Introduction

For Indian businesses, exporters, and freelancers working with clients in the United States, receiving payments in US Dollars is a regular part of doing business. However, international money transfers can be complex. Ensuring that funds arrive quickly, securely, and in the correct account requires understanding key banking details, one of the most important being the ABA number.

But what is ABA Number? The ABA routing number, also known as the Routing Transit Number, is a unique nine-digit code that serves as a digital address for different banks and financial institutions across the United States. For Indian businesses, knowing and correctly using this number is of utmost importance.

In this article, we’ll explore what ABA routing is and highlight its importance in today’s financial landscape.

What is an ABA Number?

An ABA routing number, also called an ABA Routing Transit Number (RTN), is a unique nine-digit code issued by the American Bankers Association. It is a unique digital address assigned to every bank and financial institution in the United States.

The bank ABA code can be compared to a postal code. Just as a postal code helps mail reach the right city, an ABA routing number ensures electronic money transfers go to the correct bank.

The concept of the ABA bank number isn’t new. The American Bankers Association (ABA) first introduced these numbers in 1910. As the number of banks in the US grew, a standardised system was needed to identify which bank was responsible for clearing a paper cheque. The routing number system made the cumbersome process of sorting, bundling, and delivering these cheques much more efficient.

Why is an ABA Number needed for international transfers?

Now that it’s clear “What is a Bank ABA Code?”, let’s see why it’s needed for global fund transfers. An ABA Number is mainly used for transactions within the United States. However, it becomes essential for international transfers when a US Bank is involved in the payment process.

International transfers are often not direct in a single line. They can be imagined as a relay race, in which the money moving from a bank in the US to one in India usually passes through another financial institution in the US in its journey. The ABA routing number serves to identify that specific US bank correctly. Here’s why the bank transit ABA number is important:

- Domestic Leg of the Transaction: When your US client initiates a payment to you, their bank needs its own ABA number to begin the transfer process within the American banking system. Even though the funds are ultimately destined to reach India, the initial leg of the transaction starts with identifying the US bank where the transaction originated.

- Working with SWIFT Codes: A SWIFT code is used to identify banks globally. However, if the payment originates from a US bank, the ABA routing number of that US bank is required, along with the SWIFT code for the international leg. Hence, ABA numbers and SWIFT codes are often used in conjunction for international transfers to ensure precision in identifying the specific bank within both countries.

Where can you find your ABA Number?

It is crucial to clarify that Indian banks do not possess ABA numbers, as these are exclusively assigned to banks within the United States. An Indian business requires the ABA number of their US-based client’s bank for receiving payments in USD.

Some common sources to find a US bank’s ABA number are:

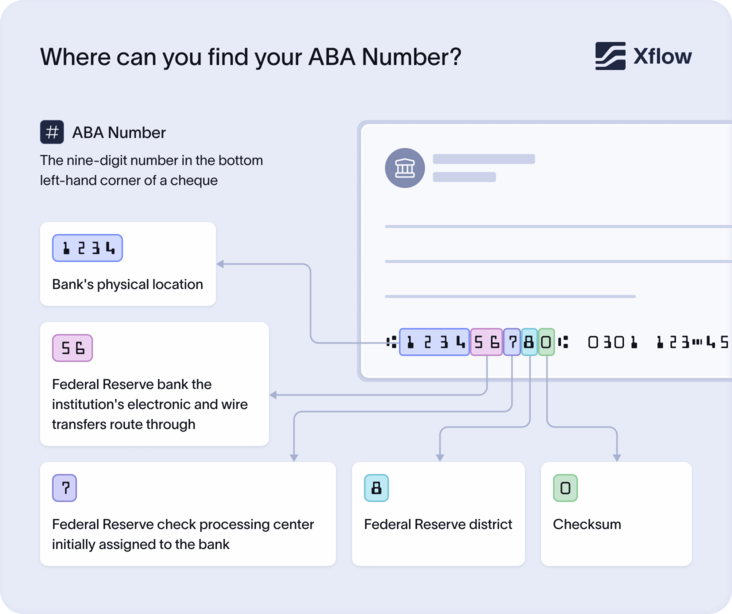

- Bank’s Cheque: Usually, an account holder in a US bank will find the ABA routing number located at the bottom left corner of a paper cheque. It is generally the first nine-digit sequence preceding the account number and cheque number.

- Via Online Banking: Banks also make their routing numbers available on their online banking platforms. After logging into the account, users can find the nine-digit code under sections such as “Account Details,” “Direct Deposit,” or “ACH Information.”

- Bank's Official Website: Some US banks publicly list their routing numbers on their official websites. Take a glance at the website and look for terms like “routing number” or “ABA number.”

- Contacting the Bank Directly: If other sources seem unhelpful, contacting the relevant bank’s customer directly via call or chat is another reliable method to obtain the correct ABA number. It is a prudent method in case larger banks choose to utilise distinct routing numbers for different services or geographical regions.

How do ABA Numbers work for global transfers?

It’s helpful to understand the meaning behind each part of the nine-digit ABA number before understanding how these numbers facilitate international transactions.

Let’s see what is an ABA bank number’s anatomy with the help of an example: 071000013

- The First Four Digits (e.g., 0710): These tell us the general location of the bank.

- The first two digits (07) show which US region or ‘Federal Reserve Bank territory’ the bank belongs to (in our example, it’s Chicago.)

- The next two digits (10) identify the specific processing office that handles that bank’s transactions.

- The Middle Four Digits (e.g., 0001): This is the bank’s own unique ID number. It tells the system exactly which bank should receive the money.

- The Last Digit (e.g., 3): This is a security number used by banks to check if all the other digits were typed in correctly.

Now that we understand the anatomy of this number, let’s see step-by-step what is ABA routing process and how the international fund transfer takes place:

Step 1 - Initiation: To send money, the US client will provide the ABA number and other bank details. This number tells the international banking system exactly which US bank the money will flow through.

Step 2 - Checking the Details: Once the transfer begins, the client’s bank uses the ABA number to verify that the money is being sent to the correct destination. They confirm the correctness of the routing information and that the receiving bank is legitimate.

Step 3 - Directing the Funds: If the details are correct, the money is then sent along the path indicated by the ABA number. This number first directs the payment to the correct central US banking hub and then directly to the recipient’s specific local bank.

Step 4 - Reaching the Account: Finally, when the money arrives at the intended bank, it’s processed and deposited into the recipient’s account. You should check the specific bank transfer details to determine how long these transfers typically take.

What happens if you enter the wrong ABA routing number?

The ABA number must be entered accurately, otherwise following problems could arise:

- Payment Delay or Rejection: The money will likely be sent back to your client or held up.

- Extra Hassle and Fees: This can cause delays for everyone and may result in unexpected charges.

- Risk of Misdirection: Rarely, funds might go to a different valid bank, making recovery difficult.

Therefore, it is essential always to double-check the ABA number for smooth and successful transfers.

Is the ABA Number same as SWIFT Code?

ABA number is not the same as the SWIFT code. They serve different purposes.

- An ABA number is like a bank’s domestic address in the USA. It’s a nine-digit code telling US banks where to send money.

- In contrast, a SWIFT code is a bank’s international address. It uses letters and numbers and is essential for cross-border payments, helping banks worldwide identify each other for international transfers.

As an Indian business receiving payments from US clients, you’ll need to provide your bank’s SWIFT code, not an ABA number.

Receive payments from the US easily with Xflow

Tired of delayed USD payments, high conversion fees, and endless compliance issues? Xflow solves all these challenges by helping Indian businesses and exporters receive international payments directly without any hidden charges or a US bank account. With Xflow, you save 50% on FX costs and can make seamless cross-border payments without any transaction limits, that too in full compliance with regulatory standards.

Sign up with Xflow today and receive your foreign currency payments in an efficient and secure way!

Frequently asked questions

An ABA number uniquely identifies US banks for electronic transfers like direct deposits and wire transfers within the United States. It ensures the money reaches the correct financial institution.

An ABA number identifies the specific bank, while your bank account number points to your individual account within that bank. Both are essential for fund transfers.

It is generally safe to share an ABA number. It is usually public information, used only to direct payments to your bank, not to access your account.

No, Indian banks do not have ABA numbers. ABA numbers are specific to US financial institutions for domestic transfers. Indian banks use SWIFT/BIC codes for international transactions.