business days. | 3.9 |

| Payoneer | Freelancers, SMBs, marketplace sellers. | ~3% per transaction fees, 3% in currency conversion fee, annual inactivity fee (around $29.95). | Fast global payouts, but high withdrawal fees. | 1-3 business days | 3.2 |

Real customer Stripe reviews

Numbers and specs only tell part of the story. Let’s hear from businesses that actually use Stripe and see what’s working for them and what isn’t. Here’s a snapshot of Stripe review from real user experiences from platforms like G2 and Capterra.

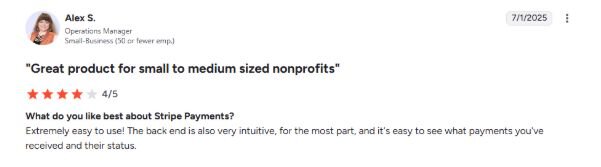

From the Stripe company reviews, we can surmise that the platform is praised for its ease of use and friendly interface, as is the case here:

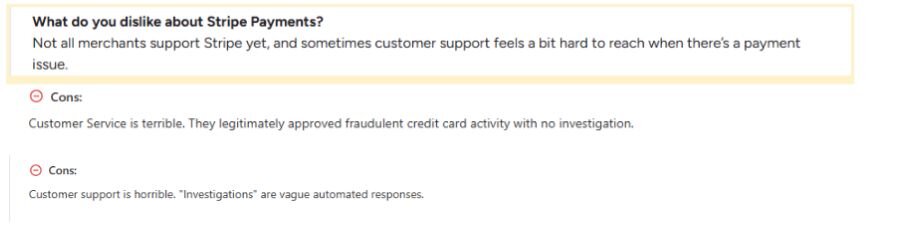

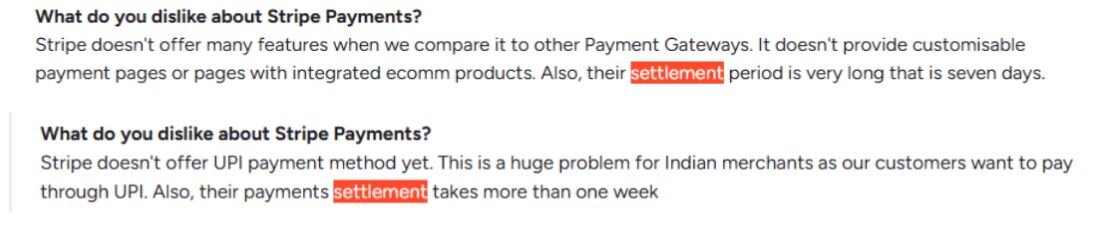

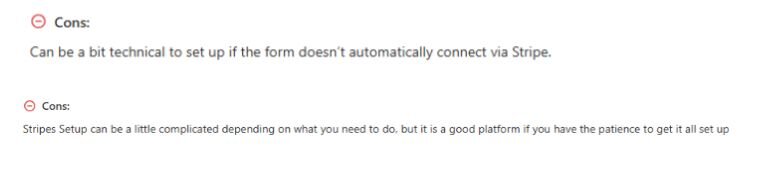

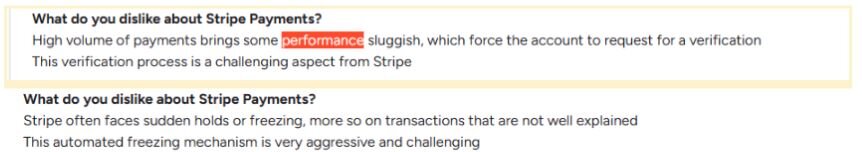

However, there are various cons as well, as evident from these reviews:

1. Most customers find the fees quite high:

2. They also flag improvement in customer support:

3. Settlement time is also highlighted as an issue by many:

4. Some users also complain that the platform can be complex to manage at times:

5. The platform can even become sluggish when processing high volumes of payments:

What are the limitations of Stripe?

Stripe has several notable limitations. Let’s have a look at these.

- As noted earlier, Stripe India operates on an invite-only basis, which makes independent sign-up tricky, especially if you are a new Indian business. Existing users continue to be supported, but new sign-ups require a special invitation.

- Next, Stripe India largely supports international payments and cross-border transactions, not domestic INR sales. As an Indian merchant, you cannot accept payments via domestic methods like UPI, RuPay, or wallets on Stripe.

- It does not issue automatic FIRA (Foreign Inward Remittance Advice), which Indian businesses need for GST compliance and refunds when receiving foreign payments, adding further burden to your tax compliance.

- The fee is quite high compared to some local alternatives, with charges exceeding 6% per transaction after currency conversion and GST.

- You can’t accept payments through bank transfers or SWIFT on Stripe India, which limits your payment flexibility.

Who should use Stripe?

It’s clear as day that Stripe’s invite-only access and premium pricing restrict many businesses from leveraging the platform for payment settlement. Stripe can be great, but mostly for specific, internationally-oriented, and tech-enabled businesses. It’s not a one-size-fits-all solution in India.

Stripe can be a good fit for:

- Global SaaS companies with recurring USD billing and predictable subscription revenue.

- E-commerce merchants targeting international customers (card-based payments from outside India).

- Freelancers, agencies, or service providers who are paid by overseas clients and need quick, reliable international payouts.

- Startups that value developer-first tools, if you have dev resources and want custom checkout, payment links, or deep API integrations.

- Businesses that already have an approved Stripe India account and don’t require automatic FIRA/eBRC for export compliance.

If your business belongs to the following category, Stripe will be less suitable:

- Businesses that rely mainly on domestic payments (UPI, RuPay). Stripe’s India footprint doesn’t focus on these native rails.

- Micro-merchants or very low-volume sellers as Stripe’s fees and premium positioning can make it more expensive than local alternatives.

- Companies that are required to automatically obtain FIRA/eBRC for GST/refund or RBI compliance.

- Organizations without developer capacity that want plug-and-play, low-touch billing across Indian payment methods.

Quick decision checklist

- Do most of your customers pay from outside India in cards? – Stripe is worth considering.

- Do you need FIRA/eBRC or heavy compliance support for Indian exports? – Consider local providers.

- Do you have dev resources to use Stripe’s APIs or need custom checkout flows? – Stripe plays to your strengths.

Why should you choose Xflow over Stripe?

By now, you must have a pretty good understanding of where Stripe lacks and why it can’t be the ideal payment platform for your business. Fortunately, there are platforms like Xflow that can address the gaps created by Stripe in your payment process, without compromising on the extensive feature set.

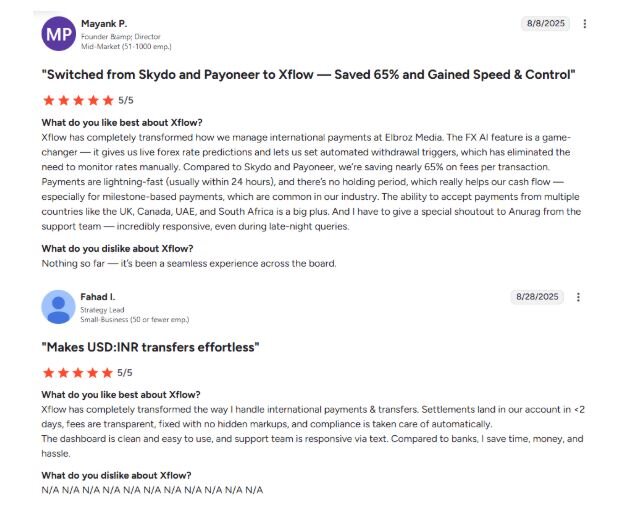

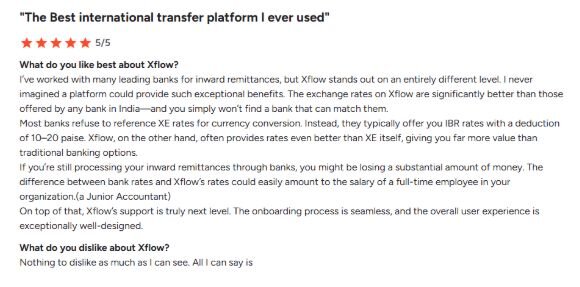

Xflow provides you with transparent pricing from the get-go. Unlike Stripe, which is constantly flagged by users for high fees, complexity, performance issues, and less than stellar customer service, Xflow is praised for its reasonable pricing, zero markup, no hidden charges, excellent customer support, ease of use, and quick onboarding. See for yourself what Xflow users have to say on G2:

Beyond these standout features, Xflow is also known for:

- Virtual bank accounts in over 25+ currencies and from 140+ countries.

- Automated digital FIRA generation at no cost.

- Quick creation of shareable payment links with clients.

- Creation and sending of professional branded invoices.

- Fund settlement within 1 business day.

- Flat, competitive fees directly linked to mid-market FX rates without hidden charges.

- White-label APIs for fintechs, marketplaces, and platforms.

- Transparent, real-time foreign exchange rates with zero markup.

- AI-powered tools to forecast forex trends.

- Processing of very large single invoices and transactions.

- Seamless integrations with accounting platforms like Zoho Books.

- High data security and regulatory compliance ensured by ISO 27001 and SOC 2 standards certifications.

When you put it all together, from the practical features and costs to real customer feedback and ratings, it’s easy to see why Xflow makes more sense than Stripe for most businesses here. If you’re looking for a smarter, more seamless way to manage payments, Xflow is where you should begin. Sign up today!

Frequently asked questions

Stripe can access your bank account once you have signed up for it, but only after your explicit authorization and within the consent limits set up by regulatory authorities. It will need information like account numbers, balances, etc., to deposit payouts or withdraw funds that you’ve authorized.

Anyone who needs to accept payments online or in-app can use Stripe. This generally includes startups, e-commerce shops, SaaS companies, subscription services, or even big players like Amazon and Shopify.

Stripe company reviews often include high transaction fees. The customer support team is also not very responsive, and the interface can be confusing and too technical for some users. Additionally, Indian businesses require invite-only access to use the platform, and even after that, they can receive international payments through cards only.

Yes, there are many alternatives to Stripe. For instance, Xflow is built with Indian businesses in mind. Among other things, it supports cost-effective international payments, automatically handles FIRA/eBRC, and keeps fees transparent and reasonable.