Understanding FIRC, eFIRC, IRM, and eBRC

These terms are often used interchangeably, which can cause confusion. Here’s a simple way to clarify them:

| Term | Meaning & Use |

|---|---|

| FIRC (Foreign Inward Remittance Certificate) | Traditionally issued by banks for inward foreign remittances. No longer issued for trade transactions and applicable only for FDI transactions. |

| eFIRC (Electronic FIRC) | A digital certificate issued by your bank for inward remittances. Your bank must generate an IRM and issue an eFIRC for every foreign inward payment, including payments received via Xflow. |

| IRM (Inward Remittance Message) | A record created and reported by your bank on the EDPMS system to confirm receipt of export proceeds. Practically serves the same purpose as an eFIRC. |

| eBRC (Electronic Bank Realisation Certificate) | Generated on the DGFT portal based on IRMs from your bank. Required to claim export incentives, GST refunds, and other benefits under the Foreign Trade Policy. Once your bank pushes the IRM to DGFT, you can log into your DGFT account (link your IEC < 5 minutes) and self-generate eBRCs by submitting invoices, Softex forms, or shipping bills. This process reduces delays and avoids extra bank charges. |

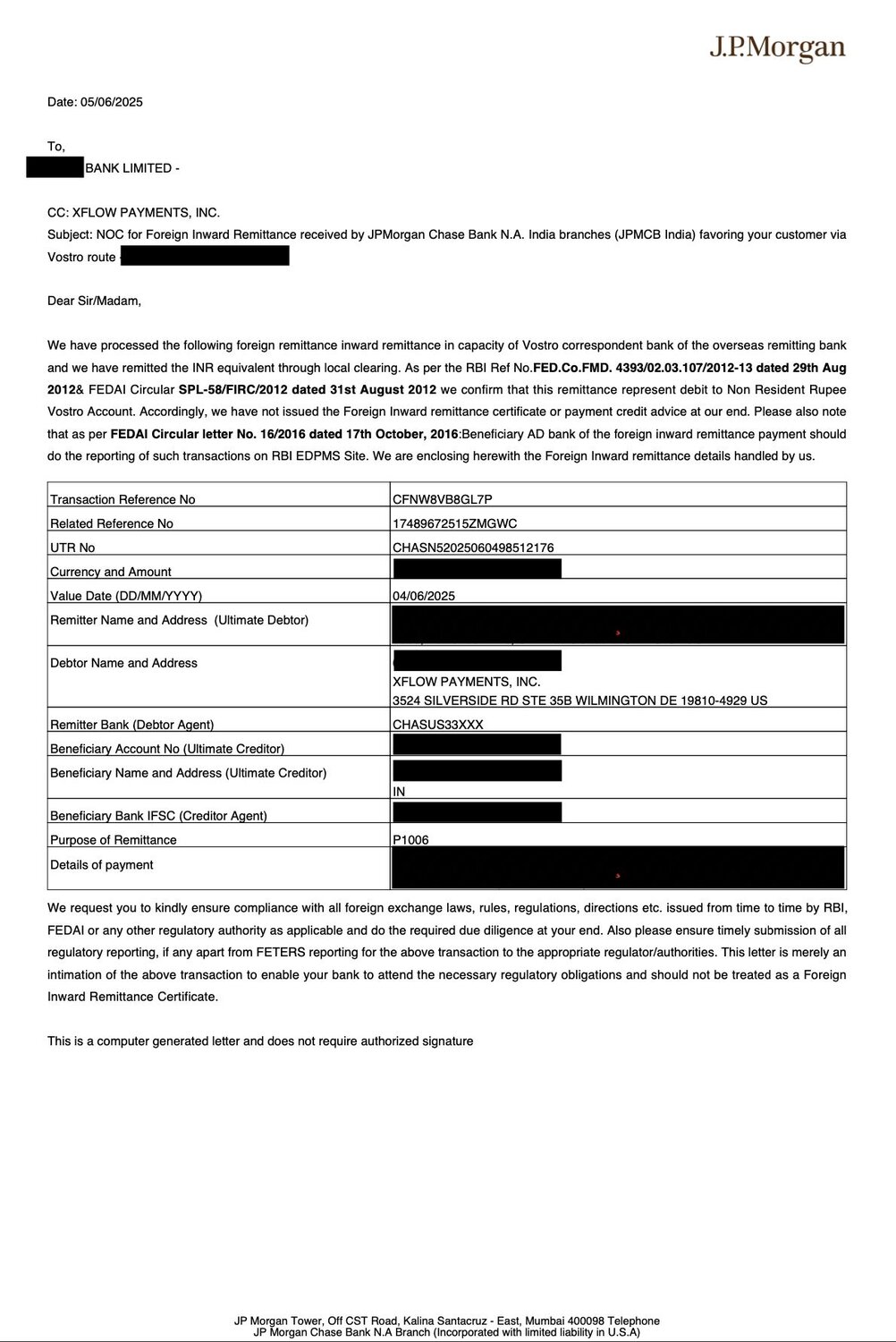

How settlement happens through Xflow

Xflow acts as your overseas collection agent for cross-border payments. Upon receipt of the funds, we instruct our overseas banking partner to remit the funds to you. The banking partner converts the foreign currency and credits its Non-Resident Rupee Vostro (NRRV) account maintained with an AD Category 1 bank in India.

The AD Category 1 bank then debits the NRRV account and remits the funds in INR to your bank account, fully compliant with FEMA and RBI norms. This process uses the Vostro route, a permitted channel under RBI guidelines for inward remittances.

After settlement, the AD Category 1 bank issues a payment advice (an intimation of foreign inward remittance details), addressed to your bank. This provides all the necessary information to help your bank create the inward remittance message (IRM) on EDPMS and issue the eFIRC. These details are also shared with your bank via SFMS and email for easy reconciliation.

Note: Please refer to the FEDAI circulars circular 1 & circular 2, implying beneficiary banks to issue eFIRC. Here’s a TLDR of the same below:

- The circular clearly states that EDPMS reporting is the responsibility of the beneficiary’s bank.

Reporting of inward remittances (IRM) happens when funds are credited to the exporter’s bank account, regardless of whether the route is NOSTRO, VOSTRO, RTGS, or NEFT.

eFIRC issuance

Through the FEDAI circulars, we have already established that your bank is responsible for generating the IRM/eFIRC for payments received via Xflow. However, since your bank has received a credit in INR and not in the foreign currency, they may not automatically issue the eFIRC to you. This may be due to non-standard practices across different branches, lack of awareness among new staff at the branch, etc. So we suggest that you follow the steps below to get your eFIRC.

How to request your eFIRC

- Download the payment advice (intimation of foreign inward remittance) from your Xflow dashboard. This is issued by JP Morgan Chase India on its letterhead.

- Share this document with your bank and request them to issue your eFIRC. Here’s an email template you can use -

Subject: Request to Issue eFIRC for Payments via Xflow

Hi [Relationship Manager Name],

We have received a foreign inward remittance through Xflow Payments via the Vostro route. Attached is the payment advice issued by JP Morgan Chase for your reference.

Kindly generate the IRM and issue the eFIRC for these Vostro payments as per standard procedure notified in the FEDAI circulars circular 1 & circular 2.

Thanks for your support,

- Your bank now has all the information to issue you the eFIRC. In case your bank has generated only the IRM and you are experiencing delays in getting the eFIRC, you can self-generate the eBRC from the DGFT portal.

"The Xflow team provided exceptional support at every step of the process. Thanks to their guidance, we were able to get our eFIRC issued smoothly by our bank, without any confusion. Our experience with Xflow has been exceptional while moving funds from the US to India."

~ Jibin Sabu (Chief of Staff, Docket)

Softex and EDPMS compliance

If you are filing SOFTEX, then there is one additional step to complete your compliance obligation. This is commonly known as EDPMS knock-off or matching of the IRM against your SOFTEX declaration. This is how the system works

- When you submit your SOFTEX form to STPI, your invoices are verified and if approved, along with the SOFTEX number electronically uploaded to RBI’s EDPMS portal.

- When your bank generates the IRM for inward remittance, the same is again uploaded to the EDPMS portal.

- The final step is to match SOFTEX invoices against the IRM to do the EDPMS knock-off. This step is again done by your bank.

Different banks have different processes to complete this step, but most banks ask you to help map the SOFTEX number to the IRM through a portal or a spreadsheet. This process remains the same whether you receive funds via Xflow or directly via SWIFT into your bank account. Once your EDPMS knock-off is done, you may download the eBRC from the DGFT portal as well.

Conclusion

To date, Xflow has enabled seamless money movement for over 10,000 exporters. Our partner AD Category 1 bank also conducts periodic, stringent checks on Xflow’s systems as per RBI guidelines and banking standards.

Exception

If your bank is unwilling to issue the eFIRC or there are delays in completing Softex or EDPMS compliance, please include the Xflow team in your communication with your bank or your relationship manager. Xflow will help you get the compliance steps completed, just as we have successfully done for multiple users.