Introduction

For businesses in India accepting domestic and international payments, tracking fund transfers becomes crucial.

Whether you’re a freelancer, run a startup, or manage a small business, RTGS and NEFT transactions help you move money safely and smoothly.

Each time you send or receive money, there’s one important code that backs your transaction. It’s called the UTR number.

UTR, or Unique Transaction Reference number, is like your transaction’s fingerprint—a unique ID attached to every RTGS and NEFT payment you make or receive.

Here's a beginners guide on what is a UTR number, how to find it, and why it is important.

What is a UTR number in NEFT & RTGS?

UTR is a common abbreviation for Unique Transaction Reference. It is a one-of-a-kind alphanumeric identification code, ranging from 16 to 22 characters, that’s assigned to each NEFT and RTGS transaction to facilitate the identification, tracking, and monitoring of electronic transactions within the Indian banking system. It acts as a digital receipt to assist in transactions, maintain permanent records for tax and accounting needs, and confirm payments almost in real-time in business settings

For National Electronic Funds Transfer (NEFT), the UTR number is a 16-digit code. Since NEFT doesn’t process payments instantly, this number helps track the funds as they move through the system.

Real-Time Gross Settlement (RTGS) uses a 22-character alphanumeric UTR number. Since RTGS transfers are completed within 2 hours, this code ensures your money moves securely from one bank to another.

What is a UTR number in banking?

In banking systems, a Unique Transaction Reference, traditionally known as a UTR number, is a code that banks generate to label and log all the transactions occurring through electronic systems like RTGS, IMPS, UPI, or even NEFT. Its purpose is not only to offer a reliable way to customers to track and confirm their payments, but to prevent banking systems that handle millions and billions of transactions from spiralling into disorder by ensuring every transaction has a clear, distinct record.

Banks depend on UTR numbers to:

- Reconcile settlements between institutions.

- Maintain a clear log for audits and compliance purposes

- Resolve disputes between banks as and when transactions get stuck.

- Provide customers with proof of transfer on request.

In short, it’s the backbone of the entire banking system. Without it, there would be no way for banks to process transactions at breakneck speeds without breaking anything.

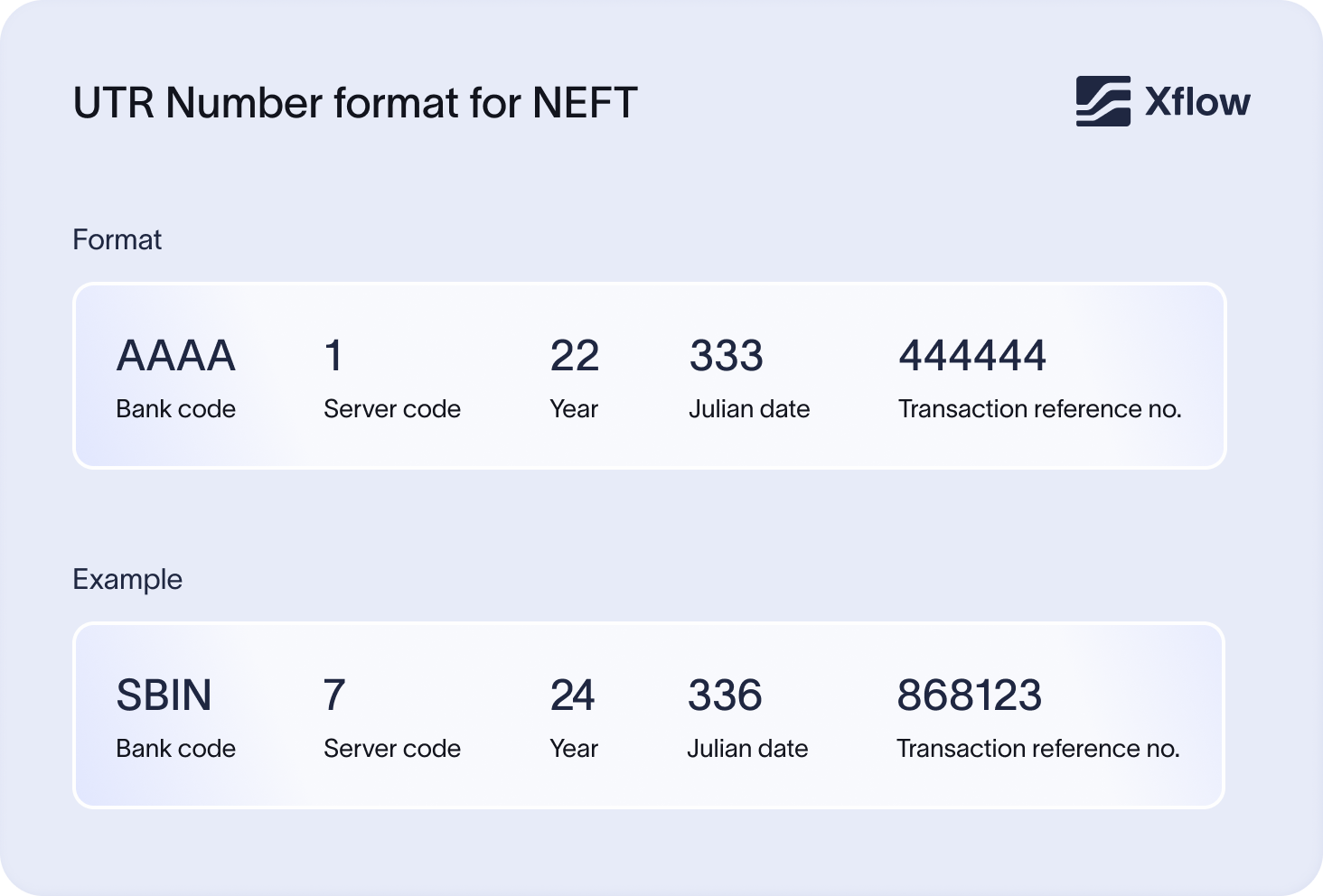

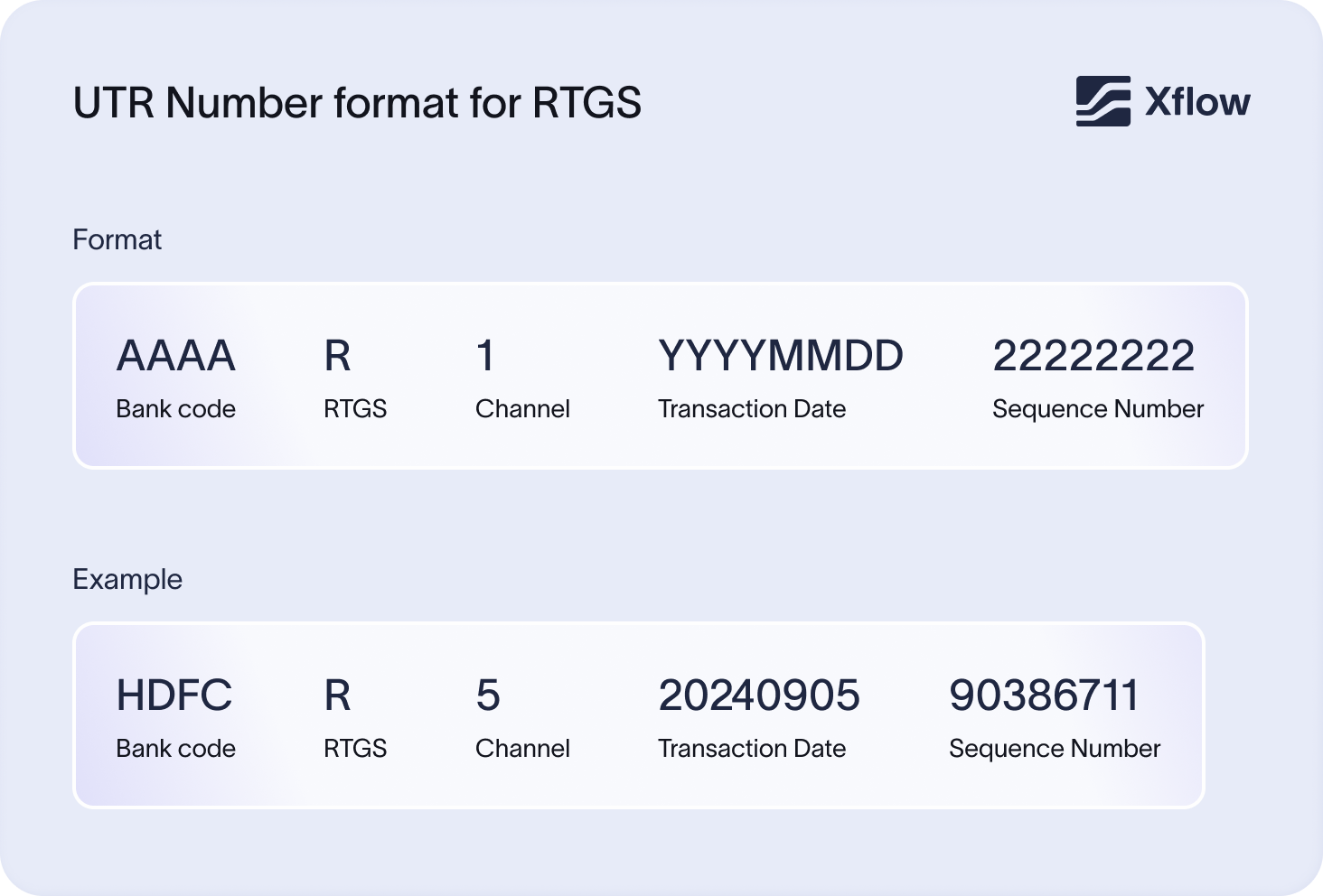

UTR format, length, and examples

Why are UTR numbers important?

When it comes to moving money digitally, trust and timing matter. UTR numbers safeguard both.

- Think of a UTR number as undeniable proof that a payment happened. It creates a verifiable trail, making it clear that money was sent or received.

- They also come in handy when something goes wrong. If a payment gets stuck, is delayed, or doesn’t show up, the UTR number helps track it down without the usual back-and-forth.

- It’s also a big help on the accounting side. Matching UTR numbers to your invoices or books makes it easier to see which payments are settled and which are still pending.

- And when it comes to international transfers, they’re essential. Banks rely on UTR numbers to confirm that funds have been received in cross-border transactions.

How to find the UTR number?

There are four common ways to find the UTR number after completing an RTGS or NEFT transaction:

1. SMS Notifications from Your Bank:

Most banks send a confirmation SMS after a transaction. The UTR number is usually included in the message, often labeled as a ‘Reference Number.’

2. Email Alerts:

Along with SMS, banks also send email notifications for each transaction. These emails include all the key details—UTR number included.

3. Bank Statements and Mobile Apps:

You can find the UTR number in your bank account statement. If you’re using a mobile banking app, head to the transaction history section—it’ll be listed there too.

4. Payment Receipts:

Banks usually generate a payment receipt after the transaction. The UTR number is clearly mentioned there. You can choose to download or print it for your records.

How to track a payment using UTR

You can use the UTR number to track payments via your banking apps, netbanking portal, or by contacting the bank’s customer support. Just navigate to the track transaction corner in your portal or the app, and copy and paste the UTR transaction number.

This way you can check the status of your transaction and see if it's processed, pending, or credited successfully. Here are the steps to carry it out:

1. Log in to your bank’s net banking portal or install the mobile application on your phone

You’ll find a dedicated corner to track and assess transactions in most internet banking portals and applications. They can be found under menu items outlining payment enquiry, transaction status, or track status.

- Find the menu item in your application

- Copy and paste your UTR number in the search bar

- Check if your status is processed, pending, or credited.

2. Customer support & branch visits

If you can not access your bank account via an app or internet banking, you can directly visit the banking branch and have your transaction status verified.

- Find a customer executive in the branch,

- Give them the UTR and your basic details for them to initiate the check.

- They can then check their backend systems and let you know the status.

Alternatively, you can also call the bank branch or customer care number directly to get assistance on tracking your UTR.

3. Beneficiary bank check

It’s not only the sender’s bank that can provide the status of your transactions. The receiver’s bank can also be used to confirm that the funds have been credited into their bank account, or if they are still stuck being processed.

4. RBI’s settlement cycle

The RBI sits in the middle of every NEFT and RTGS transfer. It’s the clearing house and final authority. No transaction between two different banks can bypass it. That’s why the settlement cycle at RBI defines when money actually “moves.”

- RTGS: RBI processes each payment one by one, in real time. Since the settlement is done instantly at RBI’s end, your transfer status flips to “success” almost immediately. That’s why UTR-based tracking for RTGS is quick and precise.

- NEFT: RBI doesn’t handle these one by one. It collects transactions into hourly buckets, then settles them together. That’s why NEFT tracking always points back to which RBI batch your UTR landed in.

NEFT vs RTGS vs IMPS vs UPI

All payments made online in India are tagged by a unique identification number, or UTR. Different formats have different formats and character lengths of this ID. And here’s an overview of how they are generated:

- NEFT/RTGS uses a 22-character UTR number.

- IMPS assigns a 12-digit transaction reference number.

- UPI shows either a numeric ID or a UTR-mapped reference.

However, there’s more to it; each section in these ID carries format-specific information that helps internal systems of the bank to track, record, and settle transactions.

Here’s a detailed comparison of each of them:

| Payment Method | Transaction ID Name | Format & Length | How It’s Generated | Tracking Use |

|---|---|---|---|---|

| NEFT | UTR (Unique Transaction Reference) | 22 characters (e.g., HDFC123456789012345678) | Assigned by the originating bank, it usually includes bank code + date + sequence. | Used to check NEFT status in hourly batch settlements |

| RTGS | UTR (Unique Transaction Reference) | 22 characters (same format as NEFT) | Generated by the originating bank in real time. | Used to track instant RTGS settlements |

| IMPS | Transaction Reference Number (Txn ID) | 12-digit numeric code (e.g., 123456789012) | Auto-generated by NPCI or IMPS switches. | Used to confirm immediate transfer; works 24x7 |

| UPI | UPI Transaction ID (UTR) or Reference Number | 12-digit numeric ID or UTR code visible in app | Generated by NPCI (UPI platform) and tagged with payer/payee VPA. | Used within UPI apps and banks to trace payments instantly |

What happens if you fill in the wrong UTR number?

If the UTR number you entered was incorrect, the money might still go through but it might land in the wrong account. Here’s a simple 4-step process on how you can reverse the transaction:

Step 1: Contact Your Bank Immediately

The moment you spot the error, get in touch with your bank.

You can:

- Raise a request through your mobile banking app

- Use internet banking

- Or call customer care and speak to a support executive via IVR

Step 2: File a ‘Wrong Credit Chargeback’ Request

Once you’ve reported the issue, the bank may ask you to raise a Wrong Credit Chargeback request.

This is usually easier if the wrong credit went to another account within the same bank.

If the funds landed in a different bank, your bank will help identify the recipient and send a return request.

Step 3: Escalate If Another Bank Is Involved

Getting funds back from a different bank takes longer.

In most cases, your bank will coordinate with the other bank to retrieve the money.

To speed things up, you can:

- Write a formal escalation email to the recipient’s bank

- Keep all documentation ready (UTR number, transaction ID, payment screenshot)

- Get a signed consent from the unintended recipient to help smoothen the reversal process.

Step 4: Follow Up Regularly

Once the reversal process is underway, stay in touch with your bank.

For same-bank errors, it usually takes 7–10 business days to resolve.

Cross-bank reversals may take longer, depending on how cooperative the recipient and their bank are.

Conclusion

Understanding how UTR numbers work and where to find them can save you a lot of time and stress when managing digital payments. Whether it’s tracking a transaction, resolving a dispute, or correcting an error, having the UTR handy puts you in control. For businesses dealing with frequent fund transfers, especially across borders, this becomes even more important. That’s where platforms like Xflow come in offering a faster, more reliable way to manage international payments with complete transparency and traceability.

Frequently asked questions

You can know your UTR number by checking your bank statement, digital passbook, mobile app, or through internet banking. The UTR number is also shared by the bank in SMS messages and email notifications.

RTGS (Real-Time Gross Settlement) and NEFT (National Electronic Funds Transfer) are two of India's most reliable systems for moving money electronically between bank accounts. RTGS is designed for high-value, time-sensitive transfers (₹2 lakh and above), processed within 2 hours. NEFT is ideal for lower-value transactions, processed in half-hourly batches from 8 am to 7 pm (Monday through Friday, and working Saturdays).

The minimum transfer value for RTGS is INR 2,00,000. There is no upper limit to RTGS transactions.

There is no minimum or maximum transfer value limit in NEFT.

The 16-digit UTR number attached to every NEFT transaction is in the format of ‘XXXXNYYDDDNNNNNNNN’.

Where XXXX = The bank’s Indian Financial System Code (IFSC) code.

N = The channel of payment, in this case, NEFT.

YY = The last two digits of the year in which the transaction is made. (For ex: 25 from 2025)

DDD = The day of the year of the transaction (Julian Date).

NNNNNNNN = Transaction sequence number

The 12-digit UTR number is generally for the UPI mode of transactions in India. With this 12-digit code, banks and customers track the transfer, verify its status, and resolve disputes if something goes wrong.

No. The IFSC code identifies a bank branch, not the transaction ID. In an RTGS transaction, it represents the first four characters of the number. The UTR number identifies a specific payment, like the receipt, and it’s unique for every transaction. On the other hand, the IFSC code stays fixed for that branch, while every new transaction generates a new UTR.