Introduction

International payments are not as simple as moving money domestically. Since it involves different currencies, varying rules, and fluctuating exchange rates, stringent regulations come into play. One such rule that businesses and individuals must comply with is the foreign remittance limit.

Given the direct impact of such global transactions on the country's economy and exchange rates, adhering to foreign remittance limits is crucial. In this article, let us delve into the details of foreign outward remittance limits that guide businesses in navigating these payments.

What is foreign remittance?

Before we get into the nitty-gritty of foreign outward remittance limits, it is essential to understand what foreign remittances are and why they happen.

Foreign remittances refer to fund transfers between individuals or businesses across different countries. These transactions can happen for both personal and business (non-personal) reasons.

Personal foreign remittances include the transfer of money between family and friends in different countries to cater to personal expenses like gifting, medical treatments, education, etc.

Business remittances, on the other hand, include transactions by businesses towards foreign investments, payments to overseas vendors, etc.

Types of foreign remittances

There are two types of remittances, inward and outward remittances.

- Inward remittances: Funds coming into India from foreign countries.

- Outward remittances: Funds going out of India to foreign countries.

This guide focuses on understanding the elements of foreign outward remittances, which deal with transactions where Indian resident individuals or businesses send money to entities in other countries.

What are foreign outward remittances?

Foreign outward remittances simply mean sending money from India to someone in another country. This could be for things like paying for studies, travel, buying something, or sending money to family.

While transactions for both personal and business purposes come under foreign outward remittances, the limit, tax implications, and other regulations differ, which we will learn about in the coming sections.

Role of FEMA and RBI in the forex market

The Indian government constituted the Foreign Exchange Management Act (FEMA) of 1999 to regulate foreign exchange transactions. The act aims at promoting foreign trade and fostering the forex market. The Reserve Bank of India, on the other hand, is the regulator responsible for administering FEMA, besides issuing guidelines about remittance limits, compliances, etc.

Outward remittance limit for Indian businesses

The RBI has set guidelines about the maximum amount of funds that can be transferred internationally in a single financial year, under the Liberalised Remittance Scheme. However, the scheme sets a foreign remittance limit exclusively for individuals. Businesses do not have such caps on the maximum funds they can transfer.

Such limits do not apply to businesses because their needs can vary to a large extent. Hence, setting an upper limit on foreign transactions may restrict the firm’s growth, eventually impacting the country’s economy. Besides, businesses must comply with stringent procedures under multiple statutory acts, making these transactions thoroughly regulated. But, it is important to note that they must route all their transfers through authorised dealer banks designated by the RBI, who will then check the documentation and ensure compliance.

It is also important to understand the type of transaction before assessing the requirement of RBI’s prior approval. Foreign transfers can be of two types – current account transactions and capital account transactions.

- Current account transactions: These are business-as-usual transactions that do not affect the value of investments held abroad. Such transactions are subject to fewer regulations and documentation. They go through the automatic route and do not require prior approval from the RBI.

Example: Vendor payments, consultant fees, etc.

- Capital account transactions: These are transactions that lead to the creation of long-term assets or liabilities abroad. They generally go through extensive regulations and documentation and may even require the RBI's prior approval for the transfer of funds.

Example: Foreign investments, asset transfers, etc.

Documentation for foreign outward remittance by business entities

Documentation is a crucial part of foreign outward remittance for businesses. They are part of the regulatory requirement and must be submitted to the authorised dealer to ensure:

- The legitimate purpose of the transfer

- The alignment with capital or current account rules

- The smooth transfer without legal hindrances

- The appropriate tracking of funds moving outside the country

The list of documents to be submitted varies from one transaction to another. However, here is a common list that is mandatory for all transactions:

- Form A2: A mandatory document required by the RBI that acts as an application and declaration of the foreign outward remittance, consisting of all the transaction details.

- Request letter: A formal letter from the business authorising the bank to process the remittance.

- Transaction proof: An invoice in case of imports, an agreement in case of investments, or other suitable documents that serve as valid proof of transactions.

- KYC documents: PAN card, company registration certificate, and other relevant documents.

In addition to the above general documents, supplementary documents are required based on the type of transactions, such as:

- Current account transactions: Import bills, proof of business relationship, purchase agreement, etc.

- Capital account transactions: Form ODI (Overseas Direct Investment), auditor's certificate, net-worth certificate, board resolution, etc.

Tax applicable for business entities on foreign payments

Foreign outward remittances are also subject to regulations under the Income Tax Act of 1961. Businesses need to comply with these tax regulations to avoid fines and penalties.

- Withholding Tax

Also called Tax Deducted at Source (TDS), businesses must deduct TDS during foreign payments if such income is taxable under the Income Tax Act.

For example, payment made to a consultant for his service is subject to TDS because such income is also taxable in India. However, if the business is paying towards importing goods, there is no TDS as this does not come within the purview of the Income Tax Act.

The rate of TDS depends on multiple factors, such as the receiver's country, transaction type, etc.

Post the deduction of TDS, businesses must file relevant forms like 15CA and 15CB that help in tracking foreign payments and ensuring tax adherence.

- Goods and Services Tax (GST)

GST for foreign outward remittances works on the reverse charge mechanism, where the receiver of goods/services is chargeable. Hence, GST is levied on the imported goods and services rather than the payment made abroad. The applicable GST rate depends on the nature of the goods or services involved.

For example, a business imports software services from a foreign country. Such imports are subject to GST at 18% in India. So, the company must pay the entire amount to the service provider and additionally pay 18% of the transaction value towards GST in India. However, the business can claim it back in the subsequent period using the Input Tax Credit.

Outward remittance limit for Indian Individuals

The Liberalised Remittance Scheme was introduced by the FEMA in 2004, allowing Indian resident individuals to transact up to USD 2,50,000 per year towards foreign outward remittance.

This foreign remittance limit applies only to individuals and not businesses.

The Foreign Exchange Management Act, however, prohibits the following remittances under the Liberalised Remittance Scheme:

- Payments towards lottery tickets and other restricted items under Schedules 1 and 2 of the Act

- Payments towards margin calls in foreign exchanges

- Payment towards Indian FCCBs (Foreign Currency Convertible Bonds) in the overseas market

- Payment towards trading in foreign exchanges abroad

- Capital account payment to countries identified by the Financial Action Task Force (FATF)

- Payments to individuals posing a risk of committing acts of terrorism

Tax Collected at Source (TCS)

Tax Collected at Source or TCS on foreign remittance is only applicable on foreign outward remittances made by individuals. As per Section 206C(1G) of the Income Tax Act, remittances by businesses fall outside the scope of the Act.

Foreign outward remittances less than ₹10,00,000 are exempt from TCS unless mentioned otherwise. The threshold, which was ₹7,00,000 earlier, was revised to ₹10,00,000 in the Union Budget of 2025.

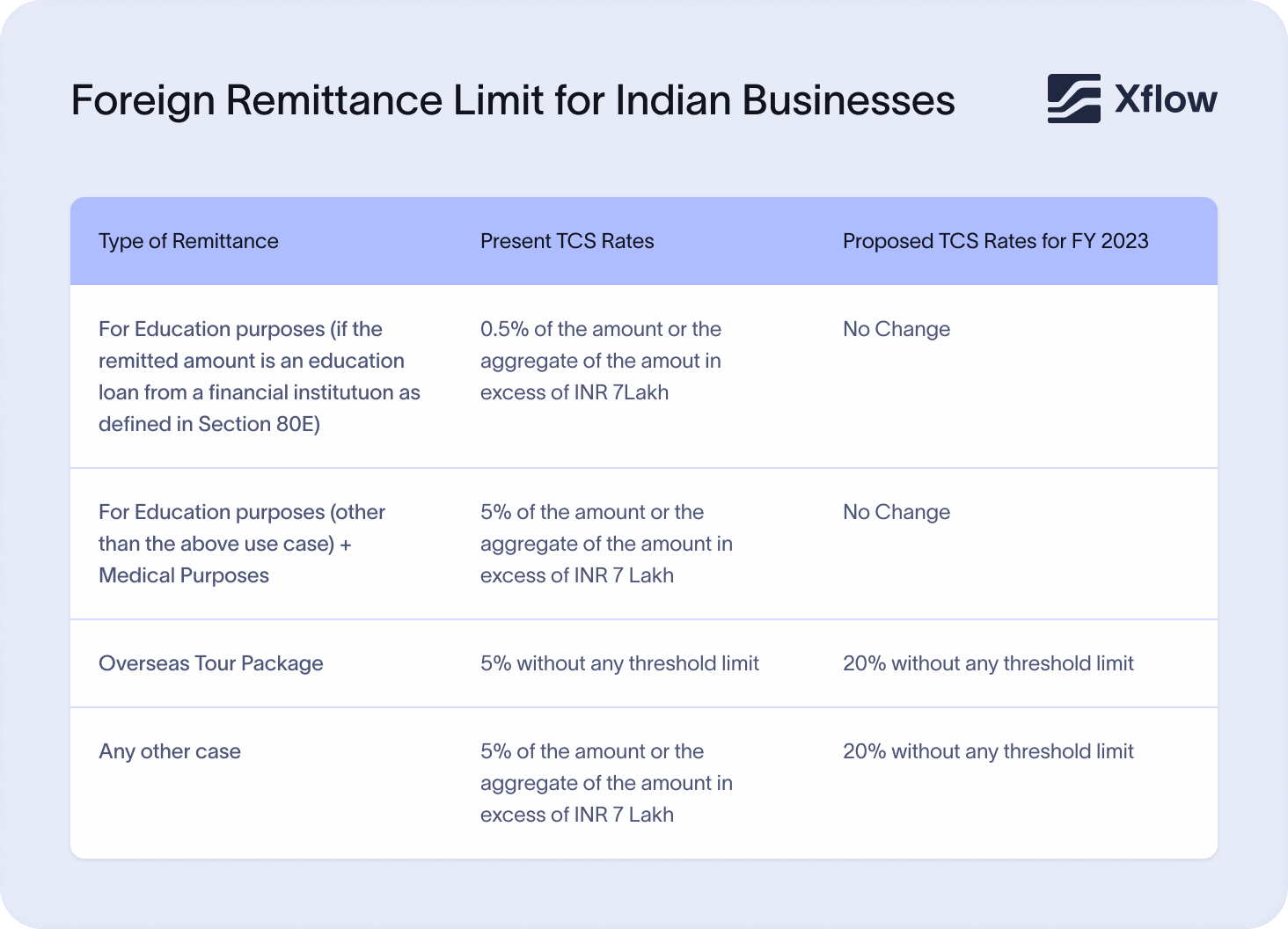

The rates of TCS are as below:

| Remittance towards | Remittance amount | TCS rate |

|---|---|---|

| Education loan from specific institutions | ₹0 to ₹10,00,000 | Nil |

| Self-funded or non-qualifying education loans | Above ₹10,00,000 | 5% |

| Medical expenses | Above ₹10,00,000 | 5% |

| Investments, gifts, etc | Above ₹10,00,000 | 20% |

| Foreign tour packages | ₹0 to ₹10,00,000 | 5% |

| Foreign tour packages | Above ₹10,00,000 | 20% |

Foreign outward remittance, despite being a significant part of operating in the global market, comes with its share of complexities. From understanding existing FEMA and RBI guidelines to keeping an eye on the new ones, understanding the distinctions between capital and current account transactions, applying correct tax rates, handling documentation, and more, there is a lot for businesses to comply with.

This is where platforms like Xflow come into play. With international payments as one of its core services, Xflow helps businesses navigate through the intricacies of foreign payments seamlessly.

Frequently asked questions

No, there is no upper limit on foreign outward remittance for businesses. Liberalised Remittance Scheme (LRS) is applicable only for foreign payments made by individuals to the extent of $2,50,000 per year.

No, TCS applies only to individual foreign payments. Foreign payments by businesses are eligible to deduct TDS, provided the payment is within the scope of the Income Tax Act.

Some foreign remittances may attract GST if such goods or services fall under the purview of GST regulations. However, under the reverse charge mechanism, the responsibility to pay GST on such goods or services falls on the recipient.

Since this is a capital account transaction, RBI's approval and filing of Form ODI may be necessary based on the foreign company's sector. However, if the transaction falls within the automatic route of the RBI, prior approval is not necessary.

Authorised dealers are banks designated by the RBI to act as middlemen between the sender and the RBI. Such banks verify documents and ensure adherence to FEMA and RBI regulations.