Introduction

If you've ever lost sleep over a delayed international payment or tried decoding mystery deductions from a bank transfer, you're not alone. Traditional systems like SWIFT may be reliable but also slow, expensive, and opaque.

According to the World Bank, banks charge an average of 12.66% to send remittances—nearly double the global average. And McKinsey estimates businesses lose $200 billion annually to transaction fees and FX markups. For freelancers, consultants, and startups, these losses cut directly into cash flow and profit margins.

The bigger problem? Transparency. With SWIFT, you rarely know:

- Who's charging what

- When your money will arrive

- Or how much will finally land in your account

Meanwhile, your business runs at internet speed. Why settle for 1970s-era infrastructure?

Enter local payout networks—a faster, more transparent alternative gaining ground.

But are they right for you? Let's break down SWIFT vs local payouts and help you choose what makes sense for your business.

Problems with the SWIFT payment system

Here's where SWIFT transfers get really frustrating—the fees come from everywhere and are rarely transparent upfront. When dealing with a swift payment process, you're not just paying one fee; you're paying a chain of fees that can significantly eat into your profits.

- Sending bank fee: Your client's bank charges $20–50 just to initiate the transfer. This might seem reasonable, but it's just the beginning.

- Intermediary bank charges: This is where things get murky. Most SWIFT transfers don't go directly from your client's bank to yours—they bounce through one or more intermediary banks, each taking their cut. We're talking $30–100 here, and the worst part? These charges are often "lifted" (deducted) from your incoming amount without clear notification.

- Receiving bank fee: Your Indian bank isn't working for free either. Expect ₹500–₹1,000 to be deducted when the funds finally arrive.

- FX markup: Perhaps the most insidious cost is the foreign exchange markup that banks apply. While they might advertise "competitive rates," the reality is often 1–2% above the mid-market rate. On a $10,000 transfer, that's $100–200 you'll never see.

Let's put this in perspective with a real example. Your client sends $10,000 via SWIFT. After sending fees ($30), intermediary charges ($75), receiving fees (₹750), and FX markup (1.5%), you might end up with ₹8,10,000 instead of the ₹8,30,000 you expected. That's ₹20,000+ in total deductions—money that could have been reinvested in your business.

How long does a SWIFT transfer usually take?

In an era where we can send messages instantly across the globe, SWIFT transfers typically take 2–5 business days. But unlike your WhatsApp message, this timeline can stretch even longer due to several factors:

- Time zones: If your US client initiates a transfer on Friday evening, it might not even begin processing until Monday in the US, which could mean Tuesday or Wednesday before it hits your Indian account.

- Holidays: US and Indian banking holidays can add days to your transfer. And if there's a holiday in any intermediary country, there will be more delays.

- Manual compliance checks: Every SWIFT transfer goes through compliance screening, which is still largely manual at many banks. If your transfer gets flagged—even falsely—it can sit in a queue for days.

- Intermediary bank workload: Since your transfer might route through banks in London, Frankfurt, or Singapore, their processing speed directly affects when you get paid.

The operational risks are equally concerning. A wrong SWIFT code example in India—like entering SBIN0001234 instead of SBIN0012345 for State Bank of India—could entirely send your payment to the wrong bank. Human error in entering beneficiary details can cause days of back-and-forth to resolve. And through all this, you have virtually no real-time visibility into where your money is or when it'll arrive.

What is a local payout?

Think of a local payout as the difference between international mail and domestic delivery. Instead of traveling through multiple countries and banking systems, your payment is handled as a domestic transfer within the recipient's country.

Here's how it works: Your US client makes a local ACH transfer (just like paying any US bill), a European client uses SEPA (their domestic system), and you receive INR in your Indian bank account. The payment platform handles all the international complexity behind the scenes.

The magic happens because companies like Xflow maintain local banking relationships in multiple countries. When your client pays locally, those funds are collected domestically in their country, converted efficiently, and then paid to you domestically in India. No SWIFT codes, no intermediary banks, no mysterious deductions.

SWIFT vs. Local payouts: Key differences that matter

Let's compare these options across the factors that actually impact your business:

| Feature | SWIFT transfer | Local payout (e.g., Xflow) |

|---|---|---|

| Setup complexity | SWIFT code, bank forms, purpose codes | Simple payment link or form |

| Time taken | 2–5 business days | 1 business day |

| Fee structure | Multiple hidden deductions | Transparent, flat pricing |

| FX conversion | Bank's spread, unclear rates | Upfront, competitive rates |

| Payment tracking | Limited, no real-time updates | Full visibility, status updates |

| Client experience | Complex forms, banking details | Easy local payment method |

| Compliance handling | Manual purpose codes required | Built-in compliance automation |

Common use cases for each option

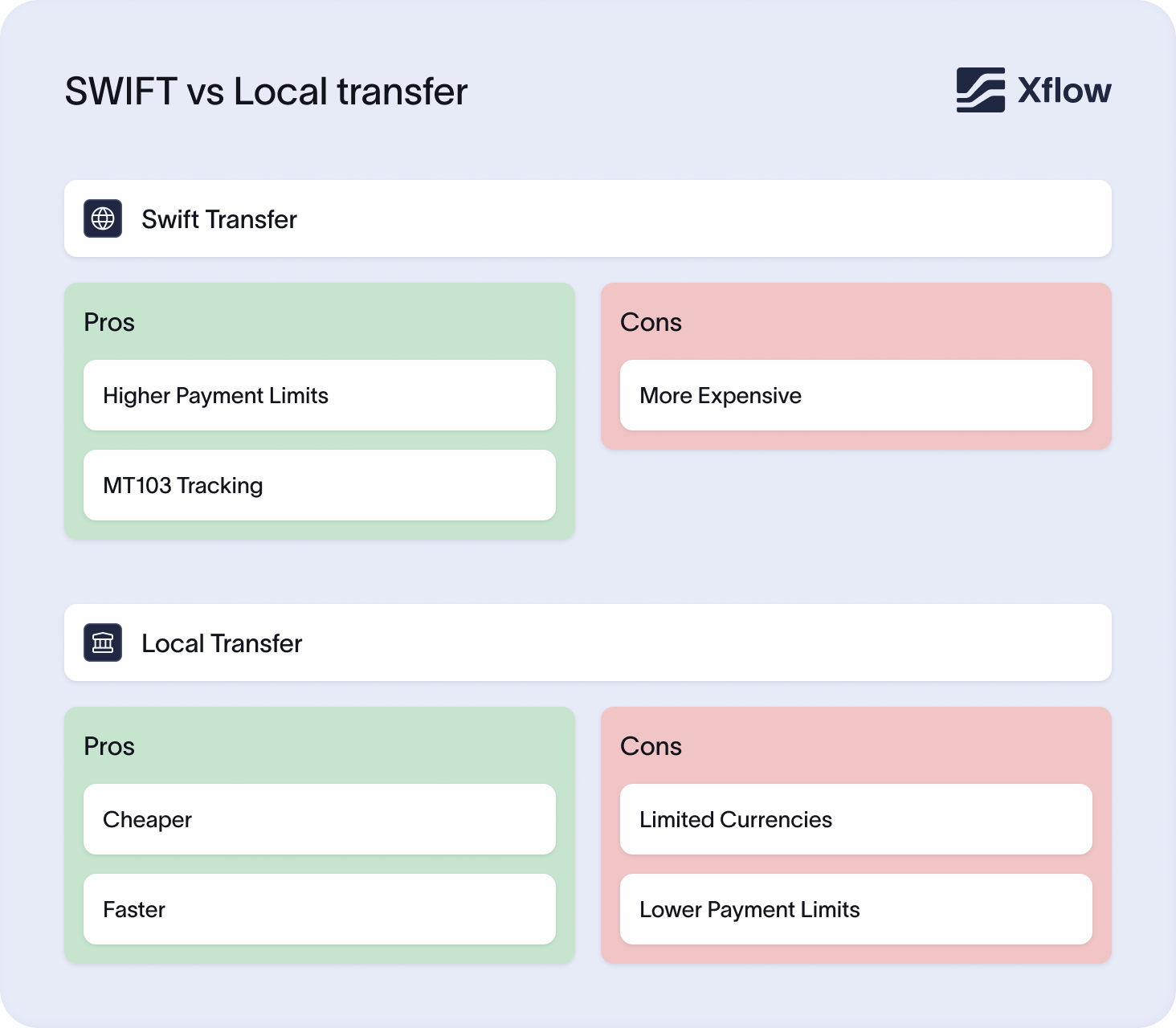

SWIFT is better for:

- Large institutional B2B payments: If you deal with established corporations making regular high-value transfers (>$50,000), SWIFT's established infrastructure and bank relationships often make sense.

- Countries without modern payment rails: Some regions still lack the local banking infrastructure that makes local payouts possible.

Clients who specifically require SWIFT: Some large enterprises have procurement policies that mandate traditional banking channels

Local payouts are better for:

- Freelancers and consultants: If you're a developer, designer, or consultant working with international clients, local payouts eliminate the friction that can delay project payments.

- Fast-growing exporters: When cash flow is critical, and you can't afford to wait a week for payments, local payouts keep your business moving.

- Startup and SME payments: Younger companies often prefer simple, transparent payment methods over traditional banking complexity.

Common issues Indian exporters face with SWIFT

Beyond the obvious costs and delays, SWIFT creates operational headaches that can impact your client relationships. Many businesses exploring SWIFT payment for exporters discover these challenges only after experiencing them firsthand:

- Unexpected deductions create awkward conversations. When you quote a project for $10,000 but only receive ₹8,10,000, who covers the difference? Many exporters end up absorbing these costs to maintain client relationships.

- Funds getting stuck in intermediary banks is surprisingly common. Your client's bank says the money was sent, your bank says they haven't received it, and somewhere in between, your payment is sitting in a correspondent bank's account, earning them interest.

- Complex client instructions can hurt your professional image. Asking a startup founder to navigate SWIFT codes and the purpose of remittance codes can make you seem less tech-savvy than competitors who offer simpler payment options.

- Zero real-time tracking means you're constantly playing phone tag with banks when clients ask about payment status.

A better way: How local payouts solve these problems

Local payouts do more than save money—they make your business run better.

- Improved cash flow = Faster growth

Local payouts settle within hours, not days. Faster access to funds means you can reinvest sooner, pay collaborators on time, and take on more projects without waiting on sluggish banking systems.

- Accurate payouts = clearer pricing

With no hidden deductions or foreign exchange surprises, your quoted price is what you receive. This builds client trust and simplifies negotiations—especially for high-ticket services and retainers.

- Frictionless client experience = faster approvals

Clients don't need to navigate international wire forms or deal with banking delays. Local banking details and one-click payments reduce friction and help close deals faster.

- End-to-end visibility = Professional communication

Know exactly when the payment is initiated, processed, and delivered. Instead of vague timelines, you can give precise updates, improving your credibility and client confidence.

What is Xflow and how it works

Xflow belongs to the new generation of payment platforms built specifically for Indian exporters and freelancers. Instead of retrofitting old banking infrastructure, they've built a system from the ground up for modern international business.

It lets your clients pay locally using familiar methods—ACH in the US, SEPA in Europe, and local bank transfers in other regions. You receive INR in your Indian bank account, typically within 1 business day, without needing to provide SWIFT codes or navigate complex compliance requirements.

The process is refreshingly simple:

- The client pays locally: Your US client makes an ACH transfer (like paying any US bill), and your European client uses their local banking app

- Xflow handles conversion: The platform collects funds locally, converts at competitive rates, and handles all regulatory compliance

- You receive INR: Money hits your Indian bank account with full traceability and documentation

SWIFT vs. Xflow: Real numbers

Let's compare a typical $10,000 payment:

| Criteria | SWIFT transfer | Xflow (local payout) |

|---|---|---|

| Time taken | 3–5 business days | 1 business day |

| Net amount received | ₹8,10,000 (after various fees) | ₹8,30,000–8,40,000 |

| Tracking visibility | Limited, requires bank calls | Full real-time updates |

| Setup complexity | SWIFT codes, compliance forms | Simple link + invoice |

| Client experience | Complex international wire | Local payment (like paying a bill) |

Choosing the right option for your transfer

Use SWIFT when:

- Your client specifically requires it: Some large enterprises have procurement policies that mandate traditional banking channels for audit trail purposes.

- Payment values are extremely high: For transfers above $100,000, SWIFT's established correspondent banking relationships can sometimes offer better rates than newer platforms.

- Destination countries lack local rails: If you're receiving payments from countries where local payout infrastructure isn't yet available.

Use local payouts when:

- You prioritize speed and transparency: If cash flow timing matters more than saving the last few rupees on exchange rates.

- You're working with startups or SMEs: These clients often prefer simple, modern payment methods over traditional banking complexity.

- Your clients value easy payment experiences: When client satisfaction and repeat business matter more than marginal cost differences.

Final thoughts: Which one wins?

SWIFT still has its place, especially for large, high-value transactions. But for most Indian freelancers, consultants, and small exporters, it's outdated, slow, and expensive.

Local payout platforms like Xflow offer what businesses actually need: faster payments, lower fees, and full transparency. When you can keep more of what you earn and get paid on time, the choice is clear.

The real question isn't if SWIFT will disappear, it won't. But can you afford to keep losing time and money while your competitors switch to smarter solutions?

Local payouts are the clear winner for businesses that value agility, cost-efficiency, and a better client experience.

Frequently asked questions

Yes, but large or frequent transfers work better with current accounts due to transaction limits and compliance requirements.

India doesn't use IBANs. Provide your SWIFT code and account number instead.

Ask your client for the MT103 reference number and use it to trace the transfer with your bank.

Yes, Xflow ensures full RBI compliance and handles export documentation automatically.

Yes, most platforms support $10,000+ payments, but check individual platform limits for high-value transfers.