Introduction

In the GST system, ITC, or Input Tax Credit is an important mechanism. It helps businesses minimize their tax liability by claiming credit on the GST paid on business purchases. Not only does this prevent double taxation, it also improves the cash flow for registered taxpayers in India.

ITC makes sure that the credit flow is smooth across the entire supply chain. It benefits different industries such as manufacturing, exports, and services.

In this article, we cover what ITC is, how it works under the GST framework, its benefits, challenges and the different ways it is used in industries.

What is Input Tax Credit (ITC) in GST?

ITC stands for Input Tax Credit. ITC in GST allows businesses to claim credit for the GST that they have already paid on business purchases. Therefore, the tax liability of the business is reduced. Not only does this prevent businesses from being taxed twice, it also lowers the overall tax that has to be paid.

For instance, if a manufacturer pays an input tax of ₹20,000 for his purchases and collects ₹40,000 as output tax after sales, he only has to pay ₹20,000 as the net tax.

ITC is available to manufacturers, service providers, trading operators, e-commerce operators, and any other type of business registered under GST. It ensures that the credit flow process across the supply chain is smooth and that businesses remain tax compliant.

How does ITC work under the GST framework?

Through ITC, businesses can reduce the tax they have to pay on business purchases against the tax liability on sales. ITC is not applicable on personal purchases. GST ITC claim rules include:

- Business should be registered under the GST system.

- Businesses should hold a valid tax invoice.

- Ensure that the supplier of the goods or services has paid GST to the government.

- Businesses should make sure that the returns are filed.

- Suppliers should be paid within 180 days.

- The ITC claims must match GSTR-2B, making it important to have accurate invoice reconciliation and compliance.

The Place of Supply Rules (Section 13 IGST) determines the location of supply for goods or services. They decide whether IGST or CGST/SGST is applicable on a transaction.

Quick note: From April 1, 2025, ITC must be claimed via the Input Service Distributor (ISD) mechanism for allocation across multiple GST registrations under the same PAN. An ISD is a taxpayer that receives invoices for services used by its branches and then distributes the ITC to those branches.

Benefits of claiming ITC for businesses

The benefits of claiming ITC for businesses include reduction in tax liability, improved cash flow, financial discipline and compliance, and optimized resource allocation.

1. Tax liability reduction

ITC helps businesses avoid double taxation. Businesses only have to pay GST on the value they add, which lowers their overall tax liability.

2. Improved cash flow

ITC reduces the tax outflow, leading to more working capital being available for daily operations and investments.

3. Financial discipline & compliance

ITC requires businesses to keep an accurate account of all invoices and GST filings. This encourages businesses to keep proper documentation, leading to more transparency and less penalties suffered by them.

4. Optimized resource allocation

By claiming ITC, businesses can redirect more money towards other resources. This can help them make better strategic decisions and allocate resources in an optimal manner.

Use cases of ITC across industries

ITC can be used across different industries such as manufacturing, services, and trading.

1. Manufacturing

Manufacturers need to buy raw materials, which include machinery or other components for their products. This requires them to pay GST or input tax on the inputs. They can, therefore, claim ITC on business-related purchases, which reduces the tax liability and decreases the output tax on the manufactured goods. Manufacturers can then lower their production costs and improve the cash flow.

2. Services

For businesses that provide or use different services, they can claim ITC on their expenditure. Businesses might make use of services such as overseas commission agents, Custom House Agent (CHA) services, or Goods Transport Agency (GTA) services. According to the IGST Act, Section 2(6), export of services means the supply of a service from India to someone who lives abroad. Businesses can claim refunds on the tax they have paid for those services.

3. Trading

Claiming ITC benefits traders by helping them reduce the cost of goods that are sold. It ensures that the prices remain competitive. Organized trade is promoted as having proper invoicing and documentation to remain GST compliant is encouraged.

4. Exporters

For exporters, the Letter of Undertaking or LUT in GST allows them to export goods and services without having to pay taxes. These supplies fall under zero-rated supplies, which means that they attract a GST rate of 0%. Even though the outward supply is zero-rated, exporters can claim ITC on input goods and services used in making these supplies, improving cash flow through refunds and tax credits.

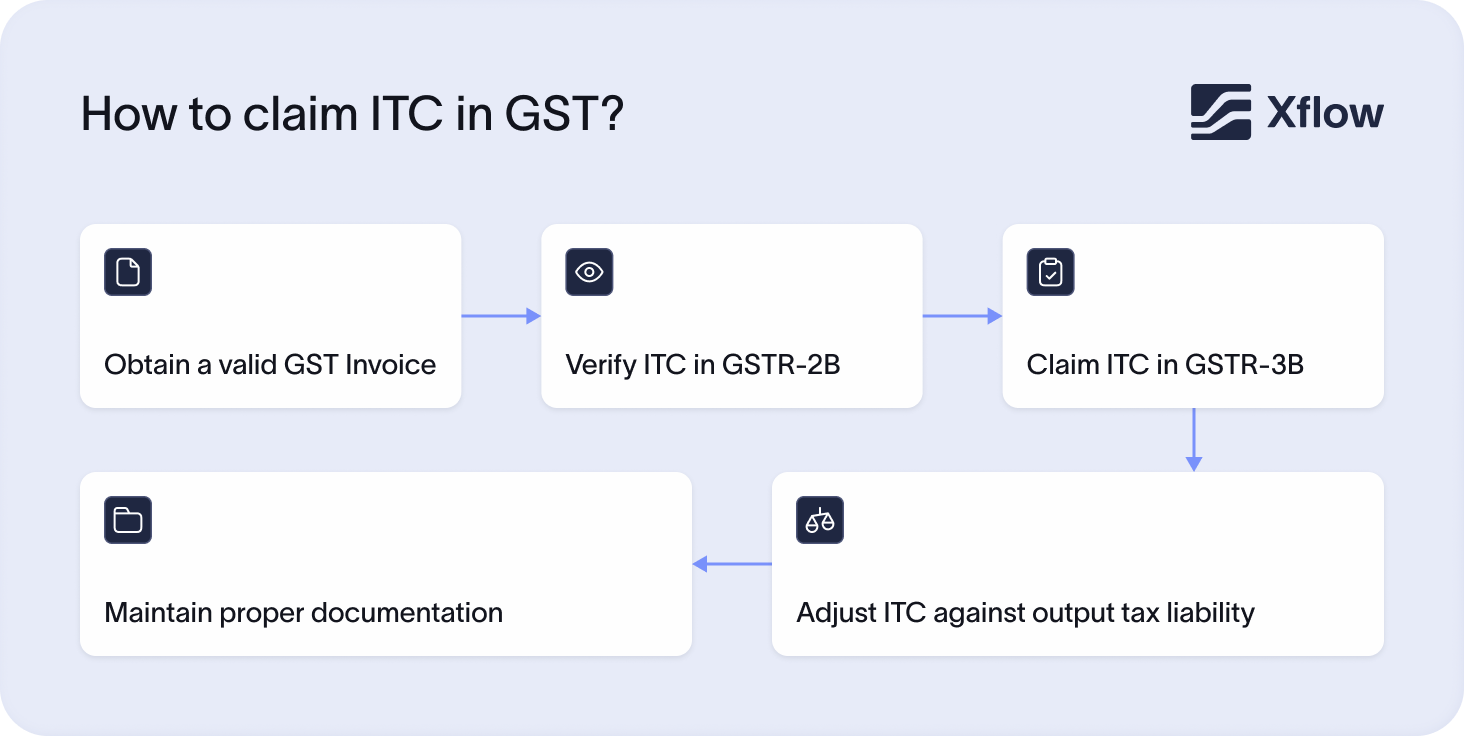

How to claim ITC in GST?

Follow the given steps to claim ITC under GST:

1. Start by collecting all eligible ITC; this includes imports, supplies under reverse charge, invoices from your Input Service Distributor (ISD), and other qualifying purchases.

2. If any goods, services, or capital assets are partially used for exempt or non-business activities, calculate the proportionate ITC that must be reversed.

3. Deduct the reversed portion from your total available ITC. This gives you the net credit you can claim for the current tax period.

4. Certain expenses are blocked under Section 17(5) of the CGST Act, like employee perks, travel, food, or other ineligible items. Make sure these are excluded from your claim.

5. Enter the final net ITC in the designated field of GSTR-3B and submit your return.

Quick note: Previously, taxpayers could claim ITC purely based on their records. With Rule 36(4), there’s now a cap: you can claim only up to 105% of the ITC shown in GSTR-2B as provisional credit. Note that this limit does not apply to imports, ISD credits, or reverse charge transactions.

Key conditions required to claim ITC in GST

You can claim ITC in GST by making sure that the following key conditions are met:

1. Business use of goods or services

ITC can only be claimed by businesses and not for personal use items.

2. Receipt of goods or services

The credit will only be given when the buyer has received the goods or service. The buyer must receive a valid tax invoice, debit note, bill of entry, or other proof of the payment.

3. Tax paid by supplier

The supplier has to pay the tax to the government.

4. Payment within 180 days

If the buyer has not paid the supplier within 180 days of the invoice being issued, then the ITC is added on to the tax liability with interest.

5. Instalment deliveries

ITC can only be claimed after the final installment. This is applicable for goods that are received in multiple different lots.

6. Timely filing of returns

To ensure that the returns are filed and the ITC refunds are claimed on time, the ITC should be claimed within the return filing timelines. The refund applications should be submitted with proper documents such as the shipping bill, GSTR-1 form and GSTR-3B form.

Items on which the Input Tax Credit is not applied

ITC is not applied to the following list of items:

1. ITC is not available for vehicles with 13 seats or fewer (including the driver), boats, or aircraft, unless they’re used for transporting goods or for training purposes.

2. Credits on food and beverages are only allowed if the business is in that sector. Standalone restaurants cannot claim ITC, though restaurants in hotels with higher room charges may be eligible.

3. ITC cannot be claimed for beauty treatments, health services, or memberships at gyms, fitness centers, and clubs.

4. Cab rentals, travel concessions for employees, and health insurance are generally excluded unless required under law or relevant to the business sector.

5. ITC is not available for the construction of immovable property or work contracts related to immovable property, except for machinery and plants.

6. Goods and services purchased for personal use, free samples, destroyed or lost items, or those involved in fraud cannot claim ITC.

7. Businesses under the composition scheme cannot claim ITC. Non-resident taxable entities can only claim it for imported goods.

ITC in GST vs. VAT input credit under the old tax regime

Input credit in VAT refers to the tax a business has to pay when it purchases a good. It was deducted from the tax collected on sales and helped in determining the overall tax amount that had to be paid for goods.

The differences between ITC in GST and VAT can be seen below.

| Aspect | ITC under GST | Input credit under VAT |

|---|---|---|

| Scope of tax | Goods and services. | Only goods. There was a separate Service Tax for services. |

| Geographic coverage | Nationwide (interstate and intrastate). | State-wise only. |

| Interstate transactions | Allowed, seamless credit. | Not allowed, leads to cascading effects. |

| Uniformity | Uniform across India. | Varied by state. |

| Credit on capital goods | Allowed with conditions. | Restricted or staggered. |

| Services | Credit available. | Generally not available. |

| Tax cascading | Avoided through seamless credit. | Common due to limited credit. |

ITC in GST vs. composition scheme without ITC

The Composition scheme is a simplified GST scheme for small businesses. According to the GST registration threshold exemption, businesses below the registration threshold that have a turnover below ₹1.5 crore are exempt from mandatory registration and thus not eligible to claim ITC. Therefore, they have to pay tax at a fixed lower rate.

The differences between ITC in GST and the composition scheme are mentioned below.

| Point | ITC under regular GST | Composition scheme under GST |

|---|---|---|

| Eligibility and turnover | For all registered taxpayers, no turnover limit. | For small businesses with turnover up to ₹1.5 crore. |

| Input Tax Credit (ITC) | Allowed, businesses can claim credit on purchases. | Not allowed, no credit on tax paid. |

| Tax rates and compliance | Standard GST rates (5%-28%), monthly/quarterly filing. | Lower fixed rates (e.g., 1%-5%), simplified quarterly filing. |

| Supply and business scope | Interstate and intrastate supply allowed. | Only intrastate supply, restricted business types. |

| Invoice and tax collection | Tax invoice issued, GST collected from customers. | Bill of supply issued, GST paid from own pocket. |

Challenges in claiming ITC under GST compliance

Claiming ITC under GST compliance might include challenges such as mismatched invoices, delayed filing of returns, reversal of ITC, and complex documentation process.

1. Mismatched invoices

If there are mistakes or inaccuracies in the invoice, then the buyer might not be able to claim the ITC.

2. Delayed filing of returns

The timely claiming of ITC depends on the filing of returns done by the trader as well as the supplier. If there are delays in this process, the credits can be blocked.

3. Reversal of ITC

If the supplier is not paid within 180 days, then the traders must reverse any claimed ITC.

4. Complexities in documentation

Maintaining accurate records and making sure that the GST compliance standards are met can overwhelm people, especially small traders.

Best practices for claiming ITC in GST effectively

Some best practices for claiming ITC in GST effectively are declaring eligible ITC, reversing ITC for non-business uses, excluding blocked credits, following the 105% rule, maintaining proper documentation, and timely payments and filing.

1. Declare all eligible ITC

You should declare all items under the GSTR-3B that are eligible under ITC, such as credits from imports, reverse charge supplies, and ISD invoices.

2. Reverse ITC for exempt or non-business use

In case the inputs, services, or capital goods are used in a non-business way, then the proportionate ITC should be reversed.

3. Exclude blocked credits

Items restricted under Section 17(5) are not eligible for ITC. These include employee travel, food, or personal expenses.

4. Follow the 105% rule

The net ITC cannot be more than 105% of the provisional credit in GSTR-2B. This is true for everything except for imports, ISD, or reverse charge supplies.

5. Maintain proper documentation

Maintaining proper documentation, such as valid invoices, bills of entry, and self-invoices is extremely important.

6. Timely payments and filing

The GST returns should be filed on time. The suppliers should be paid within 180 days to prevent the ITC being reversed and interest being added.

Regulatory considerations in claiming ITC under GST

While claiming ITC, the following regulatory considerations should be kept in mind:

- Follow local GST rules.

- Keep track of any updates to ITC rules.

- Store digital records the way the law requires.

Future trends in ITC mechanisms and GST compliance automation

As technology evolves, some trends that can be seen in the ITC mechanism and GST compliance automation are:

- Smart AI tools that match and check records automatically.

- Instant matching of records as transactions happen.

- Better data insights to plan and save on taxes.

- Using blockchain to safely share and verify data.

If receiving international payments is a regular deal for your business, you know it can come with its fair share of hassles – delays, high fees, and tricky compliance. To avoid these hassles and simplify your cross-border transactions, use Xflow.

Xflow is a modern fintech platform with transparent pricing, faster settlements, and easier compliance to make your transactions as smooth as possible. Sign up today!

Frequently asked questions

ITC lets businesses claim credit for GST paid on purchases, reducing overall tax liability and preventing double taxation, thus lowering the final tax paid on sales.

ITC reduces tax liability, improves cash flow, promotes financial discipline by ensuring accurate invoicing and filing, and helps businesses allocate resources efficiently for better growth.

Challenges include mismatched invoices, delays in filing returns, reversal of ITC if suppliers are unpaid within 180 days, and complexities in maintaining proper documentation for compliance.

To claim ITC in GST, businesses must be registered under GST, hold valid tax invoices, ensure the supplier has paid GST, make payment within 180 days, file timely returns, and reconcile claims with GSTR-2B records for accuracy.