Introduction

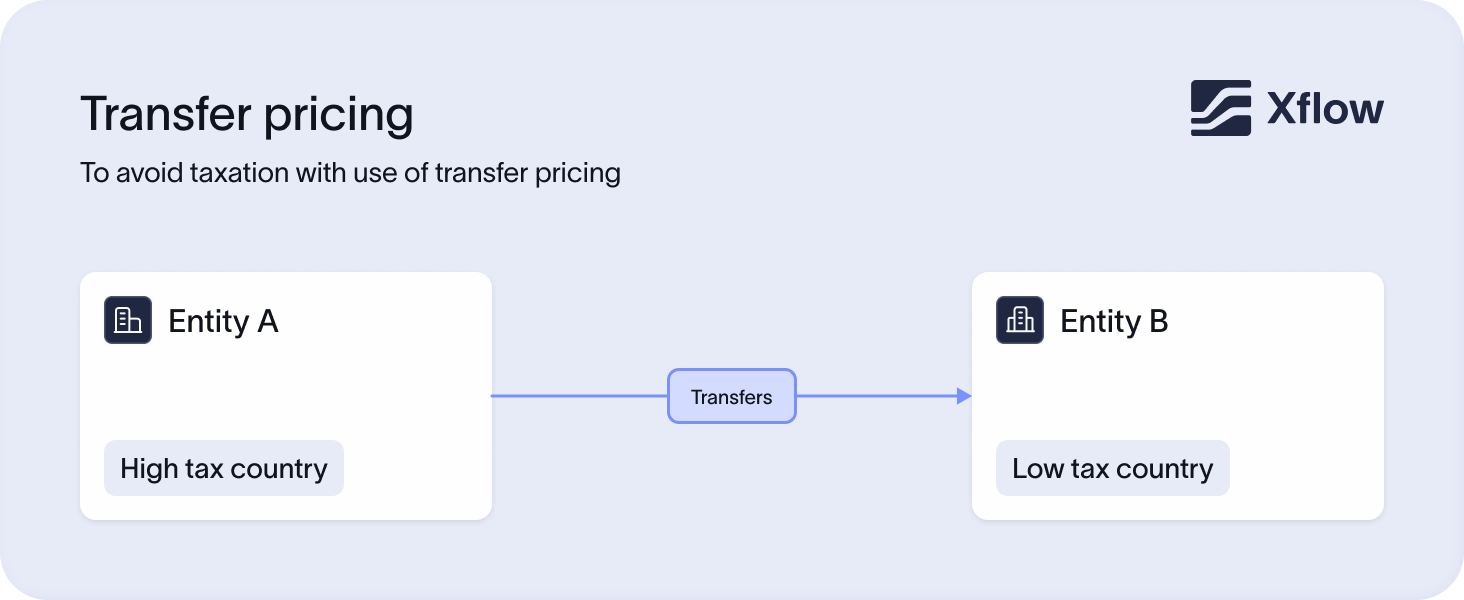

For Indian-funded startups, transfer pricing is the financial framework that governs fund transfers between the global headquarters and their subsidiary in India. Many Indian startups adopt this model, maintaining headquarters abroad while operating offices in India.

This process determines how funds are allocated to cover various service costs and tax obligations to the Indian government. Typically, transfers follow a fixed schedule—often monthly or bi-weekly—and are moved from a foreign bank account outside India, say USD, to an INR account within India.

Consequently, effective transfer pricing strategies are important for optimizing international business payments, ensuring compliance with local laws, and managing potential currency fluctuations.

However, the complexities of transfer pricing can introduce challenges such as high costs, longer processing time, fluctuations in forex rates, compliance, and the need for detailed documentation.

Understanding these details will help businesses engaged in international payments improve efficiency, achieve financial goals, and minimize risks.

This article explores the complexities of transfer pricing and how modern solutions are reimagining this process.

What is transfer pricing?

Transfer pricing is an accounting practice that allows one part of the company to sell its services, goods, and goods to another part of the company to simplify accounting and any additional tax liabilities. This is especially helpful for startups that set up their subsidiary in India, as it regulates how much their Indian subsidiary charges them for the work it does. From a regulatory lens, it’s seen as two individual companies trading with each other. This ensures fair taxation and compliance with rules like FEMA and the Income Tax Act.

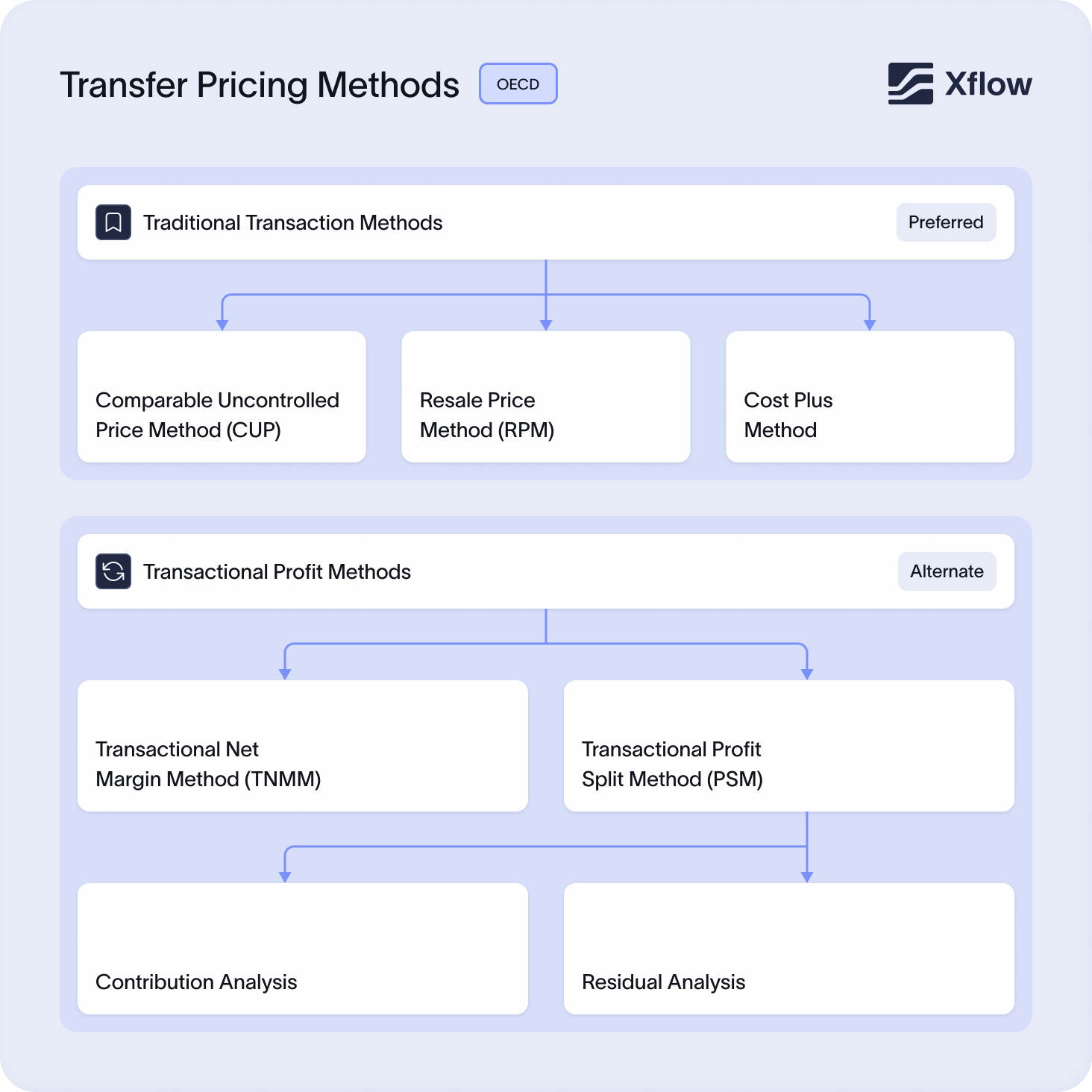

Transfer pricing methods

There are various methods to calculate transfer prices like comparable uncontrolled price, cost plust method, and more. However, to keep it fair, it’s recommended for companies to only use the ones that are recognized by regulatory bodies and tax authorities. These methods compare the prices that a subsidiary would charge with how any other independent business would charge in similar circumstances.

Here’s a simple table listing different transfer pricing methods and scenarios where you can use them:

| Method | When to Use |

|---|---|

| Comparable Uncontrolled Price | Best when you can find an identical or very similar market price for the same product or service. |

| Resale Price Method (RPM) | Used when a subsidiary resells goods without much value addition or focuses on resale margin. |

| Cost Plus Method | Ideal when services or manufacturing are provided, and costs can be clearly identified. A markup is added to the cost. |

| Transactional Net Margin Method (TNMM) | Applied when net profit margins of similar independent companies are available for comparison. |

| Profit Split Method | Suitable when transactions are so integrated (e.g., joint R&D) that profits need to be divided between entities. |

Why is documentation & compliance important?

Documentation and compliance is critical to ensure the legality of transfer pricing because every cross-border transaction attracts rigorous scrutiny. So it needs to be backed by records and hard evidence that can prove it’s fair, compliant, and necessary. Thus, the startups in India that trade with their counterparts in foreign countries need to keep all the agreements, invoices, and accounting books well organized as evidence. Banks also require a Foreign Inward Remittance Advice (FIRA) for every incoming transfer to ensure FEMA rules are met.

The reason is simple: regulators want evidence that your subsidiary isn’t shifting profits unfairly. Without it, audits, penalties, and frozen funds become real risks. With it, fund transfers move faster, compliance burdens shrink, and audit exposure drops.

Strong documentation isn’t busywork, in most cases, it’s also leverage. It keeps your global cash flow moving without disruption and protects your startup from unnecessary tax disputes.

Controlling uncertainty with Safe harbours & APA/MAP

Transfer pricing rules are complex by design. Without clear agreements, startups risk endless audits, double taxation, and cash stuck in disputes. That’s where Safe Harbours and APA/MAP come in, they exist to give you predictability in a system built on uncertainty.

Here’s how:

- Safe harbours: If you fall within fixed profit margins set by regulators, your pricing is automatically accepted. This means you have to answer fewer questions, and you get approved faster.

- Advance Pricing Agreements (APAs): It makes it possible for you to strike deals with tax authorities and agree on pricing that you can lock in for years to come.

- Mutual Agreement Procedures (MAPs): When two countries both want to tax the same income, MAPs resolve it without draining your time or cash.

- The trade-off: This simply means that you give up flexibility in how you set prices, because margins and methods are fixed. But in return, you gain some certainty, no last-minute disputes, no second-guessing, no surprise penalties.

For cross-border startups, these tools are critical to their operations and profit margins. They offer some safety against uncertainty and ensure that regulators aren’t disrupting your operations on a day-to-day basis.

The mechanics of fund transfers

When the US HQ transfers funds to its Indian subsidiary, several steps are involved:

1. The Indian subsidiary initiates the process by providing:

- The amount, which includes the transfer pricing markup

- Bank account details (account number, branch code, bank name)

- Instructions on currency preference

- Purpose of the transfer (to comply with Foreign Exchange Management Act (FEMA) regulations)

2. The US HQ then initiates the transfer through their bank. Their bank first verifies:

- Purpose of payment (services, inter-company loan, capital infusion)

- Compliance with US and Indian regulations

- Supporting documentation (such as service agreements)

3. Currency conversion considerations:

- If funds are sent in USD, the receiving Indian bank handles conversion

- If requested in INR, the US bank manages conversion before transfer

- FX rates vary by timing, thus affecting final INR received

- Both conversion and transfer fees apply

4. Transfer process:

- Funds typically are routed through multiple intermediary banks

- Additional fees can be applied by each intermediary bank

- Final clearing through RBI's RTGS or NEFT systems

- Processing time: 1-5 business days.

Challenges in transfer pricing for startups

1. High banking fees

One of the key hurdles with transfer pricing is cost. Banks typically charge high fees for services like remittances, foreign exchange conversions, and compliance-related transactions. These costs can eat into transfer amounts and ultimately translate to lesser INR received by the Indian entity.

For instance, for SWIFT transfer, there is a transaction fee of $30 per transfer, FX conversion fees (approx. 3%), and GST on these conversion fees. Unlike larger corporations that often have the leverage to negotiate more favorable rates, startups typically bear a greater financial burden, making these costs a significant concern.

2. Delays in fund transfers

Fund transfer typically takes 2 to 5 business days. Without dedicated teams to manage administrative tasks associated with fund transfers, delays are common.

When complications do arise, startups often find it hard to receive timely support to resolve compliance constraints. Such delays can mean compromising on deadlines, supplier commitments, and not having the funds to hire the right talent pool.

3. Fluctuating FX rates

Sudden dips or spikes in FX rates can significantly impact the transfer amount. In cases where the Indian subsidiary sets their fund transfer amount in USD, an appreciation in the Indian rupee can lead to lesser INR received than anticipated.

This unpredictability complicates financial forecasting, hindering the ability to budget effectively and predict future income.

4. Compliance documentation

Many countries require detailed records of intercompany transactions, and even a small error can lead to costly audits and penalties. Aligning the transfer pricing strategy with international guidelines adds pressure, requiring country-by-country reporting to prove profits are taxed where economic activities occur.

This can be a nightmare if startups are not well-versed in international tax law. In India, businesses must obtain a FIRA–Foreign Inward Remittance Advice–for every withdrawal.

However, securing the FIRA from a bank is not straightforward and can involve multiple follow-ups and reminders.

Transfer pricing in startups in 2025

To overcome these challenges effectively, startups can follow these steps:

1. Define a plan

Startups can establish a policy that reflects their business needs, detailing the pricing structure for intercompany transactions between the headquarters and subsidiaries.

To justify pricing decisions, a mechanism can be set up to maintain comprehensive documentation for all intercompany transactions, invoices, contracts, and communications. This can include methodologies (such as Comparable Uncontrolled Price or Cost Plus), agreements, invoices, and transfer pricing analyses.

Additionally, implementing an approval workflow for all fund transfers can reduce the risk of any error.

2. Mitigate FX fluctuation risks

Work with relevant payment partners to lock in favorable FX rates for future fund transfers. This predictability can help in accurate budgeting and cash flow management.

3. Engage experts for compliance assurance

Establish transfer pricing requirements that fit your specific business needs, taking into account growth plans and risk appetite.

Additionally, partner with entities specializing in international payments, like AD-1 banks or modern payment platforms.

Choosing the right payment partner for fund transfers

Consider the following factors:

a. Transaction fees

- What are the FX rates they offer for cross-border transactions?

- How much do they charge as a processing fee? Are there any hidden fees that could affect your margins?

b. Transaction size

- Are there any limits on transaction size?

- Is there a cap on the number of monthly or quarterly transactions?

c. Settlement/Processing time

- What are the average processing times for international transactions?

d. Multi-currency accounts

- Do they offer multi-currency accounts to hold, transfer, and receive funds in multiple currencies?

e. International presence

- Does the provider have a solid international network to support cross-border activities?

- What specialized services can they offer, such as cross-border tax and FX advisory?

f. Solutions to minimize FX risks

- What solutions do they provide to mitigate currency fluctuations?

Rethinking transfer pricing for better financial control

Establishing a clear policy, maintaining detailed documentation, seeking the right professional advice, and working with the right payment partner can improve the efficiency of global fund transfers. Startups can maximize the flush of global capital by partnering with providers that can help minimize foreign exchange risk, reduce transaction costs, and ensure timely fund transfers.

FAQs on transfer pricing

Transfer pricing is the value of services or goods transferred between related parties. These parties include those within the same group of companies, along with those that have direct or indirect control over the board of directors.

The arm’s length price ensures that the parties get paid fairly, similar to what they would have received if they were working independently and on the market terms.

The common methods of transfer pricing include the Comparable Uncontrolled Price Method, the Resale Price Method, the Cost Plus Method, the Transactional Net Margin Method, the Profit Split Method, etc.

Transfer pricing helps with tax planning, improved decision making, efficient allocation of profits, risk management, etc.

Yes, transfer pricing also has its own set of challenges, like a volatile economy, high compliance, fluctuating tax regulations, and more. For instance, one of the common compliance issues is not documenting everything properly. It can lead to penalties or other consequences during an audit. But you can prevent it by using tools like Xflow to help you streamline the entire process.

Xflow supports real-time foreign exchange visibility and built-in reporting. It also facilitates secure transactions, paired with a centralized dashboard that helps monitor the payments, cash flows, etc. By using this platform, you can grow your business to great heights without worrying about the compliance requirements and the FX risks.

A classic example is when a US-based tech company pays its Indian subsidiary for software development. The subsidiary does the coding, the headquarters sells the product, and transfer pricing decides how much the Indian team is compensated. If the rate is too low, profits unfairly stay in the US. If it’s too high, profits unfairly shift to India. Setting the price at arm’s length, just like what an independent company would pay, keeps both sides compliant and taxes fairly distributed.

It is called transfer pricing because there’s a transfer happening between two related entities and a price attached to it. It encompasses all the goods, services, IP, or profits that move between these two related entities so that regulators can track the value of this movement. That’s why it’s called transfer pricing, as it keeps the focus clear that it is a transaction within itself, even though it’s taxed like transfers between two individual entities.